Download - FEAS

Download - FEAS

Download - FEAS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FEDERATION OF EURO-ASIAN STOCK EXCHANGES SEMI ANNUAL REPORT OCTOBER 2005<br />

FEDERATION OF EURO-ASIAN STOCK EXCHANGES<br />

Aril Seren<br />

Secretary General of <strong>FEAS</strong> and<br />

Senior Vice Chairman of the Istanbul Stock Exchange<br />

SPONSORS<br />

Please visit our Sponsor sites. Sponsors can be<br />

seen on the <strong>FEAS</strong> website at:<br />

http://www.feas.org/Contributors.cfm.<br />

2005 Contributors to <strong>FEAS</strong> are:<br />

Atos Euronext Market Solutions:<br />

www.aemarketsolutions.com<br />

Computershare Markets Technology:<br />

www.computershare.com<br />

DenizBank FSG:<br />

www.denizbank.com<br />

Dow Jones Indexes and STOXX Ltd.<br />

www.stoxx.com<br />

Is Investment:<br />

www.isinvestment.com<br />

Garanti Securities:<br />

www.garantisecurities.com<br />

GL Trade (Schweiz) AG:<br />

www.gltrade.com<br />

Takasbank:<br />

www.takasbank.com.tr<br />

Tata Consulting Services:<br />

www.tcs.com<br />

Tayburn Kurumsal:<br />

www.tayburnkurumsal.com<br />

2005 1ST HALF REGIONAL PERFORMANCE:<br />

With the admittance of the Central Depositories<br />

and Custodies of existing members to<br />

membership, the <strong>FEAS</strong> region continues to grow<br />

in both depth and breadth. The <strong>FEAS</strong> Region is<br />

represented by 31 full and 7 affiliate members in<br />

27 countries.<br />

Since 2000 <strong>FEAS</strong> member markets have<br />

continued to reorganize their traded companies to<br />

a regional total of 7,989 in the first half of 2005,<br />

yet market capitalization has reached its highest<br />

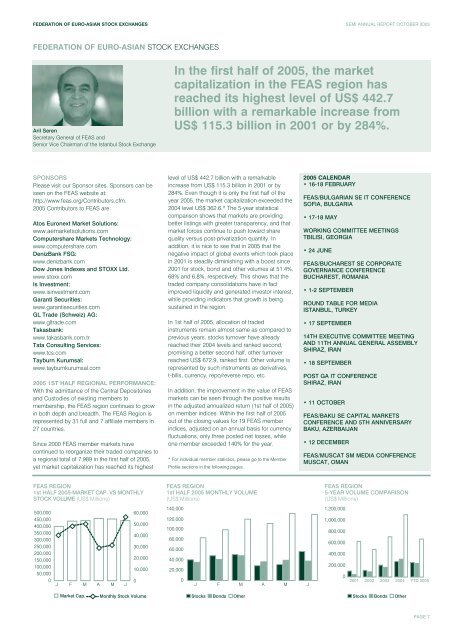

<strong>FEAS</strong> REGION<br />

1st HALF 2005-MARKET CAP. VS MONTHLY<br />

STOCK VOLUME (US$ Millions)<br />

500,000<br />

450,000<br />

400,000<br />

350,000<br />

300,000<br />

250,000<br />

200,000<br />

150,000<br />

100,000<br />

50,000<br />

0<br />

J F M A M J<br />

Market Cap.<br />

60,000<br />

50,000<br />

40,000<br />

30,000<br />

20,000<br />

10,000<br />

0<br />

Monthly Stock Volume<br />

In the first half of 2005, the market<br />

capitalization in the <strong>FEAS</strong> region has<br />

reached its highest level of US$ 442.7<br />

billion with a remarkable increase from<br />

US$ 115.3 billion in 2001 or by 284%.<br />

level of US$ 442.7 billion with a remarkable<br />

increase from US$ 115.3 billion in 2001 or by<br />

284%. Even though it is only the first half of the<br />

year 2005, the market capitalization exceeded the<br />

2004 level US$ 362.6.* The 5-year statistical<br />

comparison shows that markets are providing<br />

better listings with greater transparency, and that<br />

market forces continue to push toward share<br />

quality versus post-privatization quantity. In<br />

addition, it is nice to see that in 2005 that the<br />

negative impact of global events which took place<br />

in 2001 is steadily diminishing with a boost since<br />

2001 for stock, bond and other volumes at 51.4%,<br />

68% and 6.8%, respectively. This shows that the<br />

traded company consolidations have in fact<br />

improved liquidity and generated investor interest,<br />

while providing indicators that growth is being<br />

sustained in the region.<br />

In 1st half of 2005, allocation of traded<br />

instruments remain almost same as compared to<br />

previous years, stocks turnover have already<br />

reached their 2004 levels and ranked second,<br />

promising a better second half, other turnover<br />

reached US$ 672.9, ranked first. Other volume is<br />

represented by such instruments as derivatives,<br />

t-bills, currency, repo/reverse repo, etc.<br />

In addition, the improvement in the value of <strong>FEAS</strong><br />

markets can be seen through the positive results<br />

in the adjusted annualized return (1st half of 2005)<br />

on member indices. Within the first half of 2005<br />

out of the closing values for 19 <strong>FEAS</strong> member<br />

indices, adjusted on an annual basis for currency<br />

fluctuations, only three posted net losses, while<br />

one member exceeded 140% for the year.<br />

* For individual member statistics, please go to the Member<br />

Profile sections in the following pages.<br />

<strong>FEAS</strong> REGION<br />

1st HALF 2005 MONTHLY VOLUME<br />

(US$ Millions)<br />

140,000<br />

120,000<br />

100,000<br />

80,000<br />

60,000<br />

40,000<br />

20,000<br />

0<br />

J F M A M J<br />

Stocks Bonds Other<br />

2005 CALENDAR<br />

• 16-18 FEBRUARY<br />

<strong>FEAS</strong>/BULGARIAN SE IT CONFERENCE<br />

SOFIA, BULGARIA<br />

• 17-18 MAY<br />

WORKING COMMITTEE MEETINGS<br />

TBILISI, GEORGIA<br />

• 24 JUNE<br />

<strong>FEAS</strong>/BUCHAREST SE CORPORATE<br />

GOVERNANCE CONFERENCE<br />

BUCHAREST, ROMANIA<br />

• 1-2 SEPTEMBER<br />

ROUND TABLE FOR MEDIA<br />

ISTANBUL, TURKEY<br />

• 17 SEPTEMBER<br />

14TH EXECUTIVE COMMITTEE MEETING<br />

AND 11TH ANNUAL GENERAL ASSEMBLY<br />

SHIRAZ, IRAN<br />

• 18 SEPTEMBER<br />

POST GA IT CONFERENCE<br />

SHIRAZ, IRAN<br />

• 11 OCTOBER<br />

<strong>FEAS</strong>/BAKU SE CAPITAL MARKETS<br />

CONFERENCE AND 5TH ANNIVERSARY<br />

BAKU, AZERBAIJAN<br />

• 12 DECEMBER<br />

<strong>FEAS</strong>/MUSCAT SM MEDIA CONFERENCE<br />

MUSCAT, OMAN<br />

<strong>FEAS</strong> REGION<br />

5-YEAR VOLUME COMPARISON<br />

(US$ Millions)<br />

1,200,000<br />

1,000,000<br />

800,000<br />

600,000<br />

400,000<br />

200,000<br />

0<br />

2001 2002 2003 2004 YTD 2005<br />

Stocks Bonds Other<br />

PAGE 7