High-frequency trading – a discussion of relevant issues - Xetra

High-frequency trading – a discussion of relevant issues - Xetra

High-frequency trading – a discussion of relevant issues - Xetra

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

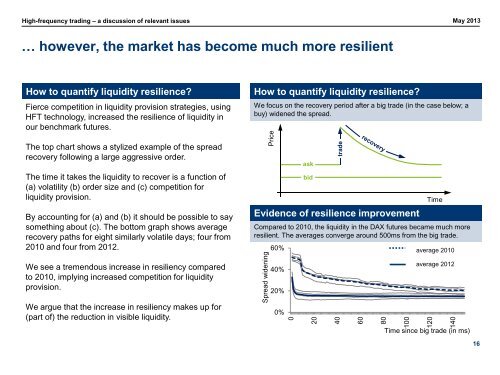

020406080100120140Spread wideningtradePrice<strong>High</strong>-<strong>frequency</strong> <strong>trading</strong> <strong>–</strong> a <strong>discussion</strong> <strong>of</strong> <strong>relevant</strong> <strong>issues</strong> May 2013… however, the market has become much more resilientHow to quantify liquidity resilience?Fierce competition in liquidity provision strategies, usingHFT technology, increased the resilience <strong>of</strong> liquidity inour benchmark futures.How to quantify liquidity resilience?We focus on the recovery period after a big trade (in the case below; abuy) widened the spread.The top chart shows a stylized example <strong>of</strong> the spreadrecovery following a large aggressive order.The time it takes the liquidity to recover is a function <strong>of</strong>(a) volatility (b) order size and (c) competition forliquidity provision.By accounting for (a) and (b) it should be possible to saysomething about (c). The bottom graph shows averagerecovery paths for eight similarly volatile days; four from2010 and four from 2012.Evidence <strong>of</strong> resilience improvementCompared to 2010, the liquidity in the DAX futures became much moreresilient. The averages converge around 500ms from the big trade.60%askbidTimeaverage 2010We see a tremendous increase in resiliency comparedto 2010, implying increased competition for liquidityprovision.We argue that the increase in resiliency makes up for(part <strong>of</strong>) the reduction in visible liquidity.40%20%0%average 2012Time since big trade (in ms)16