Download - FEAS

Download - FEAS

Download - FEAS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FEDERATION OF EURO-ASIAN STOCK EXCHANGES SEMI ANNUAL REPORT OCTOBER 2005<br />

ABU DHABI SECURITIES MARKET<br />

ECONOMIC AND POLITICAL DEVELOPMENTS<br />

Economic and Political Environment:<br />

Its most affluent and powerful emirate, Abu<br />

Dhabi, largely directs the development and<br />

diversification of prosperous United Arab<br />

Emirates (UAE), one of the more diversified<br />

and open market economies of the Middle<br />

East. Enormous hydrocarbon reserves,<br />

including almost 10% of known global oil<br />

deposits (97.8 billion barrels in 2004), and<br />

the world's fifth largest gas reserves<br />

(212 trillion cubic feet in 2004), following<br />

Russia, Iran, Qatar and Saudi Arabia), are<br />

the basis of the federation's wealth. However<br />

one emirate, Abu Dhabi, possesses nearly<br />

95% of all hydrocarbon deposits with Dubai<br />

and Sharjah holding the majority of the<br />

remainder. While continual federal budget<br />

deficits might retard major development<br />

projects in other nations, the estimated<br />

US$ 350 billion foreign asset position of<br />

Abu Dhabi's provides a large, independent<br />

income stream equivalent to approximately<br />

60% of the federation's annual GDP.<br />

Having experienced the adverse impact of<br />

low oil prices on a number of occasions,<br />

most recently in 1998, the UAE is<br />

aggressively diversifying the economy into<br />

trade, tourism, and heavily subsidized<br />

PAGE 36<br />

agriculture and high technology industries.<br />

The federal government has invested heavily<br />

in aluminum production, tourism, aviation, reexport<br />

commerce, and telecommunications<br />

and the non-oil components of the economy<br />

in 2003 accounted for more than two-thirds<br />

of GDP and in excess of 30% of exports.<br />

Government emphasis on education,<br />

modern technological infrastructure, a<br />

business-friendly climate, and comparatively<br />

more freedom than other Gulf States has<br />

maintained the Emirates' status as one of the<br />

most dynamic economies in the region.<br />

Economic Performance:<br />

Due to high oil prices, GDP grew 7% in 2003,<br />

up from only 1.9% in 2002, when oil prices<br />

were depressed. In a testament to the<br />

strength of the UAE diversification program,<br />

non-oil GDP grew a whopping 5%, due to a<br />

number of projects in construction, upstream<br />

gas, and downstream oil services. Inflation,<br />

as measured by the consumer price index<br />

(CPI) increased slightly to 2.8% from 2.3%<br />

due to higher oil prices. The fiscal balance<br />

recorded a large surplus of 13.7% in 2003,<br />

up from 10.8% in 2002.<br />

Key Information Contacts<br />

Abu Dhabi Chamber of Commerce and Industry www.abudhabichamber.ae<br />

Central Bank of UAE www.uaecb.gov.ae<br />

Ministry of Finance and Industry www.uae.gov.ae/mofi/<br />

Ministry of Planning www.uae.gov.ae/mop<br />

Ministry of Economy and Commerce www.uae.gov.ae/moec<br />

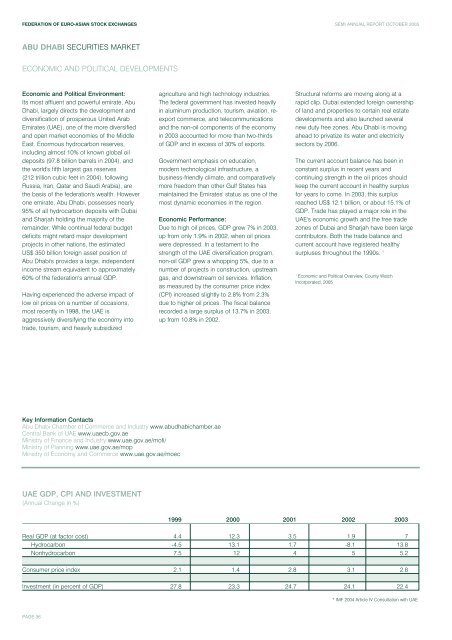

UAE GDP, CPI AND INVESTMENT<br />

(Annual Change in %)<br />

Structural reforms are moving along at a<br />

rapid clip. Dubai extended foreign ownership<br />

of land and properties to certain real estate<br />

developments and also launched several<br />

new duty free zones. Abu Dhabi is moving<br />

ahead to privatize its water and electricity<br />

sectors by 2006.<br />

The current account balance has been in<br />

constant surplus in recent years and<br />

continuing strength in the oil prices should<br />

keep the current account in healthy surplus<br />

for years to come. In 2003, this surplus<br />

reached US$ 12.1 billion, or about 15.1% of<br />

GDP. Trade has played a major role in the<br />

UAE's economic growth and the free trade<br />

zones of Dubai and Sharjah have been large<br />

contributors. Both the trade balance and<br />

current account have registered healthy<br />

surpluses throughout the 1990s. 1<br />

1 Economic and Political Overview, County Watch<br />

Incorporated, 2005<br />

1999 2000 2001 2002 2003<br />

Real GDP (at factor cost) 4.4 12.3 3.5 1.9 7<br />

Hydrocarbon -4.5 13.1 1.7 -8.1 13.8<br />

Nonhydrocarbon 7.5 12 4 5 5.2<br />

Consumer price index 2.1 1.4 2.8 3.1 2.8<br />

Investment (in percent of GDP) 27.8 23.3 24.7 24.1 22.4<br />

* IMF 2004 Article IV Consultation with UAE