Chapter 9 Materiality and Risk - HCC Learning Web

Chapter 9 Materiality and Risk - HCC Learning Web

Chapter 9 Materiality and Risk - HCC Learning Web

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

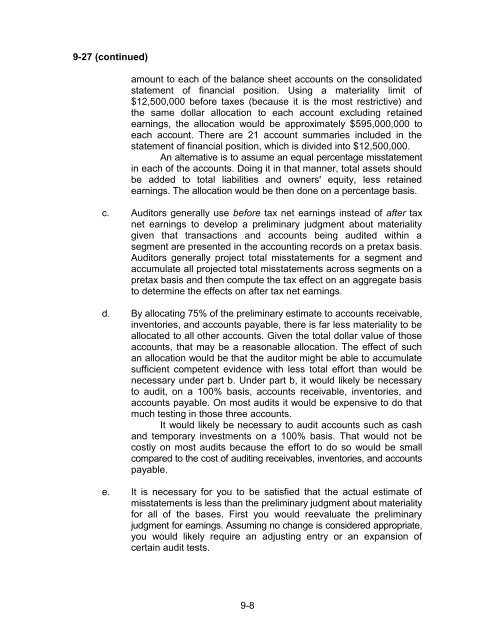

9-27 (continued)amount to each of the balance sheet accounts on the consolidatedstatement of financial position. Using a materiality limit of$12,500,000 before taxes (because it is the most restrictive) <strong>and</strong>the same dollar allocation to each account excluding retainedearnings, the allocation would be approximately $595,000,000 toeach account. There are 21 account summaries included in thestatement of financial position, which is divided into $12,500,000.An alternative is to assume an equal percentage misstatementin each of the accounts. Doing it in that manner, total assets shouldbe added to total liabilities <strong>and</strong> owners' equity, less retainedearnings. The allocation would be then done on a percentage basis.c. Auditors generally use before tax net earnings instead of after taxnet earnings to develop a preliminary judgment about materialitygiven that transactions <strong>and</strong> accounts being audited within asegment are presented in the accounting records on a pretax basis.Auditors generally project total misstatements for a segment <strong>and</strong>accumulate all projected total misstatements across segments on apretax basis <strong>and</strong> then compute the tax effect on an aggregate basisto determine the effects on after tax net earnings.d. By allocating 75% of the preliminary estimate to accounts receivable,inventories, <strong>and</strong> accounts payable, there is far less materiality to beallocated to all other accounts. Given the total dollar value of thoseaccounts, that may be a reasonable allocation. The effect of suchan allocation would be that the auditor might be able to accumulatesufficient competent evidence with less total effort than would benecessary under part b. Under part b, it would likely be necessaryto audit, on a 100% basis, accounts receivable, inventories, <strong>and</strong>accounts payable. On most audits it would be expensive to do thatmuch testing in those three accounts.It would likely be necessary to audit accounts such as cash<strong>and</strong> temporary investments on a 100% basis. That would not becostly on most audits because the effort to do so would be smallcompared to the cost of auditing receivables, inventories, <strong>and</strong> accountspayable.e. It is necessary for you to be satisfied that the actual estimate ofmisstatements is less than the preliminary judgment about materialityfor all of the bases. First you would reevaluate the preliminaryjudgment for earnings. Assuming no change is considered appropriate,you would likely require an adjusting entry or an expansion ofcertain audit tests.9-8