0175 Geely Automobile Holdings Limited Annual Report 2011

0175 Geely Automobile Holdings Limited Annual Report 2011

0175 Geely Automobile Holdings Limited Annual Report 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

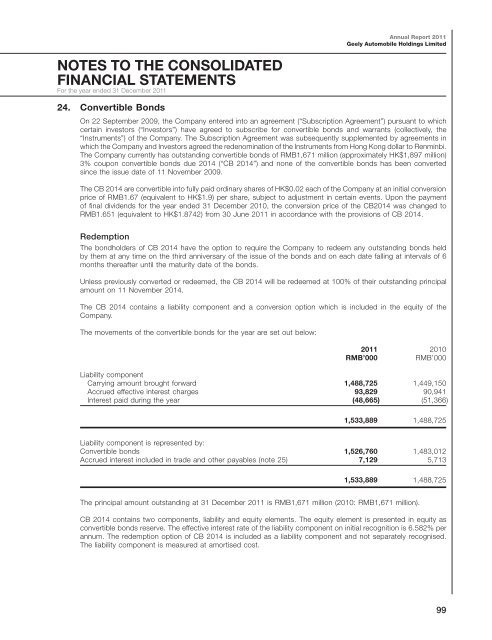

<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><strong>Geely</strong> <strong>Automobile</strong> <strong>Holdings</strong> <strong>Limited</strong>NOTES TO THE CONSOLIDATEDFINANCIAL STATEMENTSFor the year ended 31 December <strong>2011</strong>24. Convertible BondsOn 22 September 2009, the Company entered into an agreement (“Subscription Agreement”) pursuant to whichcertain investors (“Investors”) have agreed to subscribe for convertible bonds and warrants (collectively, the“Instruments”) of the Company. The Subscription Agreement was subsequently supplemented by agreements inwhich the Company and Investors agreed the redenomination of the Instruments from Hong Kong dollar to Renminbi.The Company currently has outstanding convertible bonds of RMB1,671 million (approximately HK$1,897 million)3% coupon convertible bonds due 2014 (“CB 2014”) and none of the convertible bonds has been convertedsince the issue date of 11 November 2009.The CB 2014 are convertible into fully paid ordinary shares of HK$0.02 each of the Company at an initial conversionprice of RMB1.67 (equivalent to HK$1.9) per share, subject to adjustment in certain events. Upon the paymentof final dividends for the year ended 31 December 2010, the conversion price of the CB2014 was changed toRMB1.651 (equivalent to HK$1.8742) from 30 June <strong>2011</strong> in accordance with the provisions of CB 2014.RedemptionThe bondholders of CB 2014 have the option to require the Company to redeem any outstanding bonds heldby them at any time on the third anniversary of the issue of the bonds and on each date falling at intervals of 6months thereafter until the maturity date of the bonds.Unless previously converted or redeemed, the CB 2014 will be redeemed at 100% of their outstanding principalamount on 11 November 2014.The CB 2014 contains a liability component and a conversion option which is included in the equity of theCompany.The movements of the convertible bonds for the year are set out below:<strong>2011</strong> 2010RMB’000RMB’000Liability componentCarrying amount brought forward 1,488,725 1,449,150Accrued effective interest charges 93,829 90,941Interest paid during the year (48,665) (51,366)1,533,889 1,488,725Liability component is represented by:Convertible bonds 1,526,760 1,483,012Accrued interest included in trade and other payables (note 25) 7,129 5,7131,533,889 1,488,725The principal amount outstanding at 31 December <strong>2011</strong> is RMB1,671 million (2010: RMB1,671 million).CB 2014 contains two components, liability and equity elements. The equity element is presented in equity asconvertible bonds reserve. The effective interest rate of the liability component on initial recognition is 6.582% perannum. The redemption option of CB 2014 is included as a liability component and not separately recognised.The liability component is measured at amortised cost.99