Entire Annual Report - Anglo American Platinum

Entire Annual Report - Anglo American Platinum

Entire Annual Report - Anglo American Platinum

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

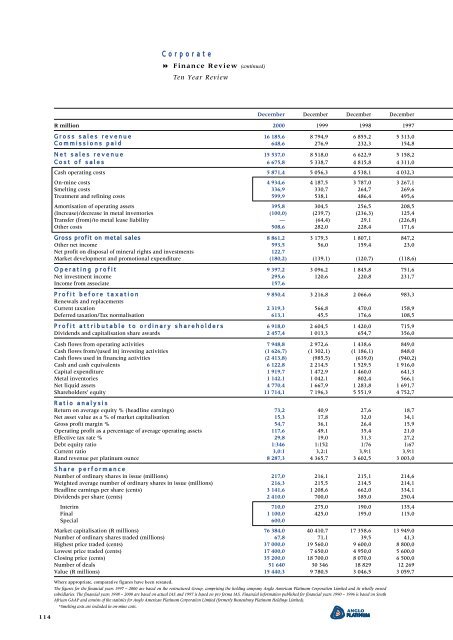

Corporate" Finance Review (continued)Ten Year ReviewDecember December December DecemberR million 2000 1999 1998 1997Gross sales revenue 16 185,6 8 794,9 6 855,2 5 313,0Commissions paid 648,6 276,9 232,3 154,8Net sales revenue 15 537,0 8 518,0 6 622,9 5 158,2Cost of sales 6 675,8 5 338,7 4 815,8 4 311,0Cash operating costs 5 871,4 5 056,3 4 538,1 4 032,3On-mine costs 4 934,6 4 187,5 3 787,0 3 267,1Smelting costs 336,9 330,7 264,7 269,6Treatment and refining costs 599,9 538,1 486,4 495,6Amortisation of operating assets 395,8 304,5 256,5 208,5(Increase)/decrease in metal inventories (100,0) (239,7) (236,3) 125,4Transfer (from)/to metal lease liability — (64,4) 29,1 (226,8)Other costs 508,6 282,0 228,4 171,6Gross profit on metal sales 8 861,2 3 179,3 1 807,1 847,2Other net income 593,5 56,0 159,4 23,0Net profit on disposal of mineral rights and investments 122,7Market development and promotional expenditure (180,2) (139,1) (120,7) (118,6)Operating profit 9 397,2 3 096,2 1 845,8 751,6Net investment income 295,6 120,6 220,8 231,7Income from associate 157,6Profit before taxation 9 850,4 3 216,8 2 066,6 983,3Renewals and replacementsCurrent taxation 2 319,3 566,8 470,0 158,9Deferred taxation/Tax normalisation 613,1 45,5 176,6 108,5Profit attributable to ordinary shareholders 6 918,0 2 604,5 1 420,0 715,9Dividends and capitalisation share awards 2 457,4 1 013,3 654,7 356,0Cash flows from operating activities 7 948,8 2 972,6 1 438,6 849,0Cash flows from/(used in) investing activities (1 626,7) (1 302,1) (1 186,1) 848,0Cash flows used in financing activities (2 413,8) (985,5) (639,0) (940,2)Cash and cash equivalents 6 122,8 2 214,5 1 529,5 1 916,0Capital expenditure 1 919,7 1 472,9 1 460,0 641,3Metal inventories 1 142,1 1 042,1 802,4 566,1Net liquid assets 4 770,4 1 667,9 1 283,8 1 691,7Shareholders’ equity 11 714,1 7 196,3 5 551,9 4 752,7Ratio analysisReturn on average equity % (headline earnings) 73,2 40,9 27,6 18,7Net asset value as a % of market capitalisation 15,3 17,8 32,0 34,1Gross profit margin % 54,7 36,1 26,4 15,9Operating profit as a percentage of average operating assets 117,6 49,1 35,4 21,0Effective tax rate % 29,8 19,0 31,3 27,2Debt equity ratio 1:346 1:152 1:76 1:67Current ratio 3,0:1 3,2:1 3,9:1 3,9:1Rand revenue per platinum ounce 8 287,3 4 365,7 3 602,5 3 003,0Share performanceNumber of ordinary shares in issue (millions) 217,0 216,1 215,1 214,6Weighted average number of ordinary shares in issue (millions) 216,3 215,5 214,5 214,1Headline earnings per share (cents) 3 141,6 1 208,6 662,0 334,1Dividends per share (cents) 2 410,0 700,0 385,0 250,4Interim 710,0 275,0 190,0 135,4Final 1 100,0 425,0 195,0 115,0Special 600,0Market capitalisation (R millions) 76 384,0 40 410,7 17 358,6 13 949,0Number of ordinary shares traded (millions) 67,8 71,1 39,5 41,3Highest price traded (cents) 37 000,0 19 560,0 9 600,0 8 800,0Lowest price traded (cents) 17 400,0 7 650,0 4 950,0 5 600,0Closing price (cents) 35 200,0 18 700,0 8 070,0 6 500,0Number of deals 51 640 30 346 18 829 12 269Value (R millions) 15 440,3 9 780,5 3 046,5 3 059,7Where appropriate, comparative figures have been restated.The figures for the financial years 1997 – 2000 are based on the restructured Group, comprising the holding company <strong>Anglo</strong> <strong>American</strong> <strong>Platinum</strong> Corporation Limited and its wholly ownedsubsidiaries. The financial years 1998 – 2000 are based on actual IAS and 1997 is based on pro forma IAS. Financial information published for financial years 1990 – 1996 is based on SouthAfrican GAAP and consists of the statistics for <strong>Anglo</strong> <strong>American</strong> <strong>Platinum</strong> Corporation Limited (formerly Rustenburg <strong>Platinum</strong> Holdings Limited).*Smelting costs are included in on-mine costs.114

![[PDF] Mogalakwena Mine - Anglo Platinum](https://img.yumpu.com/43065142/1/184x260/pdf-mogalakwena-mine-anglo-platinum.jpg?quality=85)