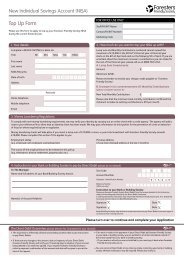

26 tax-efficient savingsAll aboutISAsphotolibraryThe new tax year may be approaching on 6th April, but it’s not too late to takeadvantage of <strong>this</strong> financial year’s tax benefits with an ISA, says Annie ShawQAWhat is an ISA?An ISA, or Individual SavingsAccount, is a ‘wrapper’ aroundsavings or investments, whichallows your money to roll up free ofIncome Tax and Capital Gains Tax. Youopen a savings account or buy shares orinvestment funds inside the wrapper –and the taxman can’t touch the gains youmake. Think of your ISA as a cookie jar,and your savings as the cookies tuckedsafely inside where the taxman’s fingerscan’t reach them.QAWho can invest in an ISA?Anyone over the age of 16 caninvest in a Cash ISA, and anyoneover 18 can invest in a Stocks andShares ISA. You can’t have a joint account,but couples and partners can simply haveone each.QAHow much can I savein an ISA?The annual ISA allowances areactually in the process of increasing,from £7,200 to £10,200.Anyone over the age of 50, or who reaches50 before 6th April 2010, is already allowed toinvest up to £10,200 each year. This can eitherbe all in stocks and shares, or some of theallowance in shares and the balance in cash.A maximum of 50 per cent of the £10,200allowance – in other words £5,100 – can besaved in cash in any one year.The annual allowance will go up foreveryone under the age of 50 in April 2010.So, for the remainder of <strong>this</strong> tax year, they caninvest up to £7,200 in Stocks and Shares ISAsand up to £3,600 in Cash ISAs each year.

tax-efficient savings 27QAQAQADo I have to pick justone provider?Yes if you invest only in shares,but no if you want to have sharesand cash – in <strong>this</strong> case they can be withthe same or different providers.In short, you can have up to twoproviders in a single year, but you can’tput money into two ISAs of the sametype in one year. If you have two ISAs, onemust be shares and one must be cash.You can, however, choose a differentprovider each year – you don’t have to staywith the same one year after year if youdon’t want to – although, of course, youcan if you wish.What happens if I’d liketo switch provider?Once you’ve bought your ISA,the rules allow you to switch, but youmust switch all the funds originating fromyour current year’s allowance at once. Fundsderiving from previous years’ allowances canbe switched in whole or in part.However, note that some providers maynot allow partial withdrawals and may havetheir own rules that require you to close youraccount if you want to switch out. Checkeach provider’s own account rules if you’rethinking of making a move.Can I switch from onetype of ISA to another?You can switch Cash ISA savingsinto a Stocks and Shares ISA if youwant, but not the other way around. You cantransfer Cash ISA proceeds straight into a<strong>Foresters</strong> Stocks and Shares ISA,for instance.QA1 in 3UK adults plan to save moremoney in the next six monthsAccording to recent research by <strong>Foresters</strong><strong>Friendly</strong> <strong>Society</strong> and YouGov, 35 per centof those surveyed said they were going topurposefully set aside more money to investin savings. “Even when the purse strings aretight, putting aside just a little money eachmonth now could make a big differencein years to come,” says <strong>Foresters</strong>Marketing Director,Neil Armitage.All about our ISAOur Stocks and Shares ISAallows your money to grow free fromIncome or Capital Gains Tax08000 214 523www.forestersfriendlysociety.co.ukSee the directory on page 30What should I bear inmind when choosingan ISA?While savings in a Cash ISA won’t fall,research shows that stock market-basedinvestments tend to perform better overtime. And while a cash account won’t evershow a loss on paper, your cash could loseits spending power over time as it is affectedby inflation.Think about whether you need absolutesecurity, or if you want the chance ofgrowth. If you opt for shares, you shouldbe prepared to invest for the longer term –at least five years – and be prepared totake losses in the short term as stockmarkets fluctuate.If you’re not an experienced investorand it could be publishedand don’t fancy in the researching next <strong>issue</strong> into shares,you might be better off selecting a productthat does the choosing for you. <strong>Foresters</strong>’Stocks and Shares ISA, for example, letsyou contribute either regular amounts fromas little as £30 per month by direct debit orinvest a one-off lump sum (minimum £250).Or, as long as you don’t go over the annuallimit, you can choose a combination of both.However, you should be aware that youmay not get back what you pay into aStocks and Shares ISA. The amount youreceive back will depend on the investmentperformance, and whether or not any annualor final bonus is added to your policy (andbonuses can’t be guaranteed).<strong>Foresters</strong>’ ISA is invested in a WithProfits Fund. This invests in a rangeof assets to spread the risk andalso smooths returns – meaningthat in good years, some of thefund’s growth is held back toprovide a buffer against yearswhen growth is not as strong.The aim is to try to providemembers with long-term stablegrowth for the future – andremember that with an ISA, yourmoney will also be safe from thehands of the taxman!Annie Shaw writes for the Daily Expressand Daily Telegraph, and is a founder ofwww.cashquestions.comGreensavingsHere are some tips on how you canhelp to save the planet and savemoney at the same time:No more standbyAlways use the ‘off’ switch. Nearly£1 billion of electricity is wasted everyyear from appliances being left onstandby. Also, remember not to leaveappliances like mobile phones orlaptops on charge unnecessarily.Keep the heat inCut your energy bills by puttingaluminium foil, shiny side out, behindradiators. This reflects heat back into theroom, rather than out through the walls.Wash at 30 degreesWashing your clothes at a highertemperature uses more energy andtherefore results in higher electricitybills. And make sure you fill up yourwashing machine, as washing with ahalf-full machine costs about the sameas washing a full load.Grow your own foodPackets of seeds usually cost less thana pound, and you can get the pleasureof watching your food grow whilesaving on travelling costs to thesupermarket. Also, make your owncompost by filling a bin with yourvegetable peelings, tea bags and grasscuttings, and then letting the worms at it!Save money while drivingReducing your speed by 15mph willcut your fuel use by about 10 per cent,while avoiding heavy braking andfast acceleration can save as much as30 per cent on fuel. And clear out theboot – the more things in it, the morefuel you use, and waste.