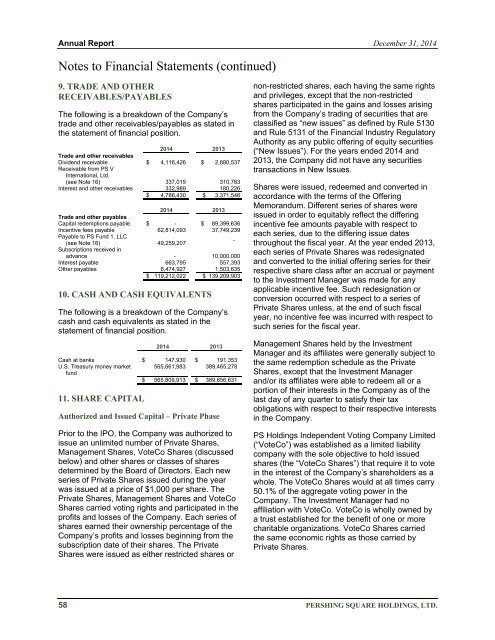

<strong>Annual</strong> <strong>Report</strong> December 31, 2014Notes to Financial Statements (continued)9. TRADE AND OTHERRECEIVABLES/PAYABLESThe following is a breakdown of the Company’strade and other receivables/payables as stated inthe statement of financial position.2014 2013Trade and other receivablesDividend receivable $ 4,116,426 $ 2,880,537Receivable from PS VInternational, Ltd.(see Note 16) 337,015 310,783Interest and other receivables 332,989 180,226$ 4,786,430 $ 3,371,5462014 2013Trade and other payablesCapital redemptions payable $ - $ 89,399,636Incentive fees payable 62,814,093 37,749,239Payable to PS Fund 1, LLC(see Note 16) 49,259,207-Subscriptions received inadvance - 10,000,000Interest payable 663,795 557,393Other payables 6,474,927 1,503,635$ 119,212,022 $ 139,209,90310. CASH AND CASH EQUIVALENTSThe following is a breakdown of the Company’scash and cash equivalents as stated in thestatement of financial position.2014 2013Cash at banks $ 147,930 $ 191,353U.S. Treasury money market 565,661,983 389,465,278fund$ 565,809,913 $ 389,656,63111. SHARE CAPITALAuthorized and Issued Capital – Private PhasePrior to the IPO, the Company was authorized toissue an unlimited number of Private Shares,Management Shares, VoteCo Shares (discussedbelow) and other shares or classes of sharesdetermined by the Board of Directors. Each newseries of Private Shares issued during the yearwas issued at a price of $1,000 per share. ThePrivate Shares, Management Shares and VoteCoShares carried voting rights and participated in theprofits and losses of the Company. Each series ofshares earned their ownership percentage of theCompany’s profits and losses beginning from thesubscription date of their shares. The PrivateShares were issued as either restricted shares ornon-restricted shares, each having the same rightsand privileges, except that the non-restrictedshares participated in the gains and losses arisingfrom the Company’s trading of securities that areclassified as “new issues” as defined by Rule 5130and Rule 5131 of the Financial Industry RegulatoryAuthority as any public offering of equity securities(“New Issues”). For the years ended 2014 and2013, the Company did not have any securitiestransactions in New Issues.Shares were issued, redeemed and converted inaccordance with the terms of the OfferingMemorandum. Different series of shares wereissued in order to equitably reflect the differingincentive fee amounts payable with respect toeach series, due to the differing issue datesthroughout the fiscal year. At the year ended 2013,each series of Private Shares was redesignatedand converted to the initial offering series for theirrespective share class after an accrual or paymentto the Investment Manager was made for anyapplicable incentive fee. Such redesignation orconversion occurred with respect to a series ofPrivate Shares unless, at the end of such fiscalyear, no incentive fee was incurred with respect tosuch series for the fiscal year.Management Shares held by the InvestmentManager and its affiliates were generally subject tothe same redemption schedule as the PrivateShares, except that the Investment Managerand/or its affiliates were able to redeem all or aportion of their interests in the Company as of thelast day of any quarter to satisfy their taxobligations with respect to their respective interestsin the Company.PS Holdings Independent Voting Company Limited(“VoteCo”) was established as a limited liabilitycompany with the sole objective to hold issuedshares (the “VoteCo Shares”) that require it to votein the interest of the Company’s shareholders as awhole. The VoteCo Shares would at all times carry50.1% of the aggregate voting power in theCompany. The Investment Manager had noaffiliation with VoteCo. VoteCo is wholly owned bya trust established for the benefit of one or morecharitable organizations. VoteCo Shares carriedthe same economic rights as those carried byPrivate Shares.58 PERSHING SQUARE HOLDINGS, LTD.

<strong>Annual</strong> <strong>Report</strong> December 31, 2014Notes to Financial Statements (continued)11. SHARE CAPITAL (continued)The Investment Manager waived the managementfee and/or the applicable incentive fee with respectto shares issued to certain shareholders, includingthe Investment Manager itself and certainmembers, partners, officers, managers, employeesor affiliates of the Investment Manager or certainother shareholders. Such shares are referred to asManagement Shares and form a separate class ofshares.Authorized and Issued Capital – Public PhaseOn September 30, 2014, a crystallization eventoccurred in connection with the IPO. Thecrystallized incentive fees totaled $137,753,373.On October 1, 2014, all existing Private Shares(the “Existing Shares”) converted into PublicShares that were no longer redeemable at theshareholder’s option, redeemable ManagementShares converted into non-redeemableManagement Shares and VoteCo Sharesconverted into non-redeemable Class B votingshares. All Existing Shares and ManagementShares were converted at the Issue Price usingtheir aggregate net asset values as ofSeptember 30, 2014.During the public phase, the Board of theCompany is authorized to issue an unlimitednumber of Public Shares, Class B Shares,Management Shares, and such other shares,classes of shares or series as determined by theBoard. All of the Company’s share classesparticipate pro rata in the profits and losses of theCompany based upon the share class’s ownershipof the Company at the time of such allocation.Shareholders in Pershing Square International,Ltd. (“PSINTL”), an affiliated fund managed by theInvestment Manager, were provided with theopportunity to rollover all or part of their respectiveinvestment in exchange for Public Shares in theCompany at the Issue Price (the “Rollover Shares”)at the time of the IPO. The Rollover Sharesrepresented 8,499,360 of the Public Shares fortotal proceeds of $212,484,000. The proceedswere treated as capital redemptions from PSINTLas of September 30, 2014. PSCM designated abank account to act as the nominee for the rollovershareholders whereby the proceeds weredeposited into PSCM’s bank account and PSCMtransferred, the next day, the proceeds to theCompany’s bank account.As of the Placing Date, the total Public Sharesoutstanding were 239,344,260, 109,090,909 ofwhich were issued in the Placing, 121,753,991 ofwhich were converted from Existing Shares and8,499,360 of which were issued in connection withthe Rollover Shares. The VoteCo Sharesconverted into 5,000,000,000 of Class B shares.Effective October 1, 2014, William A. Ackman, aswell as other members and officers of theInvestment Manager invested an aggregateamount of approximately $128.6 million, whichrepresented 5,142,945 additional ManagementShares. As of the Placing Date the totalManagement Shares outstanding were 8,500,796.The over-allotment Option of up to 10,909,091Public Shares, granted by the Company to theStabilising Manager (as discussed in Note 1), wasexercised on November 10, 2014 in the amount of784,286 Public Shares. After the Option exercise,the Company’s Public Shares issued andoutstanding were 240,128,546.Lock-upShareholders holding Public Shares representingthe Existing Shares and the Rollover Shares weresubject to a lock-up of 90 days from October 1,2014 whereby such Shareholders and/or any oftheir affiliates, were prohibited from offering,selling, contract to sell, pledging or otherwisedisposing of any Public Shares held or ownedthrough the end of the lock-up period. This lock-updid not apply to any other Public Shares acquiredin the Placing or in the secondary market.Mr. Ackman and other members of themanagement team and officers of the InvestmentManager have each agreed with the Company to alock-up of ten years commencing from October 1,2014, of their aggregate Management Shareinvestments, less amounts (i) attributable to anysales required to pay taxes on income generatedby the Company; (ii) required to be sold due toregulatory constraints, including, without limitation,sales required due to ownership limits; or (iii)attributable to sales following separation ofemployment from the Investment Manager. Underthe terms of the lock-up arrangement, sharessubject to lock up may from time to time betransfered to affiliates, provided that the transfereeagrees to be subject to the remaining lock-upperiod.Share ConversionSubject to the terms of the lock-up agreements,holders of Management Shares will be entitled toconvert into Public Shares as of the last day ofeach calendar month.PERSHING SQUARE HOLDINGS, LTD. 59

- Page 1 and 2:

2014 Annual Report

- Page 3 and 4:

Annual Report Year Ended December 3

- Page 5 and 6:

Annual Report Year Ended December 3

- Page 7 and 8:

Annual Report Year Ended December 3

- Page 9 and 10: Annual Report Year Ended December 3

- Page 11 and 12: Annual Report Year Ended December 3

- Page 13 and 14: Annual Report Year Ended December 3

- Page 15 and 16: Annual Report Year Ended December 3

- Page 17 and 18: Annual Report Year Ended December 3

- Page 19 and 20: Annual Report Year Ended December 3

- Page 21 and 22: Annual Report Year Ended December 3

- Page 23 and 24: Annual Report Year Ended December 3

- Page 25 and 26: Annual Report Year Ended December 3

- Page 27 and 28: Annual Report Year Ended December 3

- Page 29 and 30: Annual Report Year Ended December 3

- Page 31 and 32: Annual Report Year Ended December 3

- Page 33 and 34: Annual Report Year Ended December 3

- Page 35 and 36: Annual Report Year Ended December 3

- Page 37 and 38: Annual Report Year Ended December 3

- Page 39 and 40: Annual Report Year Ended December 3

- Page 41 and 42: Annual Report December 31, 2014Stat

- Page 43 and 44: Annual Report Years Ended December

- Page 45 and 46: Annual Report Years Ended December

- Page 47 and 48: Annual Report December 31, 2014Note

- Page 49 and 50: Annual Report December 31, 2014Note

- Page 51 and 52: Annual Report December 31, 2014Note

- Page 53 and 54: Annual Report December 31, 2014Note

- Page 55 and 56: Annual Report December 31, 2014Note

- Page 57 and 58: Annual Report December 31, 2014Note

- Page 59: Annual Report December 31, 2014Note

- Page 63 and 64: Annual Report December 31, 2014Note

- Page 65 and 66: Annual Report December 31, 2014Note

- Page 67 and 68: Annual Report December 31, 2014Note

- Page 69 and 70: Annual Report December 31, 2014Note

- Page 71 and 72: Annual Report December 31, 2014Note

- Page 73 and 74: Annual Report December 31, 2014U.S.

- Page 75 and 76: Annual Report Year Ended December 3

- Page 77 and 78: Annual Report Year Ended December 3