A.R. Rahman's Journey to the Oscars - International Indian

A.R. Rahman's Journey to the Oscars - International Indian

A.R. Rahman's Journey to the Oscars - International Indian

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

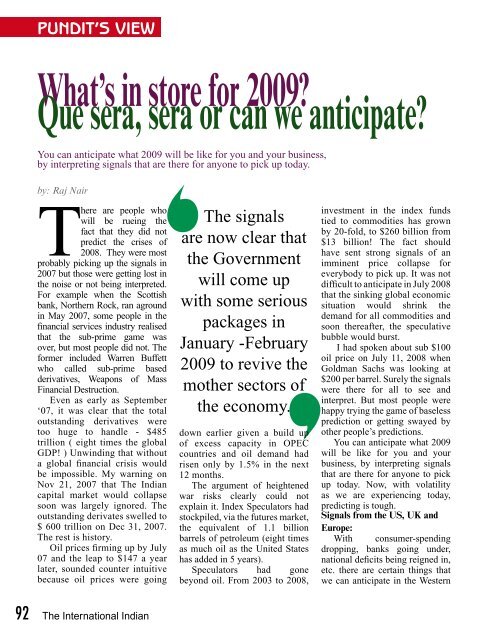

PUNDIT’S VIEWWhat’s in s<strong>to</strong>re for 2009?Que sera, sera or can we anticipate?‘You can anticipate what 2009 will be like for you and your business,by interpreting signals that are <strong>the</strong>re for anyone <strong>to</strong> pick up <strong>to</strong>day.by: Raj NairThere are people whowill be rueing <strong>the</strong> The signalsfact that <strong>the</strong>y did notpredict <strong>the</strong> crises of are now clear that2008. They were mostprobably picking up <strong>the</strong> signals in <strong>the</strong> Government2007 but those were getting lost in<strong>the</strong> noise or not being interpreted. will come upFor example when <strong>the</strong> Scottishbank, Nor<strong>the</strong>rn Rock, ran aground with some seriousin May 2007, some people in <strong>the</strong>financial services industry realised packages inthat <strong>the</strong> sub-prime game wasover, but most people did not. The January -Februaryformer included Warren Buffettwho called sub-prime based 2009 <strong>to</strong> revive <strong>the</strong>derivatives, Weapons of MassFinancial Destruction. mo<strong>the</strong>r sec<strong>to</strong>rs ofEven as early as September‘07, it was clear that <strong>the</strong> <strong>to</strong>tal <strong>the</strong> economy.outstanding derivatives were<strong>to</strong>o huge <strong>to</strong> handle - $485 down earlier given a build uptrillion ( eight times <strong>the</strong> global of excess capacity in OPECGDP! ) Unwinding that without countries and oil demand hada global financial crisis would risen only by 1.5% in <strong>the</strong> nextbe impossible. My warning on 12 months.Nov 21, 2007 that The <strong>Indian</strong> The argument of heightenedcapital market would collapse war risks clearly could notsoon was largely ignored. The explain it. Index Specula<strong>to</strong>rs hadoutstanding derivates swelled <strong>to</strong> s<strong>to</strong>ckpiled, via <strong>the</strong> futures market,$ 600 trillion on Dec 31, 2007. <strong>the</strong> equivalent of 1.1 billionThe rest is his<strong>to</strong>ry.barrels of petroleum (eight timesOil prices firming up by July as much oil as <strong>the</strong> United States07 and <strong>the</strong> leap <strong>to</strong> $147 a year has added in 5 years).later, sounded counter intuitive Specula<strong>to</strong>rs had gonebecause oil prices were going beyond oil. From 2003 <strong>to</strong> 2008,‘investment in <strong>the</strong> index fundstied <strong>to</strong> commodities has grownby 20-fold, <strong>to</strong> $260 billion from$13 billion! The fact shouldhave sent strong signals of animminent price collapse foreverybody <strong>to</strong> pick up. It was notdifficult <strong>to</strong> anticipate in July 2008that <strong>the</strong> sinking global economicsituation would shrink <strong>the</strong>demand for all commodities andsoon <strong>the</strong>reafter, <strong>the</strong> speculativebubble would burst.I had spoken about sub $100oil price on July 11, 2008 whenGoldman Sachs was looking at$200 per barrel. Surely <strong>the</strong> signalswere <strong>the</strong>re for all <strong>to</strong> see andinterpret. But most people werehappy trying <strong>the</strong> game of baselessprediction or getting swayed byo<strong>the</strong>r people’s predictions.You can anticipate what 2009will be like for you and yourbusiness, by interpreting signalsthat are <strong>the</strong>re for anyone <strong>to</strong> pickup <strong>to</strong>day. Now, with volatilityas we are experiencing <strong>to</strong>day,predicting is <strong>to</strong>ugh.Signals from <strong>the</strong> US, UK andEurope:With consumer-spendingdropping, banks going under,national deficits being reigned in,etc. <strong>the</strong>re are certain things thatwe can anticipate in <strong>the</strong> WesternRaj Nair,Chairman, Avalon Consultingworld in 2009.••More job losses.Postponement or reductionin of high ticket/ discretionarypurchases.• Severe cut in marketingspending by companies.• A Bret<strong>to</strong>n Woods-typeinitiative <strong>to</strong> save <strong>the</strong> globalfinancial system from collapse.Risk management policies willdominate discussions.• Credit & liquidity problemsdespite bail-outs.• Sec<strong>to</strong>rs like au<strong>to</strong>motive,plastics, textiles, chemicals,travel and <strong>to</strong>urism, etc. slipping.• Sec<strong>to</strong>rs like healthcare, foodstaples, doing relatively better.• More people will resort <strong>to</strong>ecommerce <strong>to</strong> fish for savings /discounts.• More business failure andconsolidation than in 2008.• Service industries suffering ingeneral.• Protectionism versus freetrade debate may swing a bit<strong>to</strong>wards <strong>the</strong> former.• Obama knows his politics. Willattempt <strong>to</strong> create many new jobsin <strong>the</strong> US by offering incentives <strong>to</strong>invest in job creating ventures and<strong>to</strong> plug loopholes in <strong>the</strong> tax regimethat put those who have offshorejobs on <strong>the</strong> same plane as thosewho keep jobs in <strong>the</strong> USth16YANNI V ERSARYA16• Obama knows his economics.Willing <strong>to</strong> negotiate ra<strong>the</strong>r than fightavoidable wars. Same goes for o<strong>the</strong>rWestern countries.• The Dollar could weaken before end2009 because <strong>the</strong> ‘safe haven’ concept atnear zero returns will not make <strong>the</strong> USTreasury <strong>the</strong> best bet for inves<strong>to</strong>rs. Someinvestments will seek more returns in India(if <strong>the</strong>re is no war with Pakistan) and China.• Russia is richer, stronger than before despite <strong>the</strong> drop in oil prices.The Russians will continue <strong>to</strong> bully neighbours.• China’s exports will be impacted but has <strong>the</strong> capability <strong>to</strong> rebounddue <strong>to</strong> <strong>the</strong> size of <strong>the</strong> domestic market. Watch out for dumping inmarkets like India, ME and parts of SE Asia.One or more of <strong>the</strong>se may impact you or your business?...What signals can we see now in India which are relevant <strong>to</strong> industryin 2009?The signals are now clear that <strong>the</strong> Government will come up withsome serious packages in January -February 2009 <strong>to</strong> revive <strong>the</strong> mo<strong>the</strong>rsec<strong>to</strong>rs of <strong>the</strong> economy, viz. Construction (housing and infrastructure),Au<strong>to</strong>motive and Textiles, on which a large number of industries andservice businesses depend. Exporters can expect rationalisation oftaxes which hurt exports and also some incentives. While it is betterThe second half of 2009 will be <strong>the</strong> start ofan economic revival in <strong>the</strong> <strong>Indian</strong> economy.However, 2009 will not be good for all.late than never, <strong>the</strong> fate of FY 08-09 has been sealed by <strong>the</strong> unwisecredit squeeze–cum-interest rate hike in mid 2008 and <strong>the</strong> delay inundoing <strong>the</strong> damage. GDP for <strong>the</strong> year will be in <strong>the</strong> 6 range and not in<strong>the</strong> 7s which was possible mid-year Things will be better in India thanin <strong>the</strong> rest of <strong>the</strong> world. That is mainly because <strong>the</strong>re is an underlyingviability in <strong>the</strong> economy due <strong>to</strong> low cost structure, growing incomes,good agricultural output in this year and <strong>the</strong> banking system is notbroken as in <strong>the</strong> West. Thankfully, <strong>the</strong> global crisis happened in 2008and not in 2011, because <strong>Indian</strong> banks had not yet fully adopted <strong>the</strong> badhabits of <strong>the</strong> western banks. They still have a decent lending portfolioand manageable bad debts.• Consumer confidence is low and uncertainty prevails...restaurants, movie halls, big ticket purchases at malls are reportinga significant drop but consumer demand is not dead.Will need astrong trigger <strong>to</strong> revive ‘fee good’, like good corporate news. June09 quarter results published in July may turn <strong>the</strong> tide.92 The <strong>International</strong> <strong>Indian</strong>The <strong>International</strong> <strong>Indian</strong> 93