Sustainable Forest Finance Toolkit - PwC

Sustainable Forest Finance Toolkit - PwC

Sustainable Forest Finance Toolkit - PwC

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

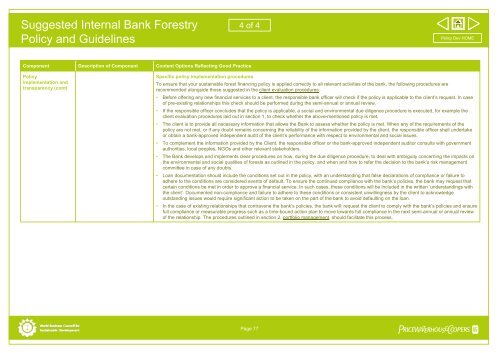

Suggested Internal Bank <strong>Forest</strong>ryPolicy and Guidelines4 of 4Policy Dev HOMEComponent Description of Component Content Options Reflecting Good PracticePolicyimplementation andtransparency (cont)Specific policy implementation proceduresTo ensure that your sustainable forest financing policy is applied correctly to all relevant activities of the bank, the following procedures arerecommended alongside those suggested in the client evaluation procedures:• Before offering any new financial services to a client, the responsible bank officer will check if the policy is applicable to the client’s request. In caseof pre-existing relationships this check should be performed during the semi-annual or annual review.• If the responsible officer concludes that the policy is applicable, a social and environmental due diligence procedure is executed, for example theclient evaluation procedures laid out in section 1, to check whether the above-mentioned policy is met.• The client is to provide all necessary information that allows the Bank to assess whether the policy is met. When any of the requirements of thepolicy are not met, or if any doubt remains concerning the reliability of the information provided by the client, the responsible officer shall undertakeor obtain a bank-approved independent audit of the client’s performance with respect to environmental and social issues.• To complement the information provided by the Client, the responsible officer or the bank-approved independent auditor consults with governmentauthorities, local peoples, NGOs and other relevant stakeholders.• The Bank develops and implements clear procedures on how, during the due diligence procedure, to deal with ambiguity concerning the impacts onthe environmental and social qualities of forests as outlined in the policy, and when and how to refer the decision to the bank’s risk managementcommittee in case of any doubts.• Loan documentation should include the conditions set out in the policy, with an understanding that false declarations of compliance or failure toadhere to the conditions are considered events of default. To ensure the continued compliance with the bank’s policies, the bank may request thatcertain conditions be met in order to approve a financial service. In such cases, these conditions will be included in the written ‘understandings withthe client’. Documented non-compliance and failure to adhere to these conditions or consistent unwillingness by the client to acknowledgeoutstanding issues would require significant action to be taken on the part of the bank to avoid defaulting on the loan.• In the case of existing relationships that contravene the bank’s policies, the bank will: request the client to comply with the bank’s policies and ensurefull compliance or measurable progress such as a time-bound action plan to move towards full compliance in the next semi-annual or annual reviewof the relationship. The procedures outlined in section 2, portfolio management, should facilitate this process.Page 77pwc