0175 Geely Automobile Holdings Limited Annual Report 2011

0175 Geely Automobile Holdings Limited Annual Report 2011

0175 Geely Automobile Holdings Limited Annual Report 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

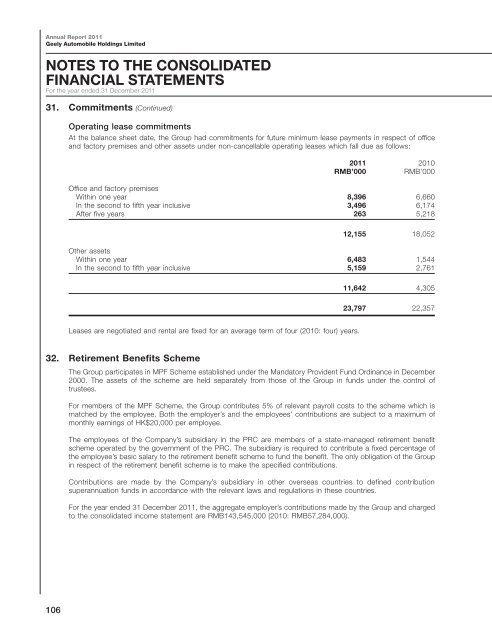

<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><strong>Geely</strong> <strong>Automobile</strong> <strong>Holdings</strong> <strong>Limited</strong>NOTES TO THE CONSOLIDATEDFINANCIAL STATEMENTSFor the year ended 31 December <strong>2011</strong>31. Commitments (Continued)Operating lease commitmentsAt the balance sheet date, the Group had commitments for future minimum lease payments in respect of officeand factory premises and other assets under non-cancellable operating leases which fall due as follows:<strong>2011</strong> 2010RMB’000RMB’000Office and factory premisesWithin one year 8,396 6,660In the second to fifth year inclusive 3,496 6,174After five years 263 5,21812,155 18,052Other assetsWithin one year 6,483 1,544In the second to fifth year inclusive 5,159 2,76111,642 4,30523,797 22,357Leases are negotiated and rental are fixed for an average term of four (2010: four) years.32. Retirement Benefits SchemeThe Group participates in MPF Scheme established under the Mandatory Provident Fund Ordinance in December2000. The assets of the scheme are held separately from those of the Group in funds under the control oftrustees.For members of the MPF Scheme, the Group contributes 5% of relevant payroll costs to the scheme which ismatched by the employee. Both the employer’s and the employees’ contributions are subject to a maximum ofmonthly earnings of HK$20,000 per employee.The employees of the Company’s subsidiary in the PRC are members of a state-managed retirement benefitscheme operated by the government of the PRC. The subsidiary is required to contribute a fixed percentage ofthe employee’s basic salary to the retirement benefit scheme to fund the benefit. The only obligation of the Groupin respect of the retirement benefit scheme is to make the specified contributions.Contributions are made by the Company’s subsidiary in other overseas countries to defined contributionsuperannuation funds in accordance with the relevant laws and regulations in these countries.For the year ended 31 December <strong>2011</strong>, the aggregate employer’s contributions made by the Group and chargedto the consolidated income statement are RMB143,545,000 (2010: RMB57,284,000).106