You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

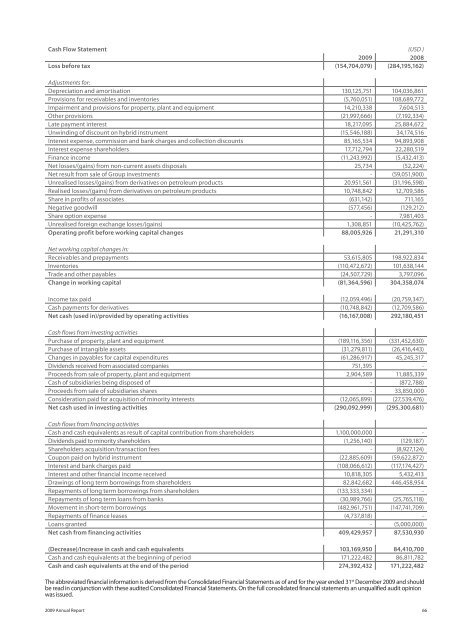

Cash Flow Statement (USD )<br />

<strong>2009</strong> 2008<br />

Loss before tax (154,704,079) (284,195,162)<br />

Adjustments for:<br />

Depreciation and amortisation 130,125,751 104,036,861<br />

Provisions for receivables and inventories (5,760,051) 108,689,772<br />

Impairment and provisions for property, plant and equipment 14,210,338 7,604,513<br />

Other provisions (21,997,666) (7,192,334)<br />

Late payment interest 18,217,095 25,884,672<br />

Unwinding of discount on hybrid instrument (15,546,188) 34,174,516<br />

Interest expense, <strong>com</strong>mission and bank charges and collection discounts 85,165,534 94,893,908<br />

Interest expense shareholders 17,712,794 22,280,519<br />

Finance in<strong>com</strong>e (11,243,992) (5,432,413)<br />

Net losses/(gains) from non-current assets disposals 25,734 (52,224)<br />

Net result from sale of Group investments - (59,051,900)<br />

Unrealised losses/(gains) from derivatives on petroleum products 20,951,561 (31,196,598)<br />

Realised losses/(gains) from derivatives on petroleum products 10,748,842 12,709,586<br />

Share in profits of associates (631,142) 711,165<br />

Negative goodwill (577,456) (129,212)<br />

Share option expense - 7,981,403<br />

Unrealised foreign exchange losses/(gains) 1,308,851 (10,425,762)<br />

Operating profit before working capital changes 88,005,926 21,291,310<br />

Net working capital changes in:<br />

Receivables and prepayments 53,615,805 198,922,834<br />

Inventories (110,472,672) 101,638,144<br />

Trade and other payables (24,507,729) 3,797,096<br />

Change in working capital (81,364,596) 304,358,074<br />

In<strong>com</strong>e tax paid (12,059,496) (20,759,347)<br />

Cash payments for derivatives (10,748,842) (12,709,586)<br />

Net cash (used in)/provided by operating activities (16,167,008) 292,180,451<br />

Cash flows from investing activities<br />

Purchase of property, plant and equipment (189,116,356) (331,452,630)<br />

Purchase of intangible assets (31,279,811) (26,416,443)<br />

Changes in payables for capital expenditures (61,286,917) 45,245,317<br />

Dividends received from associated <strong>com</strong>panies 751,395 -<br />

Proceeds from sale of property, plant and equipment 2,904,589 11,885,339<br />

Cash of subsidiaries being disposed of - (872,788)<br />

Proceeds from sale of subsidiaries shares - 33,850,000<br />

Consideration paid for acquisition of minority interests (12,065,899) (27,539,476)<br />

Net cash used in investing activities (290,092,999) (295,300,681)<br />

Cash flows from financing activities<br />

Cash and cash equivalents as result of capital contribution from shareholders 1,100,000,000 -<br />

Dividends paid to minority shareholders (1,256,140) (129,187)<br />

Shareholders acquisition/transaction fees - (8,927,124)<br />

Coupon paid on hybrid instrument (22,885,609) (59,622,872)<br />

Interest and bank charges paid (108,066,612) (117,174,427)<br />

Interest and other financial in<strong>com</strong>e received 10,818,305 5,432,413<br />

Drawings of long term borrowings from shareholders 82,842,682 446,458,954<br />

Repayments of long term borrowings from shareholders (133,333,334) -<br />

Repayments of long term loans from banks (30,989,766) (25,765,118)<br />

Movement in short-term borrowings (482,961,751) (147,741,709)<br />

Repayments of finance leases (4,737,818) -<br />

Loans granted - (5,000,000)<br />

Net cash from financing activities 409,429,957 87,530,930<br />

(Decrease)/Increase in cash and cash equivalents 103,169,950 84,410,700<br />

Cash and cash equivalents at the beginning of period 171,222,482 86,811,782<br />

Cash and cash equivalents at the end of the period 274,392,432 171,222,482<br />

The abbreviated financial information is derived from the Consolidated Financial Statements as of and for the year ended 31 st December <strong>2009</strong> and should<br />

be read in conjunction with these audited Consolidated Financial Statements. On the full consolidated financial statements an unqualified audit opinion<br />

was issued.<br />

<strong>2009</strong> <strong>Annual</strong> <strong>Report</strong> 66

![Scrisoarea Directorului General de Opera]iuni - Rompetrol.com](https://img.yumpu.com/4907398/1/184x260/scrisoarea-directorului-general-de-operaiuni-rompetrolcom.jpg?quality=85)