The SMART Group SMART ANNUAL REPORT 2001 - Scandinavia

The SMART Group SMART ANNUAL REPORT 2001 - Scandinavia

The SMART Group SMART ANNUAL REPORT 2001 - Scandinavia

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

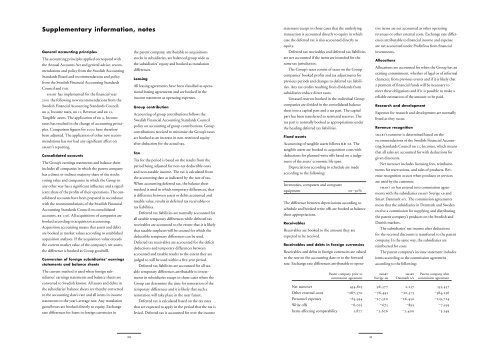

Supplementary information, notesGeneral accounting principlesthe parent company, attributable to acquisitions<strong>The</strong> accounting principles applied correspond with stocks in subsidiaries, are balanced group wide asthe Annual Accounts Act and general advice, recommendationsand policy from the Swedish Accounting differences.the subsidiaries’ equity and booked as translationStandards Board and recommendations and policyLeasingfrom the Swedish Financial Accounting StandardsAll leasing agreements have been classified as operationalleasing agreements and are booked in theCouncil and FAR.<strong>SMART</strong> has implemented for the financial yearincome statement as operating expenses.<strong>2001</strong> the following new recommendations from theSwedish Financial Accounting Standards Council; <strong>Group</strong> contributionRR 9, Income taxes, RR 11, Revenue and RR 12,Accounting of group contributions follows theTangible assets. <strong>The</strong> application of RR 9, IncomeSwedish Financial Accounting Standards Counciltaxes has resulted in the change of accounting principles.Comparison figures for 2000 have thereforepolicy on accounting of group contributions. <strong>Group</strong>contributions received to minimise the <strong>Group</strong>’s taxesbeen adjusted. <strong>The</strong> application of other new recommendationshas not had any significant affect onare booked as an increase in non-restricted equityafter deduction for the actual tax.<strong>SMART</strong>’s reporting.TaxConsolidated accountsTax for the period is based on the results from the<strong>The</strong> <strong>Group</strong>’s earnings statements and balance sheetperiod being adjusted for non-tax deductible costsincludes all companies in which the parent companyand non-taxable income. <strong>The</strong> tax is calculated fromhas a direct or indirect majority share of the stocksthe accounting date as indicated by the rate of tax.voting value and companies in which the <strong>Group</strong> inWhen accounting deferred tax, the balance sheetany other way has a significant influence and a significantshare of the profits of their operations. <strong>The</strong> con-method is used in which temporary differences, thatis difference between assets or debts accounted andsolidated accounts have been prepared in accordancetaxable value, results in deferred tax receivables orwith the recommendations of the Swedish Financialtax liabilities.Accounting Standards Council on consolidatedDeferred tax liabilities are normally accounted foraccounts, RR 1:96. All acquisitions of companies areall taxable temporary differences while deferred taxbooked according to acquisition accounting.receivables are accounted to the extent that it is likelyAcquisition accounting means that assets and debtsthat taxable surpluses will be created for which theare booked at market values according to establisheddeductible temporary differences can be used.acquisition analyses. If the acquisition value exceedsDeferred tax receivables are accounted for the deficitthe current market value of the company’s net assets,deductions and temporary differences betweenthe difference is booked as <strong>Group</strong> goodwill.accounted and taxable results to the extent they areConversion of foreign subsidiaries’ earnings judged to will be used within a five-year period.statements and balance sheetsDeferred tax liabilities are accounted for all taxabletemporary differences attributable to invest-<strong>The</strong> current method is used when foreign subsidiaries’earnings statements and balance sheets are ments in subsidiaries except in those cases where theconverted to Swedish kronor. All assets and debts in <strong>Group</strong> can determine the time for restoration of thethe subsidiaries’ balance sheets are thereby converted temporary differences and it is likely that such ato the accounting date’s rate and all items in income restoration will take place in the near future.statements to the year’s average rate. Any translation Deferred tax is calculated based on the tax ratesgains/losses are booked directly to equity. Exchange that are expected to apply in the period that the tax israte differences for loans in foreign currencies in levied. Deferred tax is accounted for over the incomestatement except in those cases that the underlyingtransaction is accounted directly to equity in whichcase the deferred tax is also accounted directly toequity.Deferred tax receivables and deferred tax liabilitiesare net accounted if the items are intended for thesame tax jurisdiction.<strong>The</strong> <strong>Group</strong>’s taxes consist of taxes on the <strong>Group</strong>companies’ booked profits and tax adjustments forprevious periods and changes to deferred tax liabilities.Any tax credits resulting from dividends fromsubsidiaries reduce direct taxes.Untaxed reserves booked in the individual <strong>Group</strong>companies are divided in the consolidated balancesheet into a capital part and a tax part. <strong>The</strong> capitalpart has been transferred to restricted reserves. <strong>The</strong>tax part is normally booked as appropriations underthe heading deferred tax liabilities.Fixed assetsAccounting of tangible assets follows RR 12. <strong>The</strong>tangible assets are booked to acquisition costs withdeductions for planned write offs based on a judgementof the assets’ economic life span.Depreciations according to schedule are madeaccording to the following:Inventories, computers and computerequipment 20‒50%<strong>The</strong> difference between depreciations according toschedule and booked write offs are booked as balancesheet appropriations.ReceivablesReceivables are booked to the amount they areexpected to be received.Receivables and debts in foreign currenciesReceivables and debts in foreign currencies are valuedto the rate on the accounting date or to the forwardrate. Exchange rate differences attributable to operativeitems are net accounted as other operatingrevenues or other external costs. Exchange rate differencesattributable to financial income and expenseare net accounted under Profit/loss from financialinvestments.AllocationsAllocations are accounted for when the <strong>Group</strong> has anexisting commitment, whether of legal or of informalcharacter, from previous events and if it is likely thata payment of financial funds will be necessary tomeet these obligations and if it is possible to make areliable estimation of the amount to be paid.Research and developmentExpenses for research and development are normallylisted as they occur.Revenue recognition<strong>SMART</strong>’s turnover is determined based on therecommendations of the Swedish Financial AccountingStandards Council RR 11, Incomes, which meansthat all sales are accounted for with deductions forgiven discounts.Net turnover includes licensing fees, reimbursementsfor reservations, and sales of products. Revenuerecognition occurs when products or servicesare used by the customer.<strong>SMART</strong> AB has entered into commission agreementswith the subsidiaries <strong>SMART</strong> Sverige AB andSmart Danmark A/S. <strong>The</strong> commission agreementsmean that the subsidiaries in Denmark and Swedenreceive a commission for supplying and distributingthe parent company’s products on the Swedish andDanish markets.<strong>The</strong> subsidiaries’ net income after deductionsfor the received discounts is transferred to the parentcompany. In the same way, the subsidiaries arereimbursed for costs.<strong>The</strong> parent company’s income statement includesitems according to the commission agreementaccording to the following:Parent company prior to smart smart Parent company aftercommission agreement Sverige ab Danmark a/s commission agreementNet turnover 454,823 96,377 2,257 553,457Other external costs ‒287,370 ‒76,491 ‒20,375 ‒384,236Personnel expenses ‒65,954 ‒27,320 ‒26,450 ‒119,724Write offs ‒6,025 ‒675 ‒895 ‒7,595Items affecting comparability 1,877 ‒2,626 ‒2,400 ‒3,14920 21