Entire Annual Report - Anglo American Platinum

Entire Annual Report - Anglo American Platinum

Entire Annual Report - Anglo American Platinum

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

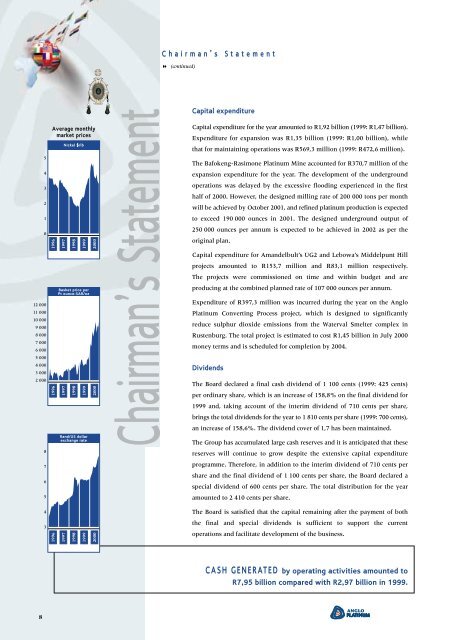

Chairman’s Statement" (continued)54321012 00011 00010 0009 0008 0007 0006 0005 0004 0003 0002 0008765Average monthlymarket prices19961996Nickel S/lb199719981999Basket price perPt ounce-SAR/oz199719981999Rand/US dollarexchange rate20002000Chairman’s StatementCapital expenditureCapital expenditure for the year amounted to R1,92 billion (1999: R1,47 billion).Expenditure for expansion was R1,35 billion (1999: R1,00 billion), whilethat for maintaining operations was R569,3 million (1999: R472,6 million).The Bafokeng-Rasimone <strong>Platinum</strong> Mine accounted for R370,7 million of theexpansion expenditure for the year. The development of the undergroundoperations was delayed by the excessive flooding experienced in the firsthalf of 2000. However, the designed milling rate of 200 000 tons per monthwill be achieved by October 2001, and refined platinum production is expectedto exceed 190 000 ounces in 2001. The designed underground output of250 000 ounces per annum is expected to be achieved in 2002 as per theoriginal plan.Capital expenditure for Amandelbult’s UG2 and Lebowa’s Middelpunt Hillprojects amounted to R153,7 million and R83,1 million respectively.The projects were commissioned on time and within budget and areproducing at the combined planned rate of 107 000 ounces per annum.Expenditure of R397,3 million was incurred during the year on the <strong>Anglo</strong><strong>Platinum</strong> Converting Process project, which is designed to significantlyreduce sulphur dioxide emissions from the Waterval Smelter complex inRustenburg. The total project is estimated to cost R1,45 billion in July 2000money terms and is scheduled for completion by 2004.DividendsThe Board declared a final cash dividend of 1 100 cents (1999: 425 cents)per ordinary share, which is an increase of 158,8% on the final dividend for1999 and, taking account of the interim dividend of 710 cents per share,brings the total dividends for the year to 1 810 cents per share (1999: 700 cents),an increase of 158,6%. The dividend cover of 1,7 has been maintained.The Group has accumulated large cash reserves and it is anticipated that thesereserves will continue to grow despite the extensive capital expenditureprogramme. Therefore, in addition to the interim dividend of 710 cents pershare and the final dividend of 1 100 cents per share, the Board declared aspecial dividend of 600 cents per share. The total distribution for the yearamounted to 2 410 cents per share.4The Board is satisfied that the capital remaining after the payment of both319961997199819992000the final and special dividends is sufficient to support the currentoperations and facilitate development of the business.CASH GENERATED by operating activities amounted toR7,95 billion compared with R2,97 billion in 1999.8

![[PDF] Mogalakwena Mine - Anglo Platinum](https://img.yumpu.com/43065142/1/184x260/pdf-mogalakwena-mine-anglo-platinum.jpg?quality=85)