Management Report - Beursgorilla

Management Report - Beursgorilla

Management Report - Beursgorilla

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

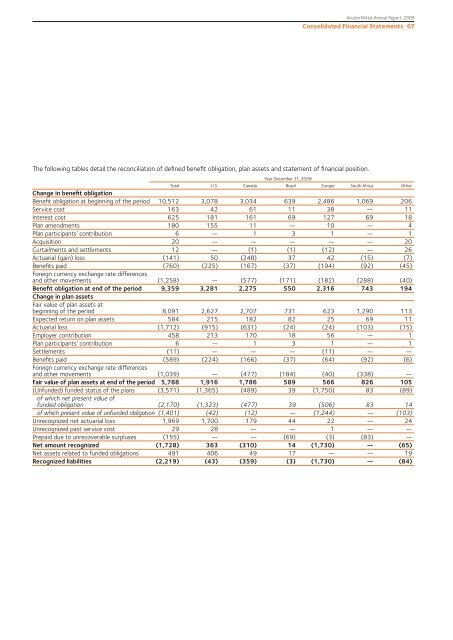

ArcelorMittal Annual <strong>Report</strong> 2009Consolidated Financial Statements 67The following tables detail the reconciliation of defined benefit obligation, plan assets and statement of financial position.Year December 31, 2008Total U.S. Canada Brazil Europe South Africa OtherChange in benefit obligationBenefit obligation at beginning of the period 10,512 3,078 3,034 639 2,486 1,069 206Service cost 163 42 61 11 38 — 11Interest cost 625 181 161 69 127 69 18Plan amendments 180 155 11 — 10 — 4Plan participants’ contribution 6 — 1 3 1 — 1Acquisition 20 — — — — — 20Curtailments and settlements 12 — (1) (1) (12) — 26Actuarial (gain) loss (141) 50 (248) 37 42 (15) (7)Benefits paid (760) (225) (167) (37) (194) (92) (45)Foreign currency exchange rate differencesand other movements (1,258) — (577) (171) (182) (288) (40)Benefit obligation at end of the period 9,359 3,281 2,275 550 2,316 743 194Change in plan assetsFair value of plan assets atbeginning of the period 8,091 2,627 2,707 731 623 1,290 113Expected return on plan assets 584 215 182 82 25 69 11Actuarial loss (1,712) (915) (631) (24) (24) (103) (15)Employer contribution 458 213 170 18 56 — 1Plan participants’ contribution 6 — 1 3 1 — 1Settlements (11) — — — (11) — —Benefits paid (589) (224) (166) (37) (64) (92) (6)Foreign currency exchange rate differencesand other movements (1,039) — (477) (184) (40) (338) —Fair value of plan assets at end of the period 5,788 1,916 1,786 589 566 826 105(Unfunded) funded status of the plans (3,571) (1,365) (489) 39 (1,750) 83 (89)of which net present value offunded obligation (2,170) (1,323) (477) 39 (506) 83 14of which present value of unfunded obligation (1,401) (42) (12) — (1,244) — (103)Unrecognized net actuarial loss 1,969 1,700 179 44 22 — 24Unrecognized past service cost 29 28 — — 1 — —Prepaid due to unrecoverable surpluses (155) — — (69) (3) (83) —Net amount recognized (1,728) 363 (310) 14 (1,730) — (65)Net assets related to funded obligations 491 406 49 17 — — 19Recognized liabilities (2,219) (43) (359) (3) (1,730) — (84)