National Bank of Cambodia

National Bank of Cambodia

National Bank of Cambodia

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

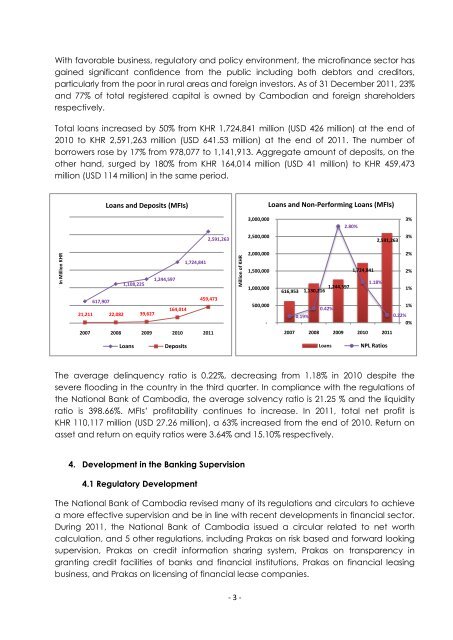

With favorable business, regulatory and policy environment, the micr<strong>of</strong>inance sector hasgained significant confidence from the public including both debtors and creditors,particularly from the poor in rural areas and foreign investors. As <strong>of</strong> 31 December 2011, 23%and 77% <strong>of</strong> total registered capital is owned by <strong>Cambodia</strong>n and foreign shareholdersrespectively.Total loans increased by 50% from KHR 1,724,841 million (USD 426 million) at the end <strong>of</strong>2010 to KHR 2,591,263 million (USD 641.53 million) at the end <strong>of</strong> 2011. The number <strong>of</strong>borrowers rose by 17% from 978,077 to 1,141,913. Aggregate amount <strong>of</strong> deposits, on theother hand, surged by 180% from KHR 164,014 million (USD 41 million) to KHR 459,473million (USD 114 million) in the same period.Loans and Deposits (MFIs)Loans and Non-Performing Loans (MFIs)3,000,0002.80%3%2,591,2632,500,0002,591,2633%In Million KHR1,724,8411,244,5971,108,225617,907459,473164,01421,211 22,082 39,627Million <strong>of</strong> KHR2,000,0001,500,0001,000,000500,000-616,953 1,130,216 1,244,597 1,724,8410.19%0.42%1.18%2%2%1%1%0.22%0%2007 2008 2009 2010 20112007 2008 2009 2010 2011LoansDepositsLoansNPL RatiosThe average delinquency ratio is 0.22%, decreasing from 1.18% in 2010 despite thesevere flooding in the country in the third quarter. In compliance with the regulations <strong>of</strong>the <strong>National</strong> <strong>Bank</strong> <strong>of</strong> <strong>Cambodia</strong>, the average solvency ratio is 21.25 % and the liquidityratio is 398.66%. MFIs’ pr<strong>of</strong>itability continues to increase. In 2011, total net pr<strong>of</strong>it isKHR 110,117 million (USD 27.26 million), a 63% increased from the end <strong>of</strong> 2010. Return onasset and return on equity ratios were 3.64% and 15.10% respectively.4. Development in the <strong>Bank</strong>ing Supervision4.1 Regulatory DevelopmentThe <strong>National</strong> <strong>Bank</strong> <strong>of</strong> <strong>Cambodia</strong> revised many <strong>of</strong> its regulations and circulars to achievea more effective supervision and be in line with recent developments in financial sector.During 2011, the <strong>National</strong> <strong>Bank</strong> <strong>of</strong> <strong>Cambodia</strong> issued a circular related to net worthcalculation, and 5 other regulations, including Prakas on risk based and forward lookingsupervision, Prakas on credit information sharing system, Prakas on transparency ingranting credit facilities <strong>of</strong> banks and financial institutions, Prakas on financial leasingbusiness, and Prakas on licensing <strong>of</strong> financial lease companies.- 3 -