Entire Annual Report - Anglo American Platinum

Entire Annual Report - Anglo American Platinum

Entire Annual Report - Anglo American Platinum

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

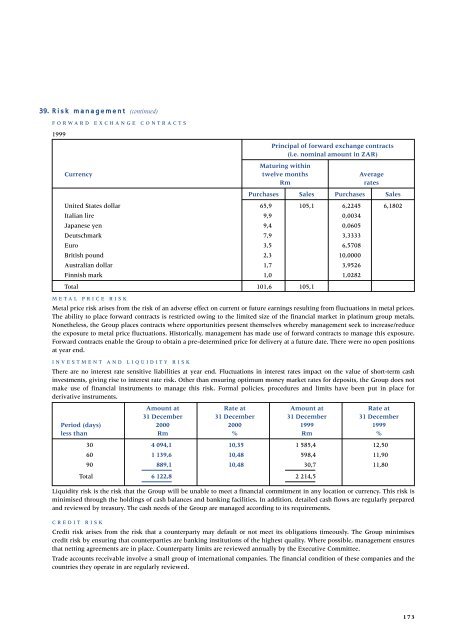

39. Risk management (continued)FORWARD EXCHANGE CONTRACTS1999Principal of forward exchange contracts(i.e. nominal amount in ZAR)Maturing withinCurrency twelve months AverageRmratesPurchases Sales Purchases SalesUnited States dollar 65,9 105,1 6,2245 6,1802Italian lire 9,9 0,0034Japanese yen 9,4 0,0605Deutschmark 7,9 3,3333Euro 3,5 6,5708British pound 2,3 10,0000Australian dollar 1,7 3,9526Finnish mark 1,0 1,0282Total 101,6 105,1METAL PRICE RISKMetal price risk arises from the risk of an adverse effect on current or future earnings resulting from fluctuations in metal prices.The ability to place forward contracts is restricted owing to the limited size of the financial market in platinum group metals.Nonetheless, the Group places contracts where opportunities present themselves whereby management seek to increase/reducethe exposure to metal price fluctuations. Historically, management has made use of forward contracts to manage this exposure.Forward contracts enable the Group to obtain a pre-determined price for delivery at a future date. There were no open positionsat year end.INVESTMENT AND LIQUIDITY RISKThere are no interest rate sensitive liabilities at year end. Fluctuations in interest rates impact on the value of short-term cashinvestments, giving rise to interest rate risk. Other than ensuring optimum money market rates for deposits, the Group does notmake use of financial instruments to manage this risk. Formal policies, procedures and limits have been put in place forderivative instruments.Amount at Rate at Amount at Rate at31 December 31 December 31 December 31 DecemberPeriod (days) 2000 2000 1999 1999less than Rm % Rm %30 4 094,1 10,35 1 585,4 12,5060 1 139,6 10,48 598,4 11,9090 889,1 10,48 30,7 11,80Total 6 122,8 2 214,5Liquidity risk is the risk that the Group will be unable to meet a financial commitment in any location or currency. This risk isminimised through the holdings of cash balances and banking facilities. In addition, detailed cash flows are regularly preparedand reviewed by treasury. The cash needs of the Group are managed according to its requirements.CREDIT RISKCredit risk arises from the risk that a counterparty may default or not meet its obligations timeously. The Group minimisescredit risk by ensuring that counterparties are banking institutions of the highest quality. Where possible, management ensuresthat netting agreements are in place. Counterparty limits are reviewed annually by the Executive Committee.Trade accounts receivable involve a small group of international companies. The financial condition of these companies and thecountries they operate in are regularly reviewed.173

![[PDF] Mogalakwena Mine - Anglo Platinum](https://img.yumpu.com/43065142/1/184x260/pdf-mogalakwena-mine-anglo-platinum.jpg?quality=85)