Chapter 9 Materiality and Risk - HCC Learning Web

Chapter 9 Materiality and Risk - HCC Learning Web

Chapter 9 Materiality and Risk - HCC Learning Web

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

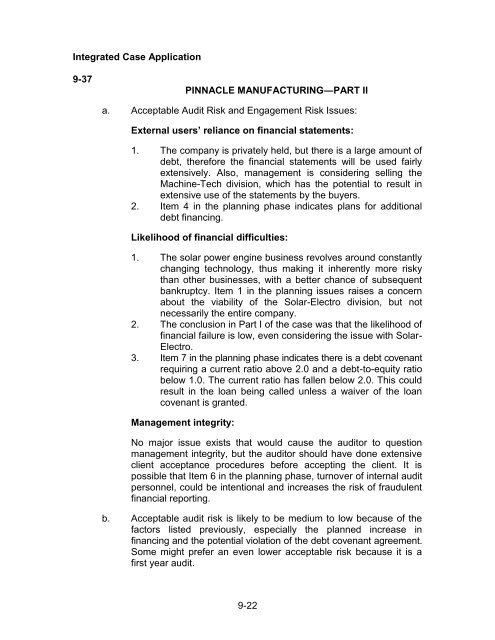

Integrated Case Application9-37PINNACLE MANUFACTURING―PART IIa. Acceptable Audit <strong>Risk</strong> <strong>and</strong> Engagement <strong>Risk</strong> Issues:External users’ reliance on financial statements:1. The company is privately held, but there is a large amount ofdebt, therefore the financial statements will be used fairlyextensively. Also, management is considering selling theMachine-Tech division, which has the potential to result inextensive use of the statements by the buyers.2. Item 4 in the planning phase indicates plans for additionaldebt financing.Likelihood of financial difficulties:1. The solar power engine business revolves around constantlychanging technology, thus making it inherently more riskythan other businesses, with a better chance of subsequentbankruptcy. Item 1 in the planning issues raises a concernabout the viability of the Solar-Electro division, but notnecessarily the entire company.2. The conclusion in Part I of the case was that the likelihood offinancial failure is low, even considering the issue with Solar-Electro.3. Item 7 in the planning phase indicates there is a debt covenantrequiring a current ratio above 2.0 <strong>and</strong> a debt-to-equity ratiobelow 1.0. The current ratio has fallen below 2.0. This couldresult in the loan being called unless a waiver of the loancovenant is granted.Management integrity:No major issue exists that would cause the auditor to questionmanagement integrity, but the auditor should have done extensiveclient acceptance procedures before accepting the client. It ispossible that Item 6 in the planning phase, turnover of internal auditpersonnel, could be intentional <strong>and</strong> increases the risk of fraudulentfinancial reporting.b. Acceptable audit risk is likely to be medium to low because of thefactors listed previously, especially the planned increase infinancing <strong>and</strong> the potential violation of the debt covenant agreement.Some might prefer an even lower acceptable risk because it is afirst year audit.9-22