ArcelorMittal Annual <strong>Report</strong> 200992 Annual AccountsNotes to the Annual Accounts continuedArcelorMittal, Société Anonyme(expressed in millions of U.S. dollars, unless otherwise stated)Shares in affiliated undertakingsCapital and reservesPercentage of Result (including resultName and registered office Carrying amount Capital held % for 2009* for 2009)*AMO Holding Switzerland A.G. Zug (Switzerland) 26,387 100.00 — 56,286ArcelorMittal Cyprus Holding Limited, Nicosia (Cyprus) 18,332 100.00 59 17,023ArcelorMittal Finance and Services Belgium S.A., Brussels (Belgium) 12,024 26.74 1,949 50,185AM Global Holding S.à.r.l., Luxembourg (Luxembourg) 6,705 100.00 (1,073) 5,034ArcelorMittal Investment S.A., Luxembourg (Luxembourg) 3,057 100.00 (889) 9,075Hera Ermac S.A., Luxembourg (Luxembourg) 420 100.00 69 489ArcelorMittal Canada Holdings Inc. , Contrecoeur (Canada) 97 1.18** 273 3,100Other 103Total 67,125* In accordance with unaudited IFRS reporting packages** 100.00% of voting rightsParticipating interestsCapital and reservesPercentage of Result (including resultName and registered office Carrying amount Capital held % for 2009* for 2009)*Hunan Valin Steel Co., Ltd., Changsha (China) 552 33.02 18 2,220Kalagadi Manganese (Pty) Ltd. Rivonia (South Africa) 433 50.00 (33) 172Total 985* In accordance with unaudited IFRS reporting packagesDescription of main changesDuring the year, the Company has granted a facility of 2,300 to ArcelorMittal USA Holdings Inc. maturing on June 18, 2014.Total borrowings under the facility as at December 31, 2009 were 1,982.On February 27, 2009, ArcelorMittal Finance S.C.A. transferred to the Company a loan to AMO Group Finance (Dubai) Ltd. amountingto EUR 12,739 (16,283). This loan was transferred to current assets on December 16, 2009 following the rescheduling of the maturityof the loan (see note 6).As part of the legal reorganization in Canada in May 2009, 4313267 Canada Inc. reduced its outstanding capital througha cash disbursement and the remaining investment held by the Company was contributed to ArcelorMittal Canada Holdings Inc.Contrecoeur (Canada) in exchange of new shares in this company representing 1.18% of the capital and 100.00% of the votingrights. As of May 28, 2009, 4313267 Canada Inc. merged into ArcelorMittal Canada Holdings Inc.On December 28, 2009, the Company made an equity contribution amounting to 420 in Hera Ermac S.A., a wholly-owned Luxembourgaffiliate, which also placed with an affiliate of Calyon an unsecured and unsubordinated 750 bond mandatorily convertible into preferredshares of such subsidiary. The total proceeds were invested in notes issued by affiliates of the Company and linked to shares of the listedrelated parties Erdemir (Turkey) and Mac Arthur Coal Ltd. (Australia) (note 19). The Company has the option to call the mandatorilyconvertible bond from May 3, 2010 until ten business days before the maturity date.Note 6: Amounts Owed by Affiliated UndertakingsAmounts owed by affiliated undertakings have increased by 10,068 over the year under review. This change is primarily a consequenceof the following elements:1) The transfer to current assets of the loan to AMO Group Finance (Dubai) Ltd. amounting to EUR 12,739 (18,352 as ofDecember 31, 2009). The interest rate on the loan is EURIBOR + margin of 1.1% per annum. The initial maturity date for the loanas per the agreement was three years following the drawdown date of January 18, 2008. On December 16, 2009, the maturitywas amended to December 20, 2010 by virtue of an addendum to the original agreement.2) The cash-pooling accounts held with ArcelorMittal Treasury S.N.C. which have decreased by 6,308 over the year as a resultof the funding of the loan mentioned above.3) The decrease by 1,422 of amounts receivable from other Group companies with respect to the tax consolidation (note 18).

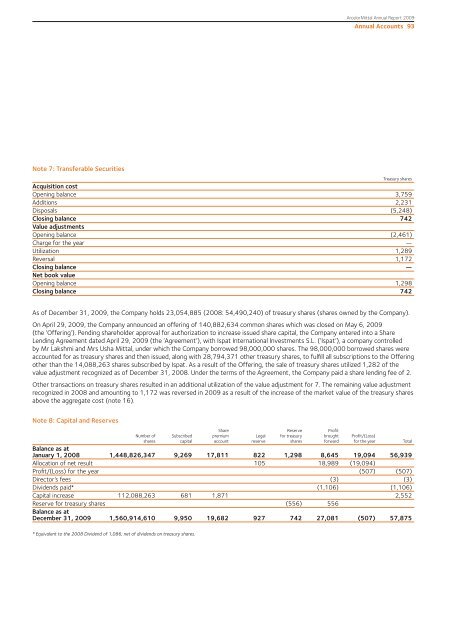

ArcelorMittal Annual <strong>Report</strong> 2009Annual Accounts 93Note 7: Transferable SecuritiesTreasury sharesAcquisition costOpening balance 3,759Additions 2,231Disposals (5,248)Closing balance 742Value adjustmentsOpening balance (2,461)Charge for the year —Utilization 1,289Reversal 1,172Closing balance —Net book valueOpening balance 1,298Closing balance 742As of December 31, 2009, the Company holds 23,054,885 (2008: 54,490,240) of treasury shares (shares owned by the Company).On April 29, 2009, the Company announced an offering of 140,882,634 common shares which was closed on May 6, 2009(the ‘Offering’). Pending shareholder approval for authorization to increase issued share capital, the Company entered into a ShareLending Agreement dated April 29, 2009 (the ‘Agreement’), with Ispat International Investments S.L. (‘Ispat’), a company controlledby Mr Lakshmi and Mrs Usha Mittal, under which the Company borrowed 98,000,000 shares. The 98,000,000 borrowed shares wereaccounted for as treasury shares and then issued, along with 28,794,371 other treasury shares, to fulfill all subscriptions to the Offeringother than the 14,088,263 shares subscribed by Ispat. As a result of the Offering, the sale of treasury shares utilized 1,282 of thevalue adjustment recognized as of December 31, 2008. Under the terms of the Agreement, the Company paid a share lending fee of 2.Other transactions on treasury shares resulted in an additional utilization of the value adjustment for 7. The remaining value adjustmentrecognized in 2008 and amounting to 1,172 was reversed in 2009 as a result of the increase of the market value of the treasury sharesabove the aggregate cost (note 16).Note 8: Capital and ReservesShare Reserve ProfitNumber of Subscribed premium Legal for treasury brought Profit/(Loss)shares capital account reserve shares forward for the year TotalBalance as atJanuary 1, 2008 1,448,826,347 9,269 17,811 822 1,298 8,645 19,094 56,939Allocation of net result 105 18,989 (19,094)Profit/(Loss) for the year (507) (507)Director’s fees (3) (3)Dividends paid* (1,106) (1,106)Capital increase 112,088,263 681 1,871 2,552Reserve for treasury shares (556) 556Balance as atDecember 31, 2009 1,560,914,610 9,950 19,682 927 742 27,081 (507) 57,875* Equivalent to the 2008 Dividend of 1,086; net of dividends on treasury shares.