Spring Break in Appalachia - Walsh University

Spring Break in Appalachia - Walsh University

Spring Break in Appalachia - Walsh University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

You can make a gift to <strong>Walsh</strong><br />

and generate <strong>in</strong>come for life<br />

BenefiTS <strong>in</strong>clude:<br />

1. A charitable <strong>in</strong>come tax deduction<br />

2. Income for life<br />

3. Possible reduction <strong>in</strong> probate costs and<br />

estate taxes<br />

4. Generous support of <strong>Walsh</strong> <strong>University</strong><br />

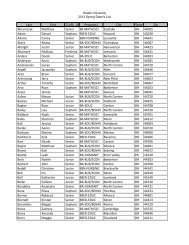

exaMple raTeS<br />

s<strong>in</strong>gle Life<br />

age rate<br />

60 5.0<br />

65 5.3<br />

70 5.7<br />

75 6.3<br />

80 7.1<br />

Current rates as approved by the American Council on Gift Annuities<br />

What is a Charitable Gift Annuity?<br />

A charitable gift annuity is a simple contract<br />

between you and <strong>Walsh</strong> <strong>University</strong>.<br />

In exchange for your irrevocable gift of cash, securities, or other assets, <strong>Walsh</strong><br />

<strong>University</strong> agrees to pay you or one to two other annuitants a fixed sum each<br />

year for life. This type of gift might be especially attractive if you are aged 70<br />

or above, you want to support <strong>Walsh</strong> <strong>University</strong>, and you would like to secure<br />

an immediate stream of <strong>in</strong>come for yourself or for yourself and your spouse.<br />

The older your designated annuitants are at the time of the gift, the greater the<br />

fixed <strong>in</strong>come <strong>Walsh</strong> <strong>University</strong> can agree to pay. In addition to the stream of<br />

fixed payments, the gift will also generate an immediate charitable <strong>in</strong>come-tax<br />

deduction. In most cases, part of each payment is tax-free, <strong>in</strong>creas<strong>in</strong>g each<br />

payment’s after-tax value.<br />

ExAMplE:<br />

For example, <strong>Walsh</strong> Donor, aged 75, gives $15,000 <strong>in</strong> cash to <strong>Walsh</strong> <strong>University</strong> <strong>in</strong><br />

exchange for a 6.3% gift annuity. He receives an <strong>in</strong>come-tax deduction of $6,372<br />

based on his age. He will beg<strong>in</strong> receiv<strong>in</strong>g an <strong>in</strong>come stream of approximately<br />

$945 each calendar year for the rest of his life. When he passes away, the rema<strong>in</strong><strong>in</strong>g<br />

pr<strong>in</strong>cipal will benefit <strong>Walsh</strong> <strong>University</strong>.<br />

If you would like more <strong>in</strong>formation on how to establish a charitable gift annuity<br />

at <strong>Walsh</strong> <strong>University</strong>, or would like to receive more current annuity rates, please<br />

contact the Office of Gift Plann<strong>in</strong>g at 330-490-7109 or jcraig@walsh.edu.<br />

walsh times<br />

summer 2009