Download - FEAS

Download - FEAS

Download - FEAS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FEDERATION OF EURO-ASIAN STOCK EXCHANGES SEMI ANNUAL REPORT OCTOBER 2005<br />

ISTANBUL STOCK EXCHANGE<br />

ECONOMIC AND POLITICAL DEVELOPMENTS<br />

Politic and Economic Environment:<br />

There have been significant developments on<br />

the Turkish economic and political agenda<br />

over the past three years following the 2002<br />

general elections which resulted in a singleparty<br />

majority government. Turkey completed<br />

an IMF-backed economic stabilization<br />

program in February 2005, after meeting all of<br />

the targets that were set in the 3-year IMF<br />

stand-by arrangement.<br />

The implementation of the stabilization<br />

program has produced positive effects in<br />

general on the economic balances and<br />

specifically on inflation figures. With the help<br />

of the program, Turkey has managed to<br />

combine disinflation with economic growth.<br />

Inflation decreased from more than 70% at the<br />

beginning of 2002 to less than 10% within a<br />

time span of about two years. Currently,<br />

inflation is following a sustainable downward<br />

trend which has allowed the economy to grow<br />

strongly out of the slump that was created<br />

with the financial crisis in 2001. From 2002 to<br />

2004, GDP grew by 7.5% on average and the<br />

trend of declining interest rates continued. The<br />

yield on domestic bonds was lowered to 17%<br />

on average from a rate of more than 30% in<br />

2002. Further, the Turkish Lira continues to<br />

appreciate. Due to this environment of<br />

confidence, Turkey’s exports and imports<br />

continue to rise; in fact, foreign trade volume<br />

exceeded US$ 150 billion by the end of 2004.<br />

The IMF Executive Board has approved a new<br />

three-year stand-by agreement for the years<br />

2005-2008 in May 2005, due to a sustained<br />

positive economic environment and recent<br />

developments on key legislation pertaining to<br />

social security, banking sector and tax<br />

administration<br />

Turkey’s achievement in the implementation of<br />

structural reforms and firmly maintaining<br />

political stability in the last few years provided<br />

momentum for progress in Turkey’s<br />

prospective membership to the European<br />

Union (EU). In its 17 December 2004 decision,<br />

the European Council found that Turkey had<br />

met the political criteria in terms of both<br />

legislation and implementation and had<br />

PAGE 82<br />

recorded significant progress in<br />

macroeconomic framework and thus decided<br />

to open accession negotiations with Turkey on<br />

3 October 2005.<br />

Meanwhile, Turkey signed the Customs Union<br />

Protocol which was the final condition to start<br />

accession talks in July 2005.<br />

Since the beginning of 2005 Turkey dropped<br />

six zeros from its currency and has introduced<br />

YTL (New Turkish Lira). With the changeover<br />

to New Turkish Lira on January 1, 2005, both<br />

TL and YTL will be in circulation for one year.<br />

Banknotes and coins currently in circulation<br />

will be withdrawn as of January 1, 2006.<br />

In June 2005, Turkey has initiated the<br />

privatization of 55% of Turk Telekom (TT)<br />

subject to the approval by the government.<br />

After the bargaining process, the highest bid<br />

was announced as US$ 6.55 billion. The result<br />

of the tender will be submitted to the<br />

Competition Authority for permission while the<br />

final decision will be given by the Council of<br />

Ministers.<br />

Economic Performance:<br />

Following the GNP growth rate of 9.9%<br />

achieved in 2004, the Turkish economy grew<br />

by 5.3% in the first quarter of 2005. The<br />

growth rate registered at the first quarter of<br />

2004 was 13.9%.<br />

By the end of May 2005, exports and imports<br />

reached US$ 28.97 billion and US$ 45.1<br />

billion, respectively, both registering an<br />

increase of 22% compared to the same<br />

period of 2004. Within the context of capital<br />

movements, the capital and financial accounts<br />

stood at US$ 8.2 billion and a net inflow of<br />

US$ 4.1 billion of foreign portfolio investments<br />

was observed at the end of May 2005.<br />

Meanwhile, the increase in the producer price<br />

index was realized at 1.9% and the consumer<br />

price index was realized at 2.6% as of the<br />

end-June 2005. The year-on-year consumer<br />

price index and producer price index were<br />

registered as 8.95% and 4.25% as of the end<br />

of June 2005, respectively.<br />

Key Information Contacts<br />

Capital Markets Board of Turkey www.cmb.gov.tr<br />

The Association of Capital Market Intermediary Institutions of Turkey www.tspakb.org.tr<br />

ISE Settlement and Custody Bank Inc. (Takasbank) www.takasbank.com.tr<br />

Central Registry Agency Incorporation of Turkey www.mkk.com.tr<br />

The Turkish Derivatives Exchange (TurkDEX) www.turkdex.org.tr<br />

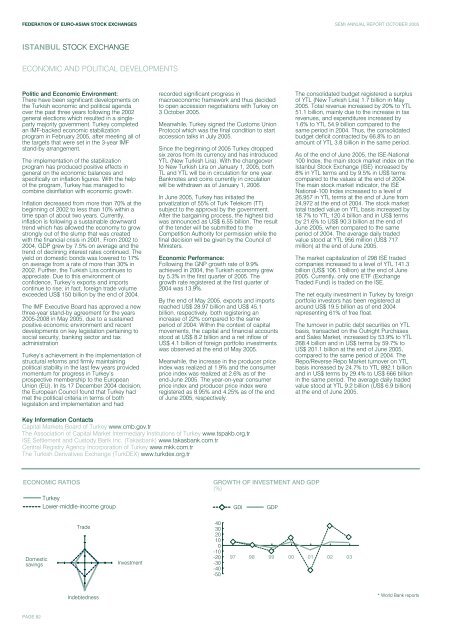

ECONOMIC RATIOS<br />

Domestic<br />

savings<br />

Turkey<br />

Lower-middle-income group<br />

Trade<br />

Indebtedness<br />

Investment<br />

GROWTH OF INVESTMENT AND GDP<br />

(%)<br />

40<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

-30<br />

-40<br />

-50<br />

97<br />

GDI GDP<br />

The consolidated budget registered a surplus<br />

of YTL (New Turkish Lira) 1.7 billion in May<br />

2005. Total revenue increased by 20% to YTL<br />

51.1 billion, mainly due to the increase in tax<br />

revenues, and expenditures increased by<br />

1.6% to YTL 54.9 billion compared to the<br />

same period in 2004. Thus, the consolidated<br />

budget deficit contracted by 66.8% to an<br />

amount of YTL 3.8 billion in the same period.<br />

As of the end of June 2005, the ISE-National<br />

100 Index, the main stock market index on the<br />

Istanbul Stock Exchange (ISE) increased by<br />

8% in YTL terms and by 9.5% in US$ terms<br />

compared to the values at the end of 2004.<br />

The main stock market indicator, the ISE<br />

National-100 Index increased to a level of<br />

26,957 in YTL terms at the end of June from<br />

24,972 at the end of 2004. The stock market<br />

total traded value on YTL basis increased by<br />

18.7% to YTL 120.4 billion and in US$ terms<br />

by 21.6% to US$ 90.3 billion at the end of<br />

June 2005, when compared to the same<br />

period of 2004. The average daily traded<br />

value stood at YTL 956 million (US$ 717<br />

million) at the end of June 2005.<br />

The market capitalization of 298 ISE traded<br />

companies increased to a level of YTL 141.3<br />

billion (US$ 106.1 billion) at the end of June<br />

2005. Currently, only one ETF (Exchange<br />

Traded Fund) is traded on the ISE.<br />

The net equity investment in Turkey by foreign<br />

portfolio investors has been registered at<br />

around US$ 19.5 billion as of end 2004<br />

representing 61% of free float.<br />

The turnover in public debt securities on YTL<br />

basis, transacted on the Outright Purchases<br />

and Sales Market, increased by 53.9% to YTL<br />

268.4 billion and in US$ terms by 59.7% to<br />

US$ 201.1 billion at the end of June 2005,<br />

compared to the same period of 2004. The<br />

Repo/Reverse Repo Market turnover on YTL<br />

basis increased by 24.7% to YTL 892.1 billion<br />

and in US$ terms by 29.4% to US$ 666 billion<br />

in the same period. The average daily traded<br />

value stood at YTL 9.2 billion (US$ 6.9 billion)<br />

at the end of June 2005.<br />

98 99 00 01 02 03<br />

* World Bank reports