0175 Geely Automobile Holdings Limited Annual Report 2011

0175 Geely Automobile Holdings Limited Annual Report 2011

0175 Geely Automobile Holdings Limited Annual Report 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

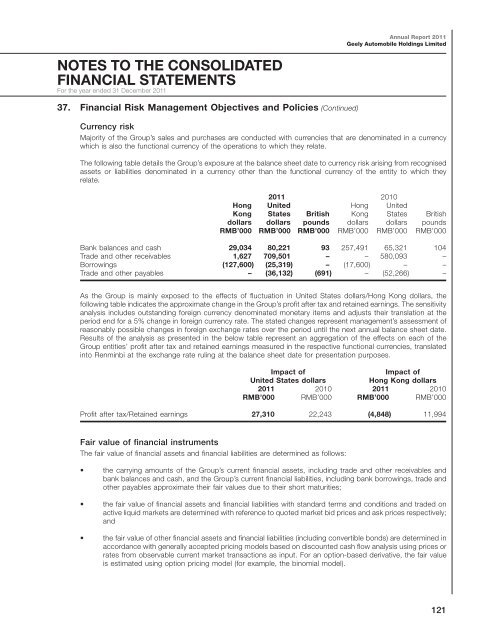

<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><strong>Geely</strong> <strong>Automobile</strong> <strong>Holdings</strong> <strong>Limited</strong>NOTES TO THE CONSOLIDATEDFINANCIAL STATEMENTSFor the year ended 31 December <strong>2011</strong>37. Financial Risk Management Objectives and Policies (Continued)Currency riskMajority of the Group’s sales and purchases are conducted with currencies that are denominated in a currencywhich is also the functional currency of the operations to which they relate.The following table details the Group’s exposure at the balance sheet date to currency risk arising from recognisedassets or liabilities denominated in a currency other than the functional currency of the entity to which theyrelate.<strong>2011</strong> 2010Hong United Hong UnitedKong States British Kong States Britishdollars dollars pounds dollars dollars poundsRMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000Bank balances and cash 29,034 80,221 93 257,491 65,321 104Trade and other receivables 1,627 709,501 – – 580,093 –Borrowings (127,600) (25,319) – (17,600) – –Trade and other payables – (36,132) (691) – (52,266) –As the Group is mainly exposed to the effects of fluctuation in United States dollars/Hong Kong dollars, thefollowing table indicates the approximate change in the Group’s profit after tax and retained earnings. The sensitivityanalysis includes outstanding foreign currency denominated monetary items and adjusts their translation at theperiod end for a 5% change in foreign currency rate. The stated changes represent management’s assessment ofreasonably possible changes in foreign exchange rates over the period until the next annual balance sheet date.Results of the analysis as presented in the below table represent an aggregation of the effects on each of theGroup entities’ profit after tax and retained earnings measured in the respective functional currencies, translatedinto Renminbi at the exchange rate ruling at the balance sheet date for presentation purposes.Impact ofImpact ofUnited States dollarsHong Kong dollars<strong>2011</strong> 2010 <strong>2011</strong> 2010RMB’000 RMB’000 RMB’000 RMB’000Profit after tax/Retained earnings 27,310 22,243 (4,848 ) 11,994Fair value of financial instrumentsThe fair value of financial assets and financial liabilities are determined as follows:• the carrying amounts of the Group’s current financial assets, including trade and other receivables andbank balances and cash, and the Group’s current financial liabilities, including bank borrowings, trade andother payables approximate their fair values due to their short maturities;• the fair value of financial assets and financial liabilities with standard terms and conditions and traded onactive liquid markets are determined with reference to quoted market bid prices and ask prices respectively;and• the fair value of other financial assets and financial liabilities (including convertible bonds) are determined inaccordance with generally accepted pricing models based on discounted cash flow analysis using prices orrates from observable current market transactions as input. For an option-based derivative, the fair valueis estimated using option pricing model (for example, the binomial model).121