Paris 15-16 September - Global Real Estate Institute

Paris 15-16 September - Global Real Estate Institute

Paris 15-16 September - Global Real Estate Institute

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

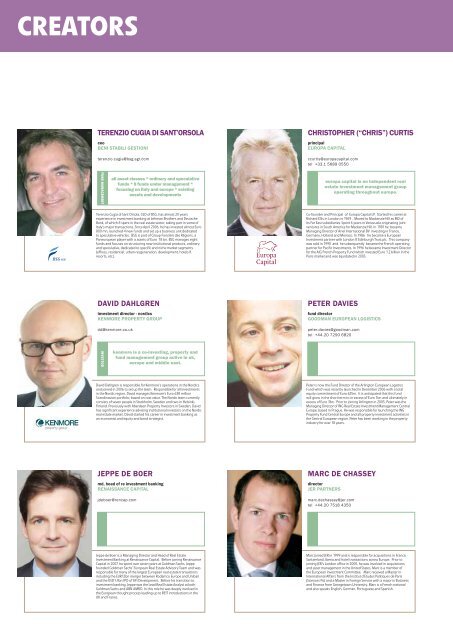

CREATORSTERENZIO CUGIA DI SANT’ORSOLAceoBENI STABILI GESTIONIterenzio.cugia@bsg-sgr.comCHRISTOPHER (“CHRIS”) CURTISprincipalEUROPA CAPITALccurtis@europacapital.comtel +33.1 5689 0550FUND MANAGEMENTall asset classes * ordinary and speculativefunds * 8 funds under management *focusing on italy and europe * existingassets and developmentseuropa capital is an independent realestate investment management groupoperating throughout europe.Terenzio Cugia di Sant’Orsola, CEO of BSG, has almost 20 yearsexperience in investment banking at Lehman Brothers and DeutscheBank, of which 8 spent in the real estate sector, taking part in some ofItaly’s major transactions. Since April 2006, he has invested almost Euro800 mn, launched 4 new funds and set up a business unit dedicatedto speculative vehicles. BSG is part of Group Foncière des Régions, aPaneuropean player with a assets of Euro 18 bn. BSG manages eightfunds and focuses on structuring new institutional products, ordinaryand speculative, dedicated to specific and niche market segments(offices, residential, urban resgeneration, development, hotels &resorts, etc.).Co-founder and Principal of Europa Capital LP. Started his career atRichard Ellis in London in 1969 . Moved to Mackenzie Hill as MD ofits Far East subsidiaries. Spent 6 years in Venezuela originating jointventures in South America for Mackenzie Hill. In 1981 he becameManaging Director of Ariel International BV investing in France,Germany, Holland and Monaco. In 1986 he became a EuropeanInvestment partner with London & Edinburgh Trust plc. This companywas sold in 1990 and he subsequently became the French operatingpartner for Pacific Investments. In 1996 he became Investment Directorfor the AIG French Property Fund which invested Euro 1.2 billion in the<strong>Paris</strong> market and was liquidated in 2003.DAVID DAHLGRENinvestment director - nordicsKENMORE PROPERTY GROUPdd@kenmore.co.ukPETER DAVIESfund directorGOODMAN EUROPEAN LOGISTICSpeter.davies@goodman.comtel +44.20 7290 6820INVESTORkenmore is a co-investing, property andfund management group active in uk,europe and middle east.David Dahlgren is responsible for Kenmore’s operations in the Nordicsand joined in 2006 to set up the team. Responsible for all investmentsin the Nordic region, David manages Kenmore’s Euro 638 millionScandinavian portfolio, based on cost value. The Nordic team currentlyconsists of seven people in Stockholm, Sweden and two in Helsinki,Finland. Previously with Aberdeen Property Investors in Sweden, Davidhas significant experience advising institutional investors on the Nordicreal estate market. David started his career in investment banking asan economist and equity and bond strategist.Peter is now the Fund Director of the Arlington European LogisticsFund which was recently launched in December 2006 with a totalequity commitment of Euro 625m. It is anticipated that this fundwill grow in the short term to in excess of Euro 1bn and ultimately inexcess of Euro 3bn. Prior to joining Arlington in 2005, Peter was theManaging Director of ING <strong>Real</strong> <strong>Estate</strong> Investment Management CentralEurope, based in Prague. He was responsible for launching the INGProperty Fund Central Europe and all property investment activities inthe Central European region. Peter has been working in the propertyindustry for over 18 years.JEPPE DE BOERmd, head of re investment bankingRENAISSANCE CAPITALjdeboer@rencap.comMARC DE CHASSEYdirectorJER PARTNERSmarc.dechassey@jer.comtel +44.20 7518 4350Jeppe de Boer is a Managing Director and Head of <strong>Real</strong> <strong>Estate</strong>Investment Banking at Renaissance Capital. Before joining RenaissanceCapital in 2007, he spent over seven years at Goldman Sachs. Jeppefounded Goldman Sachs’ European <strong>Real</strong> <strong>Estate</strong> Advisory Team and wasresponsible for many of the largest European real estate transactionsincluding the EUR12bn merger between Rodamco Europe and Unibailand the USD1.4bn IPO of AFI Development. Before his transition toinvestment banking, Jeppe was the Lead <strong>Real</strong> <strong>Estate</strong> Analyst at bothGoldman Sachs and ABN AMRO. In this role he was deeply involved inthe European thought process leading up to REIT introductions in theUK and France.Marc joined JER in 1999 and is responsible for acquisitions in France,Switzerland, Iberia and hotel transactions across Europe. Prior tojoining JER’s London office in 2000, he was involved in acquisitionsand asset management in the United States. Marc is a member ofthe European Investment Committee. Marc received a Master inInternational Affairs from the Institut d’Etudes Politiques de <strong>Paris</strong>(Sciences Po) and a Master in Foreign Service with a major in Businessand Finance from Georgetown University. Marc is a French nationaland also speaks English, German, Portuguese and Spanish.