Chapter 9 Materiality and Risk - HCC Learning Web

Chapter 9 Materiality and Risk - HCC Learning Web

Chapter 9 Materiality and Risk - HCC Learning Web

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

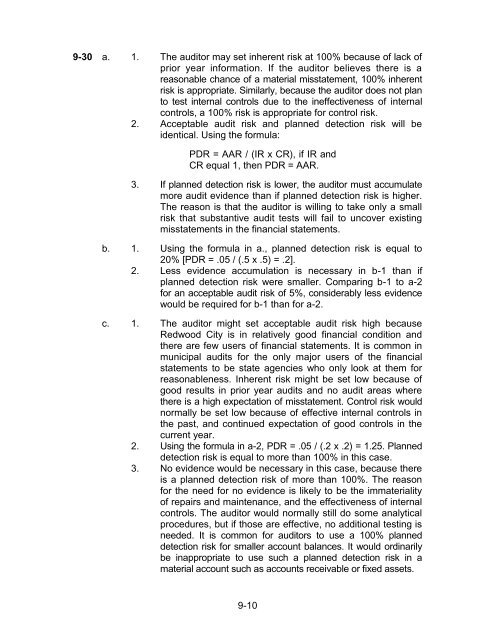

9-30 a. 1. The auditor may set inherent risk at 100% because of lack ofprior year information. If the auditor believes there is areasonable chance of a material misstatement, 100% inherentrisk is appropriate. Similarly, because the auditor does not planto test internal controls due to the ineffectiveness of internalcontrols, a 100% risk is appropriate for control risk.2. Acceptable audit risk <strong>and</strong> planned detection risk will beidentical. Using the formula:PDR = AAR / (IR x CR), if IR <strong>and</strong>CR equal 1, then PDR = AAR.3. If planned detection risk is lower, the auditor must accumulatemore audit evidence than if planned detection risk is higher.The reason is that the auditor is willing to take only a smallrisk that substantive audit tests will fail to uncover existingmisstatements in the financial statements.b. 1. Using the formula in a., planned detection risk is equal to20% [PDR = .05 / (.5 x .5) = .2].2. Less evidence accumulation is necessary in b-1 than ifplanned detection risk were smaller. Comparing b-1 to a-2for an acceptable audit risk of 5%, considerably less evidencewould be required for b-1 than for a-2.c. 1. The auditor might set acceptable audit risk high becauseRedwood City is in relatively good financial condition <strong>and</strong>there are few users of financial statements. It is common inmunicipal audits for the only major users of the financialstatements to be state agencies who only look at them forreasonableness. Inherent risk might be set low because ofgood results in prior year audits <strong>and</strong> no audit areas wherethere is a high expectation of misstatement. Control risk wouldnormally be set low because of effective internal controls inthe past, <strong>and</strong> continued expectation of good controls in thecurrent year.2. Using the formula in a-2, PDR = .05 / (.2 x .2) = 1.25. Planneddetection risk is equal to more than 100% in this case.3. No evidence would be necessary in this case, because thereis a planned detection risk of more than 100%. The reasonfor the need for no evidence is likely to be the immaterialityof repairs <strong>and</strong> maintenance, <strong>and</strong> the effectiveness of internalcontrols. The auditor would normally still do some analyticalprocedures, but if those are effective, no additional testing isneeded. It is common for auditors to use a 100% planneddetection risk for smaller account balances. It would ordinarilybe inappropriate to use such a planned detection risk in amaterial account such as accounts receivable or fixed assets.9-10