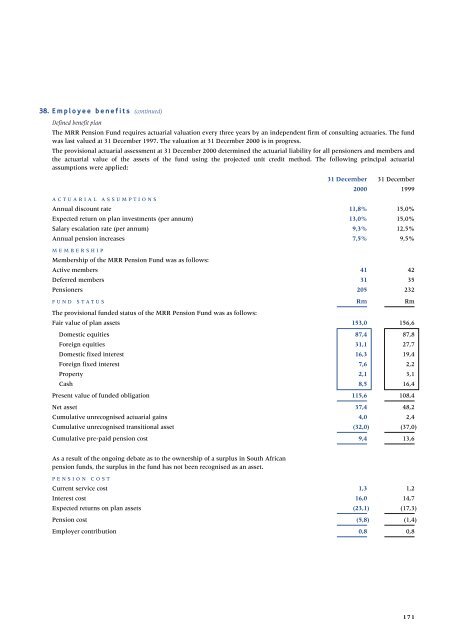

38. Employee benefits (continued)Defined benefit planThe MRR Pension Fund requires actuarial valuation every three years by an independent firm of consulting actuaries. The fundwas last valued at 31 December 1997. The valuation at 31 December 2000 is in progress.The provisional actuarial assessment at 31 December 2000 determined the actuarial liability for all pensioners and members andthe actuarial value of the assets of the fund using the projected unit credit method. The following principal actuarialassumptions were applied:31 December 31 December2000 1999ACTUARIAL ASSUMPTIONS<strong>Annual</strong> discount rate 11,8% 15,0%Expected return on plan investments (per annum) 13,0% 15,0%Salary escalation rate (per annum) 9,3% 12,5%<strong>Annual</strong> pension increases 7,5% 9,5%MEMBERSHIPMembership of the MRR Pension Fund was as follows:Active members 41 42Deferred members 31 35Pensioners 205 232FUND STATUS Rm RmThe provisional funded status of the MRR Pension Fund was as follows:Fair value of plan assets 153,0 156,6Domestic equities 87,4 87,8Foreign equities 31,1 27,7Domestic fixed interest 16,3 19,4Foreign fixed interest 7,6 2,2Property 2,1 3,1Cash 8,5 16,4Present value of funded obligation 115,6 108,4Net asset 37,4 48,2Cumulative unrecognised actuarial gains 4,0 2,4Cumulative unrecognised transitional asset (32,0) (37,0)Cumulative pre-paid pension cost 9,4 13,6As a result of the ongoing debate as to the ownership of a surplus in South Africanpension funds, the surplus in the fund has not been recognised as an asset.PENSION COSTCurrent service cost 1,3 1,2Interest cost 16,0 14,7Expected returns on plan assets (23,1) (17,3)Pension cost (5,8) (1,4)Employer contribution 0,8 0,8171

Notes to theFinancial Statements" for the year ended 31 December (continued)38. Employee benefits (continued)Post-retirement medical aid benefitsThe accumulated post-retirement medical aid obligation and the annual cost of these benefits were calculated by independentconsulting actuaries at 30 June 2000 and revised at 31 December 2000 using the projected unit credit method. The assumptionsused in the valuation included estimates of life expectancy and long-term estimates of the increase in medical costs, appropriatediscount rates and the level of claims based on the Group’s experiences.Subsequent to the actuarial valuation at 30 June 2000, the Group established its own Health Maintenance Organisation (HMO)which will provide post-retirement medical aid to its employees. The HMO will provide high-quality health care services toretirees with a reduction in cost as it is a closed operation and external inflationary pressures are expected to reduce. Certain groupsof employees at various business units have agreed to participate in the HMO with effect from 1 January 2001 which resulted ina decrease of R31,0 million in the provision for post-retirement medical aid benefits.In the revised valuation of the independent actuaries at 31 December 2000, the effect of the HMO was taken into account and theunfunded actuarial liability was determined at R290,2 million (note 30) (31 December 1999: R254,0 million). The net provisionmade during the year amounted to R36,2 million (note 30) (R27,0 million for the year ended 31 December 1999).2000 1999The principal actuarial assumptions used were as follows:Health care cost inflation per annum 12% 12%<strong>Annual</strong> discount rate 15% 15%39. Risk managementThe Group does not trade in financial instruments but, in the normal course of its operations, the Group is exposed to currency,metal price, investment, credit and liquidity risk. In order to manage these risks, the Group may enter into transactions which makeuse of financial instruments. The Group has developed a comprehensive risk management process to facilitate, control, andmonitor these risks. This process includes formal documentation of policies, including limits, controls and reporting structures.CONTROLLING RISK IN THE GROUPThe Executive Committee and the risk sub-committee are responsible for risk management activities within the Group. Overall limitshave been set by the Board. The Executive Committee is responsible for setting individual limits. In order to ensure adherence tothese limits, activities are marked to market on a daily basis and reported to the Group treasurer. The risk sub-committee, composed ofmarketing and treasury executives, meet weekly to review market trends and develop strategies to be submitted for ExecutiveCommittee approval. The treasury is responsible for managing investment, currency and liquidity risk within the limits andconstraints set by the Board. The marketing department is responsible for managing metal price risk, also within the laid-down limitsand constraints set by the Board.CURRENCY RISKThe Group operates in the global business environment and many transactions are priced in a currency other than South Africanrand. Accordingly the Group is exposed to the risk of fluctuating exchange rates and seeks to actively manage this exposurethrough the use of financial instruments. These instruments typically comprise forward exchange contracts and options. Forwardcontracts are the primary instruments used to manage currency risk. Forward contracts require a future purchase or sale offoreign currency at a specified price.Current policy prevents the use of option contracts without Executive Committee approval. Options provide the Group with theright but not the obligation to purchase (or sell) foreign currency at a pre-determined price, on or before a future date. Fewcontracts of this nature were entered into during the year, and no such contracts are in existence at year-end.FORWARD EXCHANGE CONTRACTS2000Principal of forward exchange contracts(i.e. nominal amount in ZAR)Maturing withinCurrency twelve months AverageRmratesPurchases Sales Purchases SalesUnited States dollar 18,9 76,1 6,2794 7,6122Italian lire 3,9 0,0038Japanese yen 104,4 0,0745Deutschmark 0,4 3,5251Euro 154,0 6,7463British pound 5,3 11,4277Australian dollar 25,7 4,1754Canadian dollar 0,2 5,0125Total 312,8 76,1172

![[PDF] Mogalakwena Mine - Anglo Platinum](https://img.yumpu.com/43065142/1/184x260/pdf-mogalakwena-mine-anglo-platinum.jpg?quality=85)