Management Report - Beursgorilla

Management Report - Beursgorilla

Management Report - Beursgorilla

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

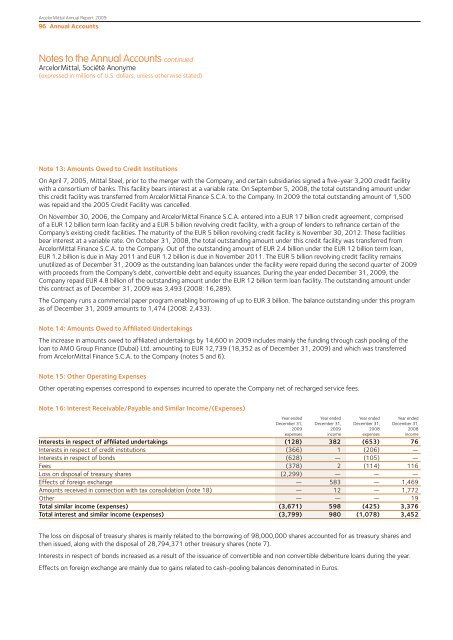

ArcelorMittal Annual <strong>Report</strong> 200996 Annual AccountsNotes to the Annual Accounts continuedArcelorMittal, Société Anonyme(expressed in millions of U.S. dollars, unless otherwise stated)Note 13: Amounts Owed to Credit InstitutionsOn April 7, 2005, Mittal Steel, prior to the merger with the Company, and certain subsidiaries signed a five-year 3,200 credit facilitywith a consortium of banks. This facility bears interest at a variable rate. On September 5, 2008, the total outstanding amount underthis credit facility was transferred from ArcelorMittal Finance S.C.A. to the Company. In 2009 the total outstanding amount of 1,500was repaid and the 2005 Credit Facility was cancelled.On November 30, 2006, the Company and ArcelorMittal Finance S.C.A. entered into a EUR 17 billion credit agreement, comprisedof a EUR 12 billion term loan facility and a EUR 5 billion revolving credit facility, with a group of lenders to refinance certain of theCompany’s existing credit facilities. The maturity of the EUR 5 billion revolving credit facility is November 30, 2012. These facilitiesbear interest at a variable rate. On October 31, 2008, the total outstanding amount under this credit facility was transferred fromArcelorMittal Finance S.C.A. to the Company. Out of the outstanding amount of EUR 2.4 billion under the EUR 12 billion term loan,EUR 1.2 billion is due in May 2011 and EUR 1.2 billion is due in November 2011. The EUR 5 billion revolving credit facility remainsunutilized as of December 31, 2009 as the outstanding loan balances under the facility were repaid during the second quarter of 2009with proceeds from the Company’s debt, convertible debt and equity issuances. During the year ended December 31, 2009, theCompany repaid EUR 4.8 billion of the outstanding amount under the EUR 12 billion term loan facility. The outstanding amount underthis contract as of December 31, 2009 was 3,493 (2008: 16,289).The Company runs a commercial paper program enabling borrowing of up to EUR 3 billion. The balance outstanding under this programas of December 31, 2009 amounts to 1,474 (2008: 2,433).Note 14: Amounts Owed to Affiliated UndertakingsThe increase in amounts owed to affiliated undertakings by 14,600 in 2009 includes mainly the funding through cash pooling of theloan to AMO Group Finance (Dubai) Ltd. amounting to EUR 12,739 (18,352 as of December 31, 2009) and which was transferredfrom ArcelorMittal Finance S.C.A. to the Company (notes 5 and 6).Note 15: Other Operating ExpensesOther operating expenses correspond to expenses incurred to operate the Company net of recharged service fees.Note 16: Interest Receivable/Payable and Similar Income/(Expenses)Year ended Year ended Year ended Year endedDecember 31, December 31, December 31, December 31,2009 2009 2008 2008expenses income expenses incomeInterests in respect of affiliated undertakings (128) 382 (653) 76Interests in respect of credit institutions (366) 1 (206) —Interests in respect of bonds (628) — (105) —Fees (378) 2 (114) 116Loss on disposal of treasury shares (2,299) — — —Effects of foreign exchange — 583 — 1,469Amounts received in connection with tax consolidation (note 18) — 12 — 1,772Other — — — 19Total similar income (expenses) (3,671) 598 (425) 3,376Total interest and similar income (expenses) (3,799) 980 (1,078) 3,452The loss on disposal of treasury shares is mainly related to the borrowing of 98,000,000 shares accounted for as treasury shares andthen issued, along with the disposal of 28,794,371 other treasury shares (note 7).Interests in respect of bonds increased as a result of the issuance of convertible and non convertible debenture loans during the year.Effects on foreign exchange are mainly due to gains related to cash-pooling balances denominated in Euros.