0175 Geely Automobile Holdings Limited Annual Report 2011

0175 Geely Automobile Holdings Limited Annual Report 2011

0175 Geely Automobile Holdings Limited Annual Report 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

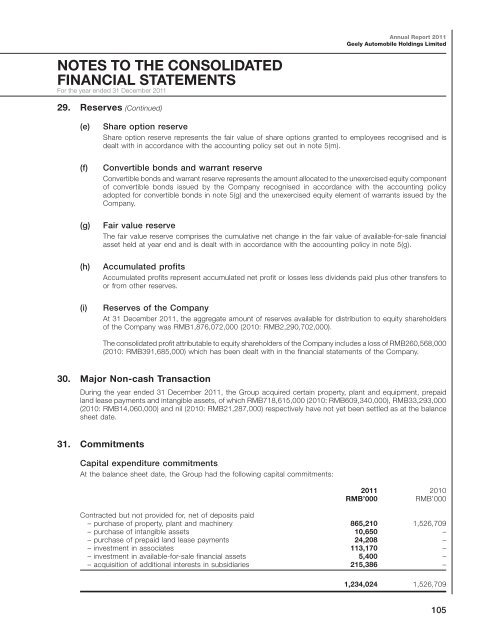

<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><strong>Geely</strong> <strong>Automobile</strong> <strong>Holdings</strong> <strong>Limited</strong>NOTES TO THE CONSOLIDATEDFINANCIAL STATEMENTSFor the year ended 31 December <strong>2011</strong>29. Reserves (Continued)(e)(f)(g)(h)(i)Share option reserveShare option reserve represents the fair value of share options granted to employees recognised and isdealt with in accordance with the accounting policy set out in note 5(m).Convertible bonds and warrant reserveConvertible bonds and warrant reserve represents the amount allocated to the unexercised equity componentof convertible bonds issued by the Company recognised in accordance with the accounting policyadopted for convertible bonds in note 5(g) and the unexercised equity element of warrants issued by theCompany.Fair value reserveThe fair value reserve comprises the cumulative net change in the fair value of available-for-sale financialasset held at year end and is dealt with in accordance with the accounting policy in note 5(g).Accumulated profitsAccumulated profits represent accumulated net profit or losses less dividends paid plus other transfers toor from other reserves.Reserves of the CompanyAt 31 December <strong>2011</strong>, the aggregate amount of reserves available for distribution to equity shareholdersof the Company was RMB1,876,072,000 (2010: RMB2,290,702,000).The consolidated profit attributable to equity shareholders of the Company includes a loss of RMB260,568,000(2010: RMB391,685,000) which has been dealt with in the financial statements of the Company.30. Major Non-cash TransactionDuring the year ended 31 December <strong>2011</strong>, the Group acquired certain property, plant and equipment, prepaidland lease payments and intangible assets, of which RMB718,615,000 (2010: RMB609,340,000), RMB33,293,000(2010: RMB14,060,000) and nil (2010: RMB21,287,000) respectively have not yet been settled as at the balancesheet date.31. CommitmentsCapital expenditure commitmentsAt the balance sheet date, the Group had the following capital commitments:<strong>2011</strong> 2010RMB’000RMB’000Contracted but not provided for, net of deposits paid– purchase of property, plant and machinery 865,210 1,526,709– purchase of intangible assets 10,650 –– purchase of prepaid land lease payments 24,208 –– investment in associates 113,170 –– investment in available-for-sale financial assets 5,400 –– acquisition of additional interests in subsidiaries 215,386 –1,234,024 1,526,709105