Chapter 9 Materiality and Risk - HCC Learning Web

Chapter 9 Materiality and Risk - HCC Learning Web

Chapter 9 Materiality and Risk - HCC Learning Web

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

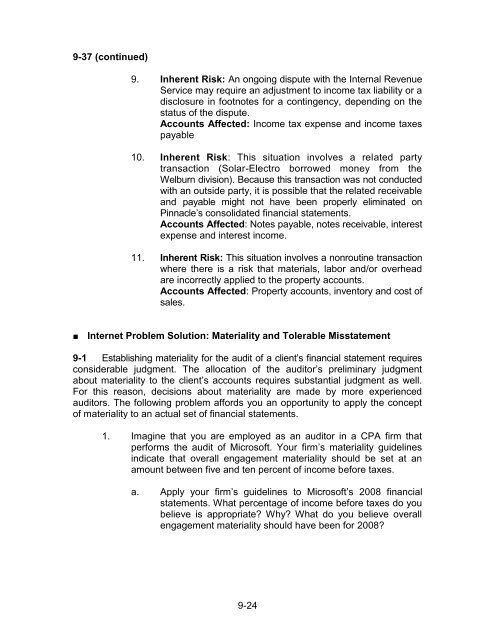

9-37 (continued)9. Inherent <strong>Risk</strong>: An ongoing dispute with the Internal RevenueService may require an adjustment to income tax liability or adisclosure in footnotes for a contingency, depending on thestatus of the dispute.Accounts Affected: Income tax expense <strong>and</strong> income taxespayable10. Inherent <strong>Risk</strong>: This situation involves a related partytransaction (Solar-Electro borrowed money from theWelburn division). Because this transaction was not conductedwith an outside party, it is possible that the related receivable<strong>and</strong> payable might not have been properly eliminated onPinnacle’s consolidated financial statements.Accounts Affected: Notes payable, notes receivable, interestexpense <strong>and</strong> interest income.11. Inherent <strong>Risk</strong>: This situation involves a nonroutine transactionwhere there is a risk that materials, labor <strong>and</strong>/or overheadare incorrectly applied to the property accounts.Accounts Affected: Property accounts, inventory <strong>and</strong> cost ofsales.■ Internet Problem Solution: <strong>Materiality</strong> <strong>and</strong> Tolerable Misstatement9-1 Establishing materiality for the audit of a client’s financial statement requiresconsiderable judgment. The allocation of the auditor’s preliminary judgmentabout materiality to the client’s accounts requires substantial judgment as well.For this reason, decisions about materiality are made by more experiencedauditors. The following problem affords you an opportunity to apply the conceptof materiality to an actual set of financial statements.1. Imagine that you are employed as an auditor in a CPA firm thatperforms the audit of Microsoft. Your firm’s materiality guidelinesindicate that overall engagement materiality should be set at anamount between five <strong>and</strong> ten percent of income before taxes.a. Apply your firm’s guidelines to Microsoft’s 2008 financialstatements. What percentage of income before taxes do youbelieve is appropriate? Why? What do you believe overallengagement materiality should have been for 2008?9-24