0175 Geely Automobile Holdings Limited Annual Report 2011

0175 Geely Automobile Holdings Limited Annual Report 2011

0175 Geely Automobile Holdings Limited Annual Report 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

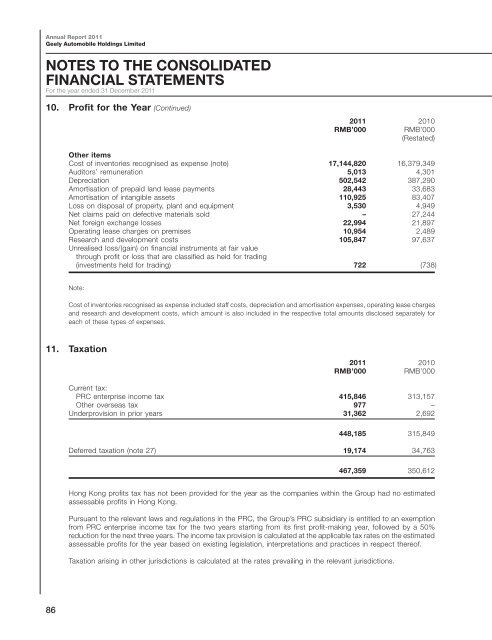

<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><strong>Geely</strong> <strong>Automobile</strong> <strong>Holdings</strong> <strong>Limited</strong>NOTES TO THE CONSOLIDATEDFINANCIAL STATEMENTSFor the year ended 31 December <strong>2011</strong>10. Profit for the Year (Continued)<strong>2011</strong> 2010RMB’000RMB’000(Restated)Other itemsCost of inventories recognised as expense (note) 17,144,820 16,379,349Auditors’ remuneration 5,013 4,301Depreciation 502,542 387,290Amortisation of prepaid land lease payments 28,443 33,683Amortisation of intangible assets 110,925 83,407Loss on disposal of property, plant and equipment 3,530 4,949Net claims paid on defective materials sold – 27,244Net foreign exchange losses 22,994 21,897Operating lease charges on premises 10,954 2,489Research and development costs 105,847 97,637Unrealised loss/(gain) on financial instruments at fair valuethrough profit or loss that are classified as held for trading(investments held for trading) 722 (738)Note:Cost of inventories recognised as expense included staff costs, depreciation and amortisation expenses, operating lease chargesand research and development costs, which amount is also included in the respective total amounts disclosed separately foreach of these types of expenses.11. Taxation<strong>2011</strong> 2010RMB’000RMB’000Current tax:PRC enterprise income tax 415,846 313,157Other overseas tax 977 –Underprovision in prior years 31,362 2,692448,185 315,849Deferred taxation (note 27) 19,174 34,763467,359 350,612Hong Kong profits tax has not been provided for the year as the companies within the Group had no estimatedassessable profits in Hong Kong.Pursuant to the relevant laws and regulations in the PRC, the Group’s PRC subsidiary is entitled to an exemptionfrom PRC enterprise income tax for the two years starting from its first profit-making year, followed by a 50%reduction for the next three years. The income tax provision is calculated at the applicable tax rates on the estimatedassessable profits for the year based on existing legislation, interpretations and practices in respect thereof.Taxation arising in other jurisdictions is calculated at the rates prevailing in the relevant jurisdictions.86