Management Report - Beursgorilla

Management Report - Beursgorilla

Management Report - Beursgorilla

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

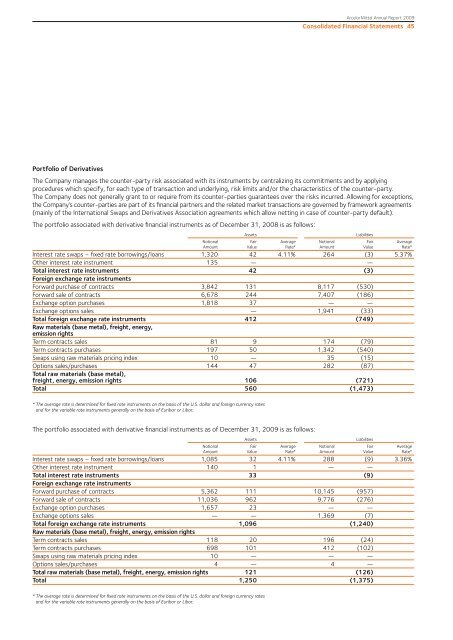

ArcelorMittal Annual <strong>Report</strong> 2009Consolidated Financial Statements 45Portfolio of DerivativesThe Company manages the counter-party risk associated with its instruments by centralizing its commitments and by applyingprocedures which specify, for each type of transaction and underlying, risk limits and/or the characteristics of the counter-party.The Company does not generally grant to or require from its counter-parties guarantees over the risks incurred. Allowing for exceptions,the Company’s counter-parties are part of its financial partners and the related market transactions are governed by framework agreements(mainly of the International Swaps and Derivatives Association agreements which allow netting in case of counter-party default).The portfolio associated with derivative financial instruments as of December 31, 2008 is as follows:Notional Fair Average Notional Fair AverageAmount Value Rate* Amount Value Rate*Interest rate swaps – fixed rate borrowings/loans 1,320 42 4.11% 264 (3) 5.37%Other interest rate instrument 135 — —Total interest rate instruments 42 (3)Foreign exchange rate instrumentsForward purchase of contracts 3,842 131 8,117 (530)Forward sale of contracts 6,678 244 7,407 (186)Exchange option purchases 1,818 37 — —Exchange options sales — 1,941 (33)Total foreign exchange rate instruments 412 (749)Raw materials (base metal), freight, energy,emission rightsTerm contracts sales 81 9 174 (79)Term contracts purchases 197 50 1,342 (540)Swaps using raw materials pricing index 10 — 35 (15)Options sales/purchases 144 47 282 (87)Total raw materials (base metal),freight, energy, emission rights 106 (721)Total 560 (1,473)AssetsLiabilities* The average rate is determined for fixed rate instruments on the basis of the U.S. dollar and foreign currency ratesand for the variable rate instruments generally on the basis of Euribor or Libor.The portfolio associated with derivative financial instruments as of December 31, 2009 is as follows:Notional Fair Average Notional Fair AverageAmount Value Rate* Amount Value Rate*Interest rate swaps – fixed rate borrowings/loans 1,085 32 4.11% 288 (9) 3.36%Other interest rate instrument 140 1 — —Total interest rate instruments 33 (9)Foreign exchange rate instrumentsForward purchase of contracts 5,362 111 10,145 (957)Forward sale of contracts 11,036 962 9,776 (276)Exchange option purchases 1,657 23 — —Exchange options sales — — 1,369 (7)Total foreign exchange rate instruments 1,096 (1,240)Raw materials (base metal), freight, energy, emission rightsTerm contracts sales 118 20 196 (24)Term contracts purchases 698 101 412 (102)Swaps using raw materials pricing index 10 — — —Options sales/purchases 4 — 4 —Total raw materials (base metal), freight, energy, emission rights 121 (126)Total 1,250 (1,375)AssetsLiabilities* The average rate is determined for fixed rate instruments on the basis of the U.S. dollar and foreign currency ratesand for the variable rate instruments generally on the basis of Euribor or Libor.