Macquarie International Infrastructure Fund Limited SGX Quarterly ...

Macquarie International Infrastructure Fund Limited SGX Quarterly ...

Macquarie International Infrastructure Fund Limited SGX Quarterly ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

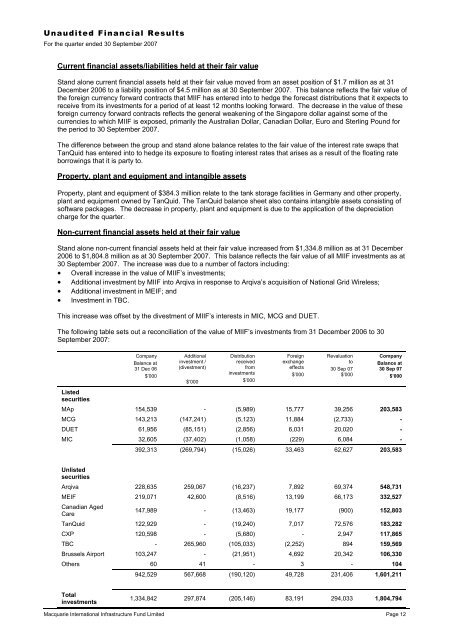

Unaudited Financial Results=For the quarter ended 30 September 2007Current financial assets/liabilities held at their fair valueStand alone current financial assets held at their fair value moved from an asset position of $1.7 million as at 31December 2006 to a liability position of $4.5 million as at 30 September 2007. This balance reflects the fair value ofthe foreign currency forward contracts that MIIF has entered into to hedge the forecast distributions that it expects toreceive from its investments for a period of at least 12 months looking forward. The decrease in the value of theseforeign currency forward contracts reflects the general weakening of the Singapore dollar against some of thecurrencies to which MIIF is exposed, primarily the Australian Dollar, Canadian Dollar, Euro and Sterling Pound forthe period to 30 September 2007.The difference between the group and stand alone balance relates to the fair value of the interest rate swaps thatTanQuid has entered into to hedge its exposure to floating interest rates that arises as a result of the floating rateborrowings that it is party to.Property, plant and equipment and intangible assetsProperty, plant and equipment of $384.3 million relate to the tank storage facilities in Germany and other property,plant and equipment owned by TanQuid. The TanQuid balance sheet also contains intangible assets consisting ofsoftware packages. The decrease in property, plant and equipment is due to the application of the depreciationcharge for the quarter.Non-current financial assets held at their fair valueStand alone non-current financial assets held at their fair value increased from $1,334.8 million as at 31 December2006 to $1,804.8 million as at 30 September 2007. This balance reflects the fair value of all MIIF investments as at30 September 2007. The increase was due to a number of factors including:• Overall increase in the value of MIIF’s investments;• Additional investment by MIIF into Arqiva in response to Arqiva’s acquisition of National Grid Wireless;• Additional investment in MEIF; and• Investment in TBC.This increase was offset by the divestment of MIIF’s interests in MIC, MCG and DUET.The following table sets out a reconciliation of the value of MIIF’s investments from 31 December 2006 to 30September 2007:ListedsecuritiesCompanyBalance at31 Dec 06$’000Additionalinvestment /(divestment)$’000Distributionreceivedfrominvestments$’000Foreignexchangeeffects$’000Revaluationto30 Sep 07$’000CompanyBalance at30 Sep 07$’000MAp 154,539 - (5,989) 15,777 39,256 203,583MCG 143,213 (147,241) (5,123) 11,884 (2,733) -DUET 61,956 (85,151) (2,856) 6,031 20,020 -MIC 32,605 (37,402) (1,058) (229) 6,084 -392,313 (269,794) (15,026) 33,463 62,627 203,583UnlistedsecuritiesArqiva 228,635 259,067 (16,237) 7,892 69,374 548,731MEIF 219,071 42,600 (8,516) 13,199 66,173 332,527Canadian AgedCare147,989 - (13,463) 19,177 (900) 152,803TanQuid 122,929 - (19,240) 7,017 72,576 183,282CXP 120,598 - (5,680) - 2,947 117,865TBC - 265,960 (105,033) (2,252) 894 159,569Brussels Airport 103,247 - (21,951) 4,692 20,342 106,330Others 60 41 - 3 - 104942,529 567,668 (190,120) 49,728 231,406 1,601,211Totalinvestments1,334,842 297,874 (205,146) 83,191 294,033 1,804,794<strong>Macquarie</strong> <strong>International</strong> <strong>Infrastructure</strong> <strong>Fund</strong> <strong>Limited</strong> Page 12