INSTRUCTIONS - Realview

INSTRUCTIONS - Realview

INSTRUCTIONS - Realview

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

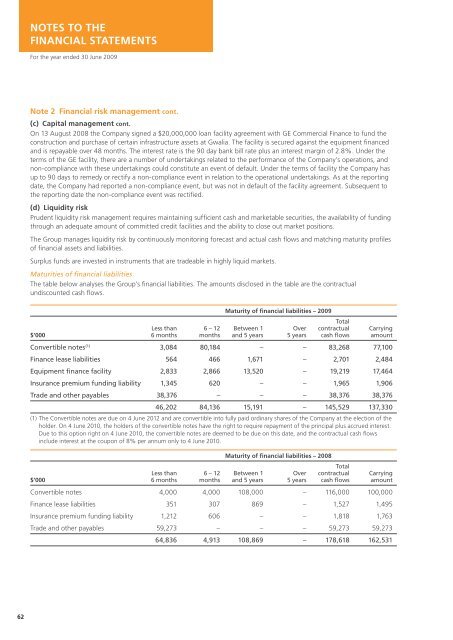

NOTES TO THEFINANCIAL STATEMENTSFor the year ended 30 June 2009Note 2 Financial risk management cont.(c) Capital management cont.On 13 August 2008 the Company signed a $20,000,000 loan facility agreement with GE Commercial Finance to fund theconstruction and purchase of certain infrastructure assets at Gwalia. The facility is secured against the equipment financedand is repayable over 48 months. The interest rate is the 90 day bank bill rate plus an interest margin of 2.8%. Under theterms of the GE facility, there are a number of undertakings related to the performance of the Company’s operations, andnon-compliance with these undertakings could constitute an event of default. Under the terms of facility the Company hasup to 90 days to remedy or rectify a non-compliance event in relation to the operational undertakings. As at the reportingdate, the Company had reported a non-compliance event, but was not in default of the facility agreement. Subsequent tothe reporting date the non-compliance event was rectified.(d) Liquidity riskPrudent liquidity risk management requires maintaining sufficient cash and marketable securities, the availability of fundingthrough an adequate amount of committed credit facilities and the ability to close out market positions.The Group manages liquidity risk by continuously monitoring forecast and actual cash flows and matching maturity profilesof financial assets and liabilities.Surplus funds are invested in instruments that are tradeable in highly liquid markets.Maturities of financial liabilitiesThe table below analyses the Group’s financial liabilities. The amounts disclosed in the table are the contractualundiscounted cash flows.Maturity of financial liabilities – 2009TotalLess than 6 – 12 Between 1 Over contractual Carrying$‘000 6 months months and 5 years 5 years cash flows amountConvertible notes (1) 3,084 80,184 – – 83,268 77,100Finance lease liabilities 564 466 1,671 – 2,701 2,484Equipment finance facility 2,833 2,866 13,520 – 19,219 17,464Insurance premium funding liability 1,345 620 – – 1,965 1,906Trade and other payables 38,376 – – – 38,376 38,37646,202 84,136 15,191 – 145,529 137,330(1) The Convertible notes are due on 4 June 2012 and are convertible into fully paid ordinary shares of the Company at the election of theholder. On 4 June 2010, the holders of the convertible notes have the right to require repayment of the principal plus accrued interest.Due to this option right on 4 June 2010, the convertible notes are deemed to be due on this date, and the contractual cash flowsinclude interest at the coupon of 8% per annum only to 4 June 2010.Maturity of financial liabilities – 2008TotalLess than 6 – 12 Between 1 Over contractual Carrying$‘000 6 months months and 5 years 5 years cash flows amountConvertible notes 4,000 4,000 108,000 – 116,000 100,000Finance lease liabilities 351 307 869 – 1,527 1,495Insurance premium funding liability 1,212 606 – – 1,818 1,763Trade and other payables 59,273 – – – 59,273 59,27364,836 4,913 108,869 – 178,618 162,53162