Macquarie International Infrastructure Fund Limited SGX Quarterly ...

Macquarie International Infrastructure Fund Limited SGX Quarterly ...

Macquarie International Infrastructure Fund Limited SGX Quarterly ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

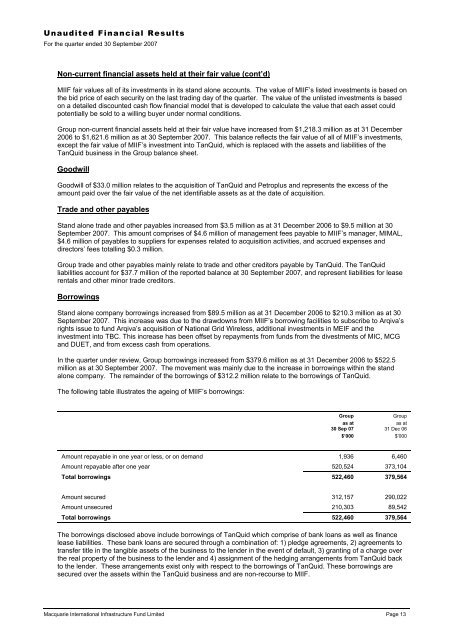

Unaudited Financial Results=For the quarter ended 30 September 2007Non-current financial assets held at their fair value (cont’d)MIIF fair values all of its investments in its stand alone accounts. The value of MIIF’s listed investments is based onthe bid price of each security on the last trading day of the quarter. The value of the unlisted investments is basedon a detailed discounted cash flow financial model that is developed to calculate the value that each asset couldpotentially be sold to a willing buyer under normal conditions.Group non-current financial assets held at their fair value have increased from $1,218.3 million as at 31 December2006 to $1,621.6 million as at 30 September 2007. This balance reflects the fair value of all of MIIF’s investments,except the fair value of MIIF’s investment into TanQuid, which is replaced with the assets and liabilities of theTanQuid business in the Group balance sheet.GoodwillGoodwill of $33.0 million relates to the acquisition of TanQuid and Petroplus and represents the excess of theamount paid over the fair value of the net identifiable assets as at the date of acquisition.Trade and other payablesStand alone trade and other payables increased from $3.5 million as at 31 December 2006 to $9.5 million at 30September 2007. This amount comprises of $4.6 million of management fees payable to MIIF’s manager, MIMAL,$4.6 million of payables to suppliers for expenses related to acquisition activities, and accrued expenses anddirectors’ fees totalling $0.3 million.Group trade and other payables mainly relate to trade and other creditors payable by TanQuid. The TanQuidliabilities account for $37.7 million of the reported balance at 30 September 2007, and represent liabilities for leaserentals and other minor trade creditors.BorrowingsStand alone company borrowings increased from $89.5 million as at 31 December 2006 to $210.3 million as at 30September 2007. This increase was due to the drawdowns from MIIF’s borrowing facilities to subscribe to Arqiva’srights issue to fund Arqiva’s acquisition of National Grid Wireless, additional investments in MEIF and theinvestment into TBC. This increase has been offset by repayments from funds from the divestments of MIC, MCGand DUET, and from excess cash from operations.In the quarter under review, Group borrowings increased from $379.6 million as at 31 December 2006 to $522.5million as at 30 September 2007. The movement was mainly due to the increase in borrowings within the standalone company. The remainder of the borrowings of $312.2 million relate to the borrowings of TanQuid.The following table illustrates the ageing of MIIF’s borrowings:Groupas at30 Sep 07$’000Groupas at31 Dec 06$’000Amount repayable in one year or less, or on demand 1,936 6,460Amount repayable after one year 520,524 373,104Total borrowings 522,460 379,564Amount secured 312,157 290,022Amount unsecured 210,303 89,542Total borrowings 522,460 379,564The borrowings disclosed above include borrowings of TanQuid which comprise of bank loans as well as financelease liabilities. These bank loans are secured through a combination of: 1) pledge agreements, 2) agreements totransfer title in the tangible assets of the business to the lender in the event of default, 3) granting of a charge overthe real property of the business to the lender and 4) assignment of the hedging arrangements from TanQuid backto the lender. These arrangements exist only with respect to the borrowings of TanQuid. These borrowings aresecured over the assets within the TanQuid business and are non-recourse to MIIF.<strong>Macquarie</strong> <strong>International</strong> <strong>Infrastructure</strong> <strong>Fund</strong> <strong>Limited</strong> Page 13