Download - FEAS

Download - FEAS

Download - FEAS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FEDERATION OF EURO-ASIAN STOCK EXCHANGES SEMI ANNUAL REPORT OCTOBER 2005<br />

CAIRO & ALEXANDRIA STOCK EXCHANGES<br />

ECONOMIC AND POLITICAL DEVELOPMENTS<br />

Politic and Economic Environment:<br />

Strengthening macroeconomic indicators in<br />

recent years provide ground for optimism<br />

that the reform process has paved the way<br />

for a period of more rapid modernization and<br />

solid economic growth. Economic reforms<br />

have come within the past decade under<br />

President Hosni Mubarak. Key elements of<br />

the reform program are: structural<br />

adjustment financing through the IMF-World<br />

Bank, strong policy action to curb fiscal<br />

deficits and inflation, tax and policy changes,<br />

including large-scale privatization of state<br />

industries, opening the economy to private<br />

(including foreign) investment, and pursuit of<br />

funding from a flexible range of sources to<br />

expedite needed development. A<br />

combination of bilateral and private moneyvariously<br />

channeled as loans, grants, and<br />

incentivized investment-has been committed<br />

to numerous infrastructure projects.<br />

Egypt’s latest economic indicators reflect<br />

robust signs of an accelerating economic<br />

upturn. These development mainly came as<br />

a result of the aggressive reform program<br />

undertaken by the new government<br />

appointed in July 2004, including a<br />

comprehensive package of economic,<br />

structural and political reform, with long term<br />

impact.<br />

Moreover, in December 2004, Egypt signed<br />

the Qualified Industrial Zone Protocol (QIZ),<br />

which is expected to have sustained impacts<br />

on exports growth and trade efficiency as<br />

well as stimulate foreign investment in Egypt.<br />

The protocol is the first step towards the<br />

Key Information Contacts<br />

Central Bank of Egypt www.cbe.org.eg<br />

Capital Market Authority www.cma.gov.eg<br />

Misr Settlement, Clearance and Depository www.mcsd.com.eg<br />

Ministry of Finance www.mof.gov.eg<br />

Ministry of Investment www.investment.gov.eg<br />

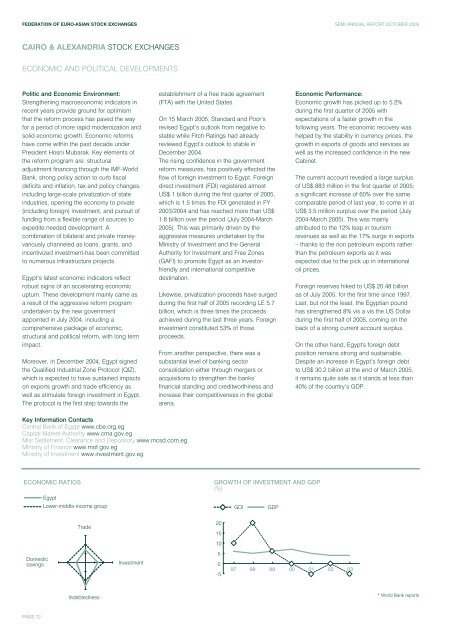

ECONOMIC RATIOS<br />

Domestic<br />

savings<br />

PAGE 72<br />

Egypt<br />

Lower-middle-income group<br />

Trade<br />

Indebtedness<br />

Investment<br />

establishment of a free trade agreement<br />

(FTA) with the United States.<br />

On 15 March 2005, Standard and Poor’s<br />

revised Egypt’s outlook from negative to<br />

stable while Fitch Ratings had already<br />

reviewed Egypt’s outlook to stable in<br />

December 2004.<br />

The rising confidence in the government<br />

reform measures, has positively effected the<br />

flow of foreign investment to Egypt. Foreign<br />

direct investment (FDI) registered almost<br />

US$ 1 billion during the first quarter of 2005,<br />

which is 1.5 times the FDI generated in FY<br />

2003/2004 and has reached more than US$<br />

1.8 billion over the period (July 2004-March<br />

2005). This was primarily driven by the<br />

aggressive measures undertaken by the<br />

Ministry of Investment and the General<br />

Authority for Investment and Free Zones<br />

(GAFI) to promote Egypt as an investorfriendly<br />

and international competitive<br />

destination.<br />

Likewise, privatization proceeds have surged<br />

during the first half of 2005 recording LE 5.7<br />

billion, which is three times the proceeds<br />

achieved during the last three years. Foreign<br />

investment constituted 53% of those<br />

proceeds.<br />

From another perspective, there was a<br />

substantial level of banking sector<br />

consolidation either through mergers or<br />

acquisitions to strengthen the banks’<br />

financial standing and creditworthiness and<br />

increase their competitiveness in the global<br />

arena.<br />

GROWTH OF INVESTMENT AND GDP<br />

(%)<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

97<br />

GDI GDP<br />

Economic Performance:<br />

Economic growth has picked up to 5.2%<br />

during the first quarter of 2005 with<br />

expectations of a faster growth in the<br />

following years. The economic recovery was<br />

helped by the stability in currency prices, the<br />

growth in exports of goods and services as<br />

well as the increased confidence in the new<br />

Cabinet.<br />

The current account revealed a large surplus<br />

of US$ 883 million in the first quarter of 2005;<br />

a significant increase of 60% over the same<br />

comparable period of last year, to come in at<br />

US$ 3.5 million surplus over the period (July<br />

2004-March 2005). This was mainly<br />

attributed to the 12% leap in tourism<br />

revenues as well as the 17% surge in exports<br />

– thanks to the non petroleum exports rather<br />

than the petroleum exports as it was<br />

expected due to the pick up in international<br />

oil prices.<br />

Foreign reserves hiked to US$ 20.48 billion<br />

as of July 2005, for the first time since 1997.<br />

Last, but not the least, the Egyptian pound<br />

has strengthened 8% vis a vis the US Dollar<br />

during the first half of 2005, coming on the<br />

back of a strong current account surplus.<br />

On the other hand, Egypt's foreign debt<br />

position remains strong and sustainable.<br />

Despite an increase in Egypt’s foreign debt<br />

to US$ 30.2 billion at the end of March 2005,<br />

it remains quite safe as it stands at less than<br />

40% of the country’s GDP.<br />

98 99 00 01 02 03<br />

* World Bank reports