Heidelberg Cement (MYSCEM) - ICICI Direct

Heidelberg Cement (MYSCEM) - ICICI Direct

Heidelberg Cement (MYSCEM) - ICICI Direct

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

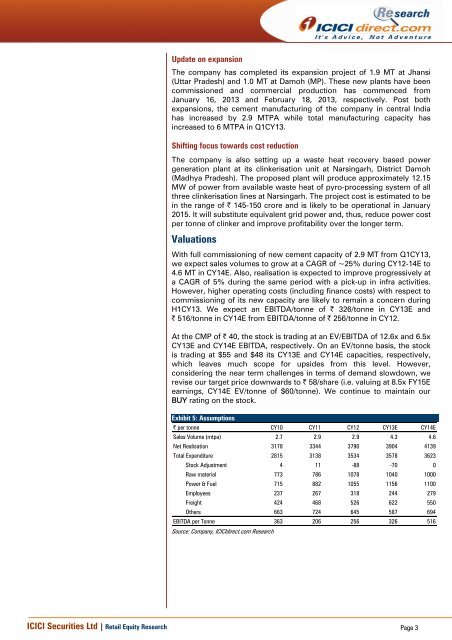

Update on expansionThe company has completed its expansion project of 1.9 MT at Jhansi(Uttar Pradesh) and 1.0 MT at Damoh (MP). These new plants have beencommissioned and commercial production has commenced fromJanuary 16, 2013 and February 18, 2013, respectively. Post bothexpansions, the cement manufacturing of the company in central Indiahas increased by 2.9 MTPA while total manufacturing capacity hasincreased to 6 MTPA in Q1CY13.Shifting focus towards cost reductionThe company is also setting up a waste heat recovery based powergeneration plant at its clinkerisation unit at Narsingarh, District Damoh(Madhya Pradesh). The proposed plant will produce approximately 12.15MW of power from available waste heat of pyro-processing system of allthree clinkerisation lines at Narsingarh. The project cost is estimated to bein the range of | 145-150 crore and is likely to be operational in January2015. It will substitute equivalent grid power and, thus, reduce power costper tonne of clinker and improve profitability over the longer term.ValuationsWith full commissioning of new cement capacity of 2.9 MT from Q1CY13,we expect sales volumes to grow at a CAGR of ~25% during CY12-14E to4.6 MT in CY14E. Also, realisation is expected to improve progressively ata CAGR of 5% during the same period with a pick-up in infra activities.However, higher operating costs (including finance costs) with respect tocommissioning of its new capacity are likely to remain a concern duringH1CY13. We expect an EBITDA/tonne of | 326/tonne in CY13E and| 516/tonne in CY14E from EBITDA/tonne of | 256/tonne in CY12.At the CMP of | 40, the stock is trading at an EV/EBITDA of 12.6x and 6.5xCY13E and CY14E EBITDA, respectively. On an EV/tonne basis, the stockis trading at $55 and $48 its CY13E and CY14E capacities, respectively,which leaves much scope for upsides from this level. However,considering the near term challenges in terms of demand slowdown, werevise our target price downwards to | 58/share (i.e. valuing at 8.5x FY15Eearnings, CY14E EV/tonne of $60/tonne). We continue to maintain ourBUY rating on the stock.Exhibit 5: Assumptions| per tonne CY10 CY11 CY12 CY13E CY14ESales Volume (mtpa) 2.7 2.9 2.9 4.3 4.6Net Realisation 3178 3344 3790 3904 4139Total Expenditure 2815 3138 3534 3578 3623Stock Adjustment 4 11 -88 -70 0Raw material 773 786 1078 1040 1000Power & Fuel 715 882 1055 1156 1100Employees 237 267 318 244 279Freight 424 468 526 622 550Others 663 724 645 587 694EBITDA per Tonne 363 206 256 326 516Source: Company, <strong>ICICI</strong>direct.com Research<strong>ICICI</strong> Securities Ltd | Retail Equity Research Page 3