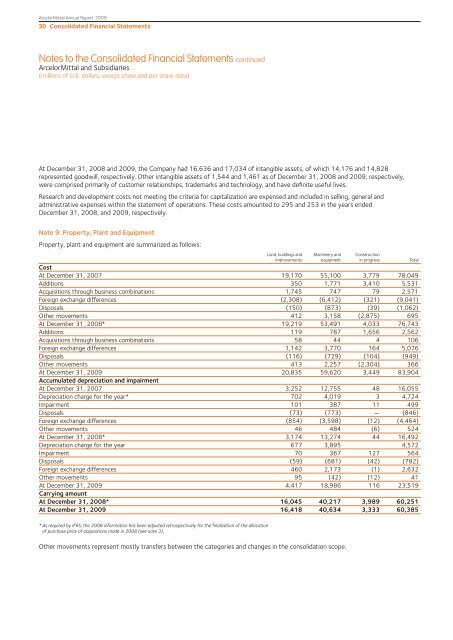

ArcelorMittal Annual <strong>Report</strong> 200930 Consolidated Financial StatementsNotes to the Consolidated Financial Statements continuedArcelorMittal and Subsidiaries(millions of U.S. dollars, except share and per share data)At December 31, 2008 and 2009, the Company had 16,636 and 17,034 of intangible assets, of which 14,176 and 14,828represented goodwill, respectively. Other intangible assets of 1,544 and 1,461 as of December 31, 2008 and 2009, respectively,were comprised primarily of customer relationships, trademarks and technology, and have definite useful lives.Research and development costs not meeting the criteria for capitalization are expensed and included in selling, general andadministrative expenses within the statement of operations. These costs amounted to 295 and 253 in the years endedDecember 31, 2008, and 2009, respectively.Note 9: Property, Plant and EquipmentProperty, plant and equipment are summarized as follows:Land, buildings and Machinery and Constructionimprovements equipment in progress TotalCostAt December 31, 2007 19,170 55,100 3,779 78,049Additions 350 1,771 3,410 5,531Acquisitions through business combinations 1,745 747 79 2,571Foreign exchange differences (2,308) (6,412) (321) (9,041)Disposals (150) (873) (39) (1,062)Other movements 412 3,158 (2,875) 695At December 31, 2008* 19,219 53,491 4,033 76,743Additions 119 787 1,656 2,562Acquisitions through business combinations 58 44 4 106Foreign exchange differences 1,142 3,770 164 5,076Disposals (116) (729) (104) (949)Other movements 413 2,257 (2,304) 366At December 31, 2009 20,835 59,620 3,449 83,904Accumulated depreciation and impairmentAt December 31, 2007 3,252 12,755 48 16,055Depreciation charge for the year* 702 4,019 3 4,724Impairment 101 387 11 499Disposals (73) (773) — (846)Foreign exchange differences (854) (3,598) (12) (4,464)Other movements 46 484 (6) 524At December 31, 2008* 3,174 13,274 44 16,492Depreciation charge for the year 677 3,895 4,572Impairment 70 367 127 564Disposals (59) (681) (42) (782)Foreign exchange differences 460 2,173 (1) 2,632Other movements 95 (42) (12) 41At December 31, 2009 4,417 18,986 116 23,519Carrying amountAt December 31, 2008* 16,045 40,217 3,989 60,251At December 31, 2009 16,418 40,634 3,333 60,385* As required by IFRS, the 2008 information has been adjusted retrospectively for the finalization of the allocationof purchase price of acquisitions made in 2008 (see note 3).Other movements represent mostly transfers between the categories and changes in the consolidation scope.

ArcelorMittal Annual <strong>Report</strong> 2009Consolidated Financial Statements 31During the year ended December 31, 2009and in conjunction with its testing ofgoodwill for impairment, the Companyanalyzed the recoverable amount of itsproperty, plant, and equipment. Property,plant, and equipment was tested at theCGU level, which was comprised of anOperating Subsidiary or a group ofOperating Subsidiaries. The recoverableamounts of the CGUs are determinedbased on value in use calculation and followsimilar assumptions as those used for thetest on impairment for goodwill.<strong>Management</strong> estimates discount ratesusing pre-tax rates that reflect currentmarket rates for investments of similarrisk. The rate for each CGU was estimatedfrom the weighted average cost of capitalof producers which operate a portfolioof assets similar to those of theCompany’s assets.The impairment loss recorded in 2008 of499 was recognized as an expense as partof operating income (loss) in the statementof operations and consisted primarily of thedisposal of the Sparrows Point plant in theUnited States (200) and asset impairmentsat various ArcelorMittal USA sites (74),Gandrange, France (60) and Zumarraga,Spain (54), as these assets were consideredidled based on management decisions andstrategic planning and due to the economicdownturn at the end of 2008. The facilitiesin the US were included in the reportablesegment Flat Carbon Americas and theothers in the reportable segment LongCarbon Americas & Europe.In connection with management’s annualtest for impairment of goodwill as ofNovember 30, 2009, property, plant andequipment was also tested for impairmentat that date. <strong>Management</strong> concluded thatthe value in use of certain of the Company’sproperty, plant, and equipment was lessthan its carrying amount due primarilyto the economic downturn in 2008 whichcontinued to have an impact on 2009.Accordingly, an impairment loss of 564was recognized as an expense as part ofoperating income (loss) in the statementof operations for the year ended December31, 2009. <strong>Management</strong> does not expectthis trend to continue. This impairmentconsisted primarily of the following:• 237 of various idle assets (including92 at ArcelorMittal Galati (coke ovenbatteries) and 65 at ArcelorMittalLas Truchas (primarily an electric arcfurnace, rolling mill, oxygen furnaceand wire rod mill)• 122 of various tubular productoperations (primarily 65 at ArcelorMittalTubular Products Roman, using a pre-taxdiscount rate of 16.9% in 2009(14.9% in 2008)• 172 of other impairments (primarily 117at ArcelorMittal Construction in France,using a pre-tax discount rate of 14.3%in 2009 (12.5% in 2008)ArcelorMittal Galati, ArcelorMittalTubular Products Roman and ArcelorMittalConstruction were included in the FlatCarbon Europe, Long Carbon Americas &Europe and Steel Solutions and Servicesreportable segments, respectively.The carrying amount of property, plantand equipment includes 361 and 499 ofcapital leases as of December 31, 2008and 2009, respectively. The carryingamount of these capital leases is includedin machinery and equipment.The Company has pledged 580 and750 in property, plant and equipmentas of December 31, 2008 and 2009,respectively, to secure banking facilitiesgranted to the Company. These facilitiesare further disclosed in note 14.