Macquarie International Infrastructure Fund Limited SGX Quarterly ...

Macquarie International Infrastructure Fund Limited SGX Quarterly ...

Macquarie International Infrastructure Fund Limited SGX Quarterly ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

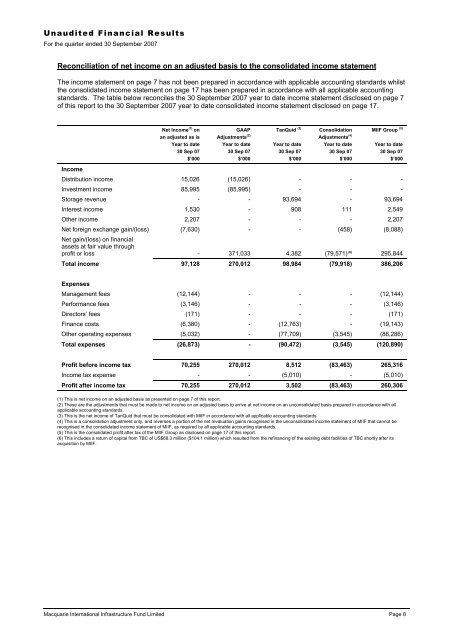

Unaudited Financial Results=For the quarter ended 30 September 2007Reconciliation of net income on an adjusted basis to the consolidated income statementThe income statement on page 7 has not been prepared in accordance with applicable accounting standards whilstthe consolidated income statement on page 17 has been prepared in accordance with all applicable accountingstandards. The table below reconciles the 30 September 2007 year to date income statement disclosed on page 7of this report to the 30 September 2007 year to date consolidated income statement disclosed on page 17.Net Income (1) onan adjusted as isYear to date30 Sep 07$’000GAAPAdjustments (2)Year to date30 Sep 07$’000TanQuid (3)Year to date30 Sep 07$’000ConsolidationAdjustments (4)Year to date30 Sep 07$’000MIIF Group (5)Year to date30 Sep 07$’000IncomeDistribution income 15,026 (15,026) - - -Investment income 85,995 (85,995) - - -Storage revenue - - 93,694 - 93,694Interest income 1,530 - 908 111 2,549Other income 2,207 - - - 2,207Net foreign exchange gain/(loss) (7,630) - - (458) (8,088)Net gain/(loss) on financialassets at fair value throughprofit or loss - 371,033 4,382 (79,571) (6) 295,844Total income 97,128 270,012 98,984 (79,918) 386,206ExpensesManagement fees (12,144) - - - (12,144)Performance fees (3,146) - - - (3,146)Directors’ fees (171) - - - (171)Finance costs (6,380) - (12,763) - (19,143)Other operating expenses (5,032) - (77,709) (3,545) (86,286)Total expenses (26,873) - (90,472) (3,545) (120,890)Profit before income tax 70,255 270,012 8,512 (83,463) 265,316Income tax expense - - (5,010) - (5,010)Profit after income tax 70,255 270,012 3,502 (83,463) 260,306(1) This is net income on an adjusted basis as presented on page 7 of this report.(2) These are the adjustments that must be made to net income on an adjusted basis to arrive at net income on an unconsolidated basis prepared in accordance with allapplicable accounting standards.(3) This is the net income of TanQuid that must be consolidated with MIIF in accordance with all applicable accounting standards.(4) This is a consolidation adjustment only, and reverses a portion of the net revaluation gains recognised in the unconsolidated income statement of MIIF that cannot berecognised in the consolidated income statement of MIIF, as required by all applicable accounting standards.(5) This is the consolidated profit after tax of the MIIF Group as disclosed on page 17 of this report.(6) This includes a return of capital from TBC of US$68.3 million ($104.1 million) which resulted from the refinancing of the existing debt facilities of TBC shortly after itsacquisition by MIIF.<strong>Macquarie</strong> <strong>International</strong> <strong>Infrastructure</strong> <strong>Fund</strong> <strong>Limited</strong> Page 8