Chapter 9 Materiality and Risk - HCC Learning Web

Chapter 9 Materiality and Risk - HCC Learning Web

Chapter 9 Materiality and Risk - HCC Learning Web

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

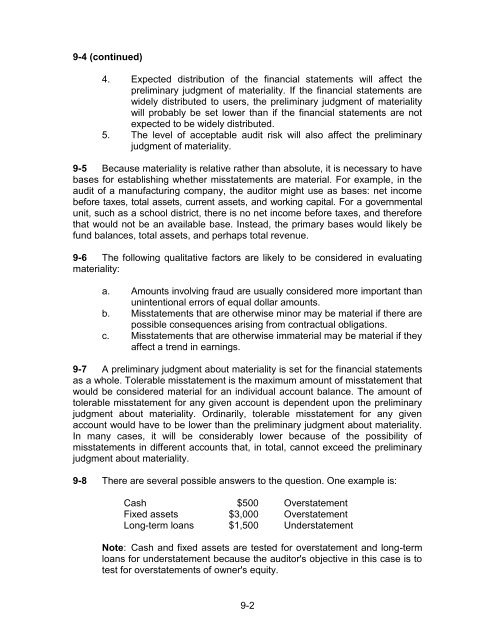

9-4 (continued)4. Expected distribution of the financial statements will affect thepreliminary judgment of materiality. If the financial statements arewidely distributed to users, the preliminary judgment of materialitywill probably be set lower than if the financial statements are notexpected to be widely distributed.5. The level of acceptable audit risk will also affect the preliminaryjudgment of materiality.9-5 Because materiality is relative rather than absolute, it is necessary to havebases for establishing whether misstatements are material. For example, in theaudit of a manufacturing company, the auditor might use as bases: net incomebefore taxes, total assets, current assets, <strong>and</strong> working capital. For a governmentalunit, such as a school district, there is no net income before taxes, <strong>and</strong> thereforethat would not be an available base. Instead, the primary bases would likely befund balances, total assets, <strong>and</strong> perhaps total revenue.9-6 The following qualitative factors are likely to be considered in evaluatingmateriality:a. Amounts involving fraud are usually considered more important thanunintentional errors of equal dollar amounts.b. Misstatements that are otherwise minor may be material if there arepossible consequences arising from contractual obligations.c. Misstatements that are otherwise immaterial may be material if theyaffect a trend in earnings.9-7 A preliminary judgment about materiality is set for the financial statementsas a whole. Tolerable misstatement is the maximum amount of misstatement thatwould be considered material for an individual account balance. The amount oftolerable misstatement for any given account is dependent upon the preliminaryjudgment about materiality. Ordinarily, tolerable misstatement for any givenaccount would have to be lower than the preliminary judgment about materiality.In many cases, it will be considerably lower because of the possibility ofmisstatements in different accounts that, in total, cannot exceed the preliminaryjudgment about materiality.9-8 There are several possible answers to the question. One example is:Cash $500 OverstatementFixed assets $3,000 OverstatementLong-term loans $1,500 UnderstatementNote: Cash <strong>and</strong> fixed assets are tested for overstatement <strong>and</strong> long-termloans for understatement because the auditor's objective in this case is totest for overstatements of owner's equity.9-2