Download - FEAS

Download - FEAS

Download - FEAS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FEDERATION OF EURO-ASIAN STOCK EXCHANGES SEMI ANNUAL REPORT OCTOBER 2005<br />

MUSCAT SECURITIES MARKET<br />

ECONOMIC AND POLITICAL DEVELOPMENTS<br />

Politic and Economic Environment:<br />

Oman has been launching a massive drive<br />

to build the basic infrastructure facilities and<br />

improve living standards of its citizens since<br />

1970. The key economic indicators such as<br />

Gross National Product (GNP); Gross<br />

Domestic Product (GDP); per capita income;<br />

money supply (M3); trade balance and<br />

foreign currency reserves indicated<br />

remarkable growth in 2004.<br />

The policy response of Oman to the<br />

changing international and domestic<br />

economic conditions is marked by its clearcut<br />

willingness to adjust and remain flexible.<br />

Oman's fiscal position has been showing<br />

considerable growth since the 1970s.<br />

The nation has witnessed noticeable<br />

economic achievements in 2004 that are<br />

reflected in its modern physical<br />

infrastructure. Considerable progress in<br />

basic health and education systems and the<br />

improvement in standard of living have been<br />

commendable.<br />

Key Information Contacts<br />

Ministry of National Economy www.moneoman.gov.om<br />

Capital Market Authority www.cma-oman.gov.om<br />

Oman Chamber of Commerce and Industry www.cbo-oman.org<br />

Financial Corporation www.fincorp.org<br />

National Bank of Oman www.nbo.co.om<br />

PAGE 114<br />

Economic Performance:<br />

According to provisional estimates, the<br />

domestic economy registered a record<br />

12.5% growth in 2004 as against 6.9%<br />

recorded in 2003. A sharp increase in oil<br />

prices brought windfall profits for Oman in<br />

2004. Oman crude realized an average price<br />

of US$ 33.9 a barrel last year compared with<br />

the budgeted price of US$ 21.0 a barrel, an<br />

increase of US$ 12.9 a barrel. The government<br />

had increased public expenditure by another<br />

US$ 784 million during the year, resulting in<br />

a higher deficit of US$ 2.1 billion as against<br />

the budgeted deficit of US$ 1.3 billion.<br />

Though the oil revenues were estimated at<br />

US$ 4.3 billion, it grew by a whopping<br />

US$ 3.3 billion to US$ 7.6 billion. Thus the<br />

total actual revenues rose by nearly 43% to<br />

US$ 10.9 billion as against the estimated<br />

US$ 7.6 billion. Oil revenues contributed<br />

more than 69.5% of total income in 2004.<br />

From the additional revenues of US$ 3.3<br />

billion, the total exposure is US$ 2.5 billion,<br />

comprising budgeted deficit of US$ 1.3<br />

billion, additional allocations of US$ 784<br />

million and payment of foreign debts of US$<br />

539 million. The remaining surplus amount is<br />

expected to be reserved as additional<br />

resources for the government.<br />

The actual public expenditures in 2004 were<br />

US$ 9.6 billion. The increased revenues<br />

indicate that the government’s estimates of<br />

US$ 7.6 billion revenues were conservative<br />

and prudent, based on conservative oil price<br />

forecast of US$ 21.0 per barrel. The record<br />

revenues achieved in 2004 will help<br />

government continue its ongoing economic<br />

reform programs and other development<br />

initiatives. Oman’s external debt position<br />

comfortably stands at US$ 3.4 billion as<br />

against staggering debts of many other<br />

countries in the region. The excess of<br />

planned aggregate expenditure of US$ 9.6<br />

billion over budgeted revenue receipts of<br />

US$ 8.0 billion leaves a deficit of US$ 1.4<br />

billion for 2005. The deficit represents 17% of<br />

total revenues and 6% of GDP. The 2005<br />

current expenditure of US$ 7.2 billion<br />

accounts for 75% of total expenditures, with<br />

investment spending (US$ 2.3 billion) and<br />

support to private sector (US$ 171.9 million)<br />

taking the remaining 25%. The oil price<br />

estimated for 2005 budget at US$ 23 a barrel<br />

also seems lower than the expected actual<br />

realization.<br />

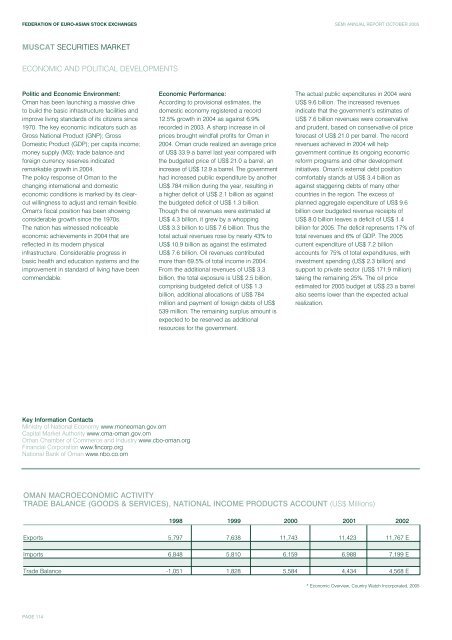

OMAN MACROECONOMIC ACTIVITY<br />

TRADE BALANCE (GOODS & SERVICES), NATIONAL INCOME PRODUCTS ACCOUNT (US$ Millions)<br />

1998 1999 2000 2001 2002<br />

Exports 5,797 7,638 11,743 11,423 11,767 E<br />

Imports 6,848 5,810 6,159 6,988 7,199 E<br />

Trade Balance -1,051 1,828 5,584 4,434 4,568 E<br />

* Economic Overview, Country Watch Incorporated, 2005