Sustainable Forest Finance Toolkit - PwC

Sustainable Forest Finance Toolkit - PwC

Sustainable Forest Finance Toolkit - PwC

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

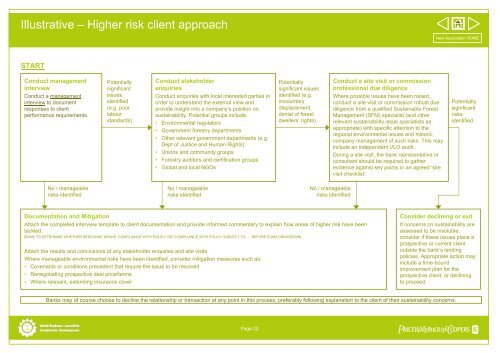

Illustrative – Higher risk client approachNew Application HOMESTARTConduct managementinterviewConduct a managementinterview to documentresponses to clientperformance requirements.Potentiallysignificantissuesidentified(e.g. poorlabourstandards)Conduct stakeholderenquiriesConduct enquiries with local interested parties inorder to understand the external view andprovide insight into a company’s position onsustainability. Potential groups include:• Environmental regulators• Government forestry departments• Other relevant government departments (e.g.Dept of Justice and Human Rights)• Unions and community groups• <strong>Forest</strong>ry auditors and certification groups• Global and local NGOsPotentiallysignificant issuesidentified (e.g.involuntarydisplacement,denial of forestdwellers’ rights)Conduct a site visit or commissionprofessional due diligenceWhere possible issues have been raised,conduct a site visit or commission robust duediligence from a qualified <strong>Sustainable</strong> <strong>Forest</strong>Management (SFM) specialist (and otherrelevant sustainability issue specialists asappropriate) with specific attention to theregional environmental issues and historiccompany management of such risks. This mayinclude an independent VLO audit.During a site visit, the bank representative orconsultant should be required to gatherevidence against key points in an agreed ‘sitevisit checklist’.PotentiallysignificantrisksidentifiedNo / manageablerisks identifiedNo / manageablerisks identifiedNo / manageablerisks identifiedDocumentation and MitigationAttach the completed interview template to client documentation and provide informed commentary to explain how areas of higher risk have beentackled.[BANK TO DETERMINE WHETHER RESPONSE MEANS ‘COMPLIANCE WITH POLICY’ OR ‘COMPLIANCE WITH POLICY SUBJECT TO….’ BEFORE FUND DRAWDOWN]Attach the results and conclusions of any stakeholder enquiries and site visits.Where manageable environmental risks have been identified, consider mitigation measures such as:• Covenants or conditions precedent that require the issue to be resolved• Renegotiating prospective deal price/terms• Where relevant, extending insurance coverConsider declining or exitIf concerns on sustainability areassessed to be insoluble,consider if these issues place aprospective or current clientoutside the bank’s lendingpolicies. Appropriate action mayinclude a time-boundimprovement plan for theprospective client, or decliningto proceed.Banks may of course choose to decline the relationship or transaction at any point in this process, preferably following explanation to the client of their sustainability concerns.Page 22pwc