Chapter 9 Materiality and Risk - HCC Learning Web

Chapter 9 Materiality and Risk - HCC Learning Web

Chapter 9 Materiality and Risk - HCC Learning Web

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

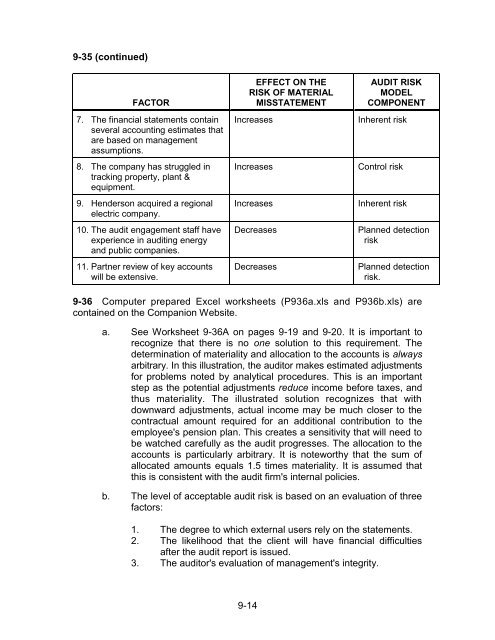

9-35 (continued)FACTOR7. The financial statements containseveral accounting estimates thatare based on managementassumptions.8. The company has struggled intracking property, plant &equipment.9. Henderson acquired a regionalelectric company.10. The audit engagement staff haveexperience in auditing energy<strong>and</strong> public companies.11. Partner review of key accountswill be extensive.EFFECT ON THERISK OF MATERIALMISSTATEMENTIncreasesIncreasesIncreasesDecreasesDecreasesAUDIT RISKMODELCOMPONENTInherent riskControl riskInherent riskPlanned detectionriskPlanned detectionrisk.9-36 Computer prepared Excel worksheets (P936a.xls <strong>and</strong> P936b.xls) arecontained on the Companion <strong>Web</strong>site.a. See Worksheet 9-36A on pages 9-19 <strong>and</strong> 9-20. It is important torecognize that there is no one solution to this requirement. Thedetermination of materiality <strong>and</strong> allocation to the accounts is alwaysarbitrary. In this illustration, the auditor makes estimated adjustmentsfor problems noted by analytical procedures. This is an importantstep as the potential adjustments reduce income before taxes, <strong>and</strong>thus materiality. The illustrated solution recognizes that withdownward adjustments, actual income may be much closer to thecontractual amount required for an additional contribution to theemployee's pension plan. This creates a sensitivity that will need tobe watched carefully as the audit progresses. The allocation to theaccounts is particularly arbitrary. It is noteworthy that the sum ofallocated amounts equals 1.5 times materiality. It is assumed thatthis is consistent with the audit firm's internal policies.b. The level of acceptable audit risk is based on an evaluation of threefactors:1. The degree to which external users rely on the statements.2. The likelihood that the client will have financial difficultiesafter the audit report is issued.3. The auditor's evaluation of management's integrity.9-14