High-frequency trading – a discussion of relevant issues - Xetra

High-frequency trading – a discussion of relevant issues - Xetra

High-frequency trading – a discussion of relevant issues - Xetra

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

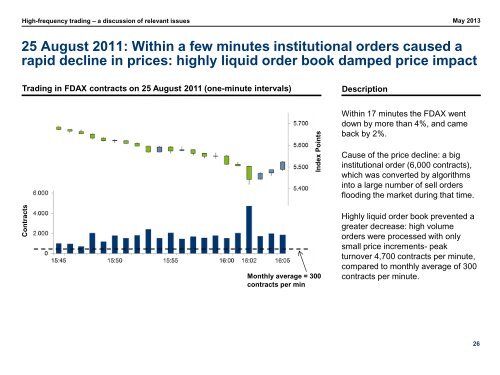

ContractsIndex Points<strong>High</strong>-<strong>frequency</strong> <strong>trading</strong> <strong>–</strong> a <strong>discussion</strong> <strong>of</strong> <strong>relevant</strong> <strong>issues</strong> May 201325 August 2011: Within a few minutes institutional orders caused arapid decline in prices: highly liquid order book damped price impactTrading in FDAX contracts on 25 August 2011 (one-minute intervals)DescriptionWithin 17 minutes the FDAX wentdown by more than 4%, and cameback by 2%.Cause <strong>of</strong> the price decline: a biginstitutional order (6,000 contracts),which was converted by algorithmsinto a large number <strong>of</strong> sell ordersflooding the market during that time.Monthly average = 300contracts per min<strong>High</strong>ly liquid order book prevented agreater decrease: high volumeorders were processed with onlysmall price increments- peakturnover 4,700 contracts per minute,compared to monthly average <strong>of</strong> 300contracts per minute.26