National Bank of Cambodia

National Bank of Cambodia

National Bank of Cambodia

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

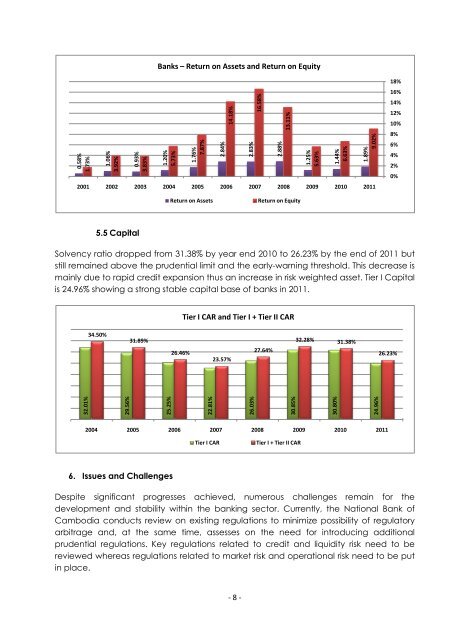

<strong>Bank</strong>s – Return on Assets and Return on Equity14.18%16.58%13.11%0.58%1.73%1.06%3.92%0.93%3.83%1.20%5.73%1.76%7.87%2.84%2.83%2.88%1.25%5.63%1.44%6.63%1.89%9.02%2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 201118%16%14%12%10%8%6%4%2%0%Return on AssetsReturn on Equity5.5 CapitalSolvency ratio dropped from 31.38% by year end 2010 to 26.23% by the end <strong>of</strong> 2011 butstill remained above the prudential limit and the early-warning threshold. This decrease ismainly due to rapid credit expansion thus an increase in risk weighted asset. Tier I Capitalis 24.96% showing a strong stable capital base <strong>of</strong> banks in 2011.Tier I CAR and Tier I + Tier II CAR34.50%31.89%26.46%23.57%27.64%32.28% 31.38%26.23%32.01%29.56%25.25%22.81%26.03%30.85%30.80%24.96%2004 2005 2006 2007 2008 2009 2010 2011Tier I CARTier I + Tier II CAR6. Issues and ChallengesDespite significant progresses achieved, numerous challenges remain for thedevelopment and stability within the banking sector. Currently, the <strong>National</strong> <strong>Bank</strong> <strong>of</strong><strong>Cambodia</strong> conducts review on existing regulations to minimize possibility <strong>of</strong> regulatoryarbitrage and, at the same time, assesses on the need for introducing additionalprudential regulations. Key regulations related to credit and liquidity risk need to bereviewed whereas regulations related to market risk and operational risk need to be putin place.- 8 -