Download the Annual Report for 2010-11. - kiocl limited

Download the Annual Report for 2010-11. - kiocl limited

Download the Annual Report for 2010-11. - kiocl limited

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

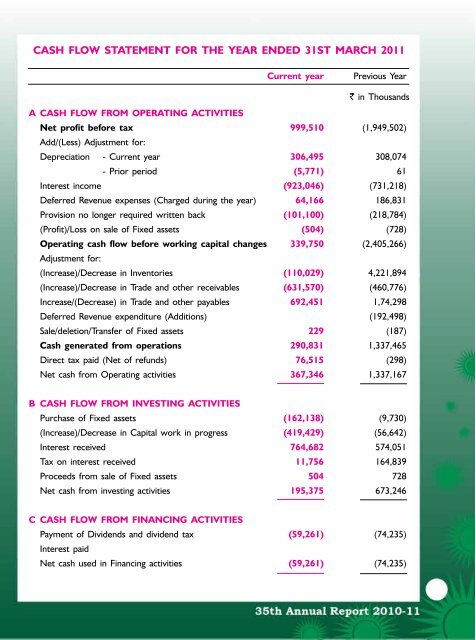

Cash Flow Statement <strong>for</strong> <strong>the</strong> year ended 31St March 2011Current yearPrevious Year` in ThousandsA CASH FLOW FROM OPERATING ACTIVITIESNet profit be<strong>for</strong>e tax 999,510 (1,949,502)Add/(Less) Adjustment <strong>for</strong>:Depreciation - Current year 306,495 308,074- Prior period (5,771) 61Interest income (923,046) (731,218)Deferred Revenue expenses (Charged during <strong>the</strong> year) 64,166 186,831Provision no longer required written back (101,100) (218,784)(Profit)/Loss on sale of Fixed assets (504) (728)Operating cash flow be<strong>for</strong>e working capital changes 339,750 (2,405,266)Adjustment <strong>for</strong>:(Increase)/Decrease in Inventories (110,029) 4,221,894(Increase)/Decrease in Trade and o<strong>the</strong>r receivables (631,570) (460,776)Increase/(Decrease) in Trade and o<strong>the</strong>r payables 692,451 1,74,298Deferred Revenue expenditure (Additions) (192,498)Sale/deletion/Transfer of Fixed assets 229 (187)Cash generated from operations 290,831 1,337,465Direct tax paid (Net of refunds) 76,515 (298)Net cash from Operating activities 367,346 1,337,167B CASH FLOW FROM INVESTING ACTIVITIESPurchase of Fixed assets (162,138) (9,730)(Increase)/Decrease in Capital work in progress (419,429) (56,642)Interest received 764,682 574,051Tax on interest received 11,756 164,839Proceeds from sale of Fixed assets 504 728Net cash from investing activities 195,375 673,246C CASH FLOW FROM FINANCING ACTIVITIESPayment of Dividends and dividend tax (59,261) (74,235)Interest paidNet cash used in Financing activities (59,261) (74,235)113