Management Report - Beursgorilla

Management Report - Beursgorilla

Management Report - Beursgorilla

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

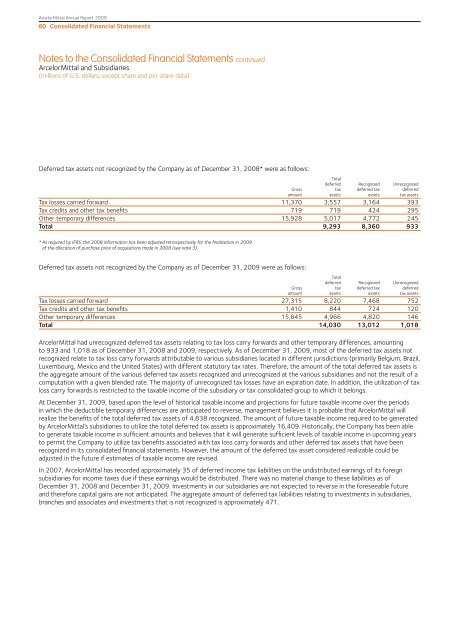

ArcelorMittal Annual <strong>Report</strong> 200960 Consolidated Financial StatementsNotes to the Consolidated Financial Statements continuedArcelorMittal and Subsidiaries(millions of U.S. dollars, except share and per share data)Deferred tax assets not recognized by the Company as of December 31, 2008* were as follows:Totaldeferred Recognized UnrecognizedGross tax deferred tax deferredamount assets assets tax assetsTax losses carried forward 11,370 3,557 3,164 393Tax credits and other tax benefits 719 719 424 295Other temporary differences 15,928 5,017 4,772 245Total 9,293 8,360 933* As required by IFRS, the 2008 information has been adjusted retrospectively for the finalization in 2009of the allocation of purchase price of acquisitions made in 2008 (see note 3).Deferred tax assets not recognized by the Company as of December 31, 2009 were as follows:Totaldeferred Recognized UnrecognizedGross tax deferred tax deferredamount assets assets tax assetsTax losses carried forward 27,315 8,220 7,468 752Tax credits and other tax benefits 1,410 844 724 120Other temporary differences 15,845 4,966 4,820 146Total 14,030 13,012 1,018ArcelorMittal had unrecognized deferred tax assets relating to tax loss carry forwards and other temporary differences, amountingto 933 and 1,018 as of December 31, 2008 and 2009, respectively. As of December 31, 2009, most of the deferred tax assets notrecognized relate to tax loss carry forwards attributable to various subsidiaries located in different jurisdictions (primarily Belgium, Brazil,Luxembourg, Mexico and the United States) with different statutory tax rates. Therefore, the amount of the total deferred tax assets isthe aggregate amount of the various deferred tax assets recognized and unrecognized at the various subsidiaries and not the result of acomputation with a given blended rate. The majority of unrecognized tax losses have an expiration date. In addition, the utilization of taxloss carry forwards is restricted to the taxable income of the subsidiary or tax consolidated group to which it belongs.At December 31, 2009, based upon the level of historical taxable income and projections for future taxable income over the periodsin which the deductible temporary differences are anticipated to reverse, management believes it is probable that ArcelorMittal willrealize the benefits of the total deferred tax assets of 4,838 recognized. The amount of future taxable income required to be generatedby ArcelorMittal’s subsidiaries to utilize the total deferred tax assets is approximately 16,409. Historically, the Company has been ableto generate taxable income in sufficient amounts and believes that it will generate sufficient levels of taxable income in upcoming yearsto permit the Company to utilize tax benefits associated with tax loss carry forwards and other deferred tax assets that have beenrecognized in its consolidated financial statements. However, the amount of the deferred tax asset considered realizable could beadjusted in the future if estimates of taxable income are revised.In 2007, ArcelorMittal has recorded approximately 35 of deferred income tax liabilities on the undistributed earnings of its foreignsubsidiaries for income taxes due if these earnings would be distributed. There was no material change to these liabilities as ofDecember 31, 2008 and December 31, 2009. Investments in our subsidiaries are not expected to reverse in the foreseeable futureand therefore capital gains are not anticipated. The aggregate amount of deferred tax liabilities relating to investments in subsidiaries,branches and associates and investments that is not recognized is approximately 471.