<strong>Annual</strong> <strong>Report</strong> December 31, 2014Notes to Financial Statements (continued)11. SHARE CAPITAL (continued)Voting RightsThe holders of Public Shares have the right toreceive notice of, attend and vote at generalmeetings of the Company.Each Public Share and Management Share carrysuch voting power so that the aggregate issuednumber of Public Shares and Management Sharescarries 49.9% of the total voting power of theaggregate number of voting shares in issue. EachPublic Share carries one vote and eachManagement Share carries such voting power sothat the total voting power of the Public Shares andManagement Shares are pro-rated in accordancewith their respective net asset values. Each ClassB share carries such voting power so that theaggregate issued number of Class B sharescarries 50.1% of the aggregate voting power in theCompany.DistributionsThe Board may at any time declare and paydividends (or interim dividends) based upon thefinancial position of the Company. No dividendsshall be paid in excess of the amounts permittedby the Guernsey Companies Law or approved bythe Board and the Investment Manager. Nodividends have been paid for the year ended 2014.The net asset values per share by series andshares outstanding as of December 31, 2014 andDecember 31, 2013, are as follows:SharesOutstandingDecember31, 2014NAV perShareDecember31, 2014SharesOutstandingDecember31, 2013NAV perShareDecember31, 2013Class/SeriesIssuance DateClass Private Shares Series Non-Restricted 1 December 31, 2012 - $ - 1,676,266.35 $ 1,095.67Class Private Shares Series Non-Restricted 1A July 1, 2013 - $ - 1,441.86 $ 1,031.95Class Private Shares Series Non-Restricted 2 February 1, 2013 - $ - 3,700.00 $ 1,056.31Class Private Shares Series Non-Restricted 3 March 1, 2013 - $ - 820.00 $ 1,058.15Class Private Shares Series Non-Restricted 4 April 1, 2013 - $ - 2,099.83 $ 1,031.77Class Private Shares Series Non-Restricted 5 May 1, 2013 - $ - 6,500.00 $ 1,023.44Class Private Shares Series Non-Restricted 6 June 1, 2013 - $ - 500.00 $ 1,019.61Class Private Shares Series Non-Restricted 7 July 1, 2013 - $ - 130,801.89 $ 1,031.60Class Private Shares Series Non-Restricted 10 October 1, 2013 - $ - 5,000.00 $ 1,094.39Class Private Shares Series Non-Restricted 11 November 1, 2013 - $ - 3,000.00 $ 1,011.38Class Private Shares Series Restricted 1 December 31, 2012 - $ - 223,118.97 $ 1,095.67Class Private Shares Series Restricted 1A June 1, 2013 - $ - 1,900.79 $ 1,095.67Class Private Shares Series Restricted 1B July 1, 2013 - $ - 21,134.68 $ 1,095.67Class Private Shares Series Restricted 1C September 1, 2013 - $ - 721.83 $ 1,097.70Class Private Shares Series Restricted 5 May 1, 2013 - $ - 830.00 $ 1,023.44Class Private Shares Series Restricted 6 June 1, 2013 - $ - 2,000.00 $ 1,019.61Class Private Shares Series Restricted 7 July 1, 2013 - $ - 40,843.75 $ 1,031.60Class Private Shares Series Restricted 10 October 1, 2013 - $ - 2,220.00 $ 1,094.39Class VoteCo Shares December 31, 2012 - $ - 100.00 $ 1,130.31Class Management Shares December 31, 2012 8,500,796.00 $ 26.73 52,738.76 $ 1,130.31Public Shares October 1, 2014 240,128,546.00 $ 26.37 - $ -Class B Shares October 1, 2014 5,000,000,000.00 $ 0.00 - $ -The Public Shares, Management Shares and Class B Shares transactions for the year ended December31, 2014 and Private Shares, Management Shares and VoteCo Shares transactions for the year endedDecember 31, 2013, were as follows:Private Series Non-RestrictedPrivate SeriesRestrictedManagementShares VoteCo SharesShares as of December 31, 2012 1,881,780.36 255,712.01 52,738.76 100.00Transfers (1) (22,393.16) 22,503.62 - -Subscriptions 162,320.58 48,393.76 - -Redemptions (191,577.85) (33,839.37) - -Shares as of December 31, 2013 1,830,129.93 292,770.02 52,738.76 100.00Private Series Non-RestrictedPrivate SeriesRestrictedManagementShares VoteCo Shares Public Shares Class B SharesShares as of December 31, 2013 1,830,129.93 292,770.02 52,738.76 100.00 - -Period from January 1, 2014 - September 30, 2014Transfers (1) 14,280.74 (19,395.07) - - - -Subscriptions 144,376.82 26,497.50 - - - -Redemptions (124,516.27) (25,829.50) - - - -Period from October 1, 2014 - December 31, 2014Conversion Out (1,864,271.22) (274,042.95) (52,738.76) (100.00) - -Conversion In - - 3,357,851.00 - 121,753,991.00 5,000,000,000.00Issuance of Shares - - 5,142,945.00 - 109,875,195.00 -Rollover from Pershing Square International, Ltd - - - - 8,499,360.00 -Shares as of December 31, 2014 - - 8,500,796.00 - 240,128,546.00 5,000,000,000.00(1) This adjustment accounts for transfers between series when such series have different NAV per share (i.e., a series roll-up)60 PERSHING SQUARE HOLDINGS, LTD.

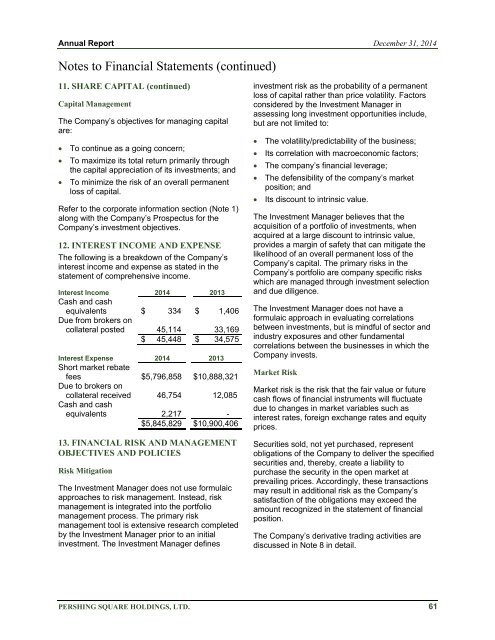

<strong>Annual</strong> <strong>Report</strong> December 31, 2014Notes to Financial Statements (continued)11. SHARE CAPITAL (continued)Capital ManagementThe Company’s objectives for managing capitalare: To continue as a going concern; To maximize its total return primarily throughthe capital appreciation of its investments; and To minimize the risk of an overall permanentloss of capital.Refer to the corporate information section (Note 1)along with the Company’s Prospectus for theCompany’s investment objectives.12. INTEREST INCOME AND EXPENSEThe following is a breakdown of the Company’sinterest income and expense as stated in thestatement of comprehensive income.Interest Income 2014 2013Cash and cashequivalents $ 334 $ 1,406Due from brokers oncollateral posted 45,114 33,169$ 45,448 $ 34,575Interest Expense 2014 2013Short market rebatefees $5,796,858 $10,888,321Due to brokers oncollateral received 46,754 12,085Cash and cashequivalents 2,217 -$5,845,829 $10,900,40613. FINANCIAL RISK AND MANAGEMENTOBJECTIVES AND POLICIESRisk MitigationThe Investment Manager does not use formulaicapproaches to risk management. Instead, riskmanagement is integrated into the portfoliomanagement process. The primary riskmanagement tool is extensive research completedby the Investment Manager prior to an initialinvestment. The Investment Manager definesinvestment risk as the probability of a permanentloss of capital rather than price volatility. Factorsconsidered by the Investment Manager inassessing long investment opportunities include,but are not limited to: The volatility/predictability of the business; Its correlation with macroeconomic factors; The company’s financial leverage; The defensibility of the company’s marketposition; and Its discount to intrinsic value.The Investment Manager believes that theacquisition of a portfolio of investments, whenacquired at a large discount to intrinsic value,provides a margin of safety that can mitigate thelikelihood of an overall permanent loss of theCompany’s capital. The primary risks in theCompany’s portfolio are company specific riskswhich are managed through investment selectionand due diligence.The Investment Manager does not have aformulaic approach in evaluating correlationsbetween investments, but is mindful of sector andindustry exposures and other fundamentalcorrelations between the businesses in which theCompany invests.Market RiskMarket risk is the risk that the fair value or futurecash flows of financial instruments will fluctuatedue to changes in market variables such asinterest rates, foreign exchange rates and equityprices.Securities sold, not yet purchased, representobligations of the Company to deliver the specifiedsecurities and, thereby, create a liability topurchase the security in the open market atprevailing prices. Accordingly, these transactionsmay result in additional risk as the Company’ssatisfaction of the obligations may exceed theamount recognized in the statement of financialposition.The Company’s derivative trading activities arediscussed in Note 8 in detail.PERSHING SQUARE HOLDINGS, LTD. 61

- Page 1 and 2:

2014 Annual Report

- Page 3 and 4:

Annual Report Year Ended December 3

- Page 5 and 6:

Annual Report Year Ended December 3

- Page 7 and 8:

Annual Report Year Ended December 3

- Page 9 and 10:

Annual Report Year Ended December 3

- Page 11 and 12: Annual Report Year Ended December 3

- Page 13 and 14: Annual Report Year Ended December 3

- Page 15 and 16: Annual Report Year Ended December 3

- Page 17 and 18: Annual Report Year Ended December 3

- Page 19 and 20: Annual Report Year Ended December 3

- Page 21 and 22: Annual Report Year Ended December 3

- Page 23 and 24: Annual Report Year Ended December 3

- Page 25 and 26: Annual Report Year Ended December 3

- Page 27 and 28: Annual Report Year Ended December 3

- Page 29 and 30: Annual Report Year Ended December 3

- Page 31 and 32: Annual Report Year Ended December 3

- Page 33 and 34: Annual Report Year Ended December 3

- Page 35 and 36: Annual Report Year Ended December 3

- Page 37 and 38: Annual Report Year Ended December 3

- Page 39 and 40: Annual Report Year Ended December 3

- Page 41 and 42: Annual Report December 31, 2014Stat

- Page 43 and 44: Annual Report Years Ended December

- Page 45 and 46: Annual Report Years Ended December

- Page 47 and 48: Annual Report December 31, 2014Note

- Page 49 and 50: Annual Report December 31, 2014Note

- Page 51 and 52: Annual Report December 31, 2014Note

- Page 53 and 54: Annual Report December 31, 2014Note

- Page 55 and 56: Annual Report December 31, 2014Note

- Page 57 and 58: Annual Report December 31, 2014Note

- Page 59 and 60: Annual Report December 31, 2014Note

- Page 61: Annual Report December 31, 2014Note

- Page 65 and 66: Annual Report December 31, 2014Note

- Page 67 and 68: Annual Report December 31, 2014Note

- Page 69 and 70: Annual Report December 31, 2014Note

- Page 71 and 72: Annual Report December 31, 2014Note

- Page 73 and 74: Annual Report December 31, 2014U.S.

- Page 75 and 76: Annual Report Year Ended December 3

- Page 77 and 78: Annual Report Year Ended December 3