MICROBANKING BULLETIN - Microfinance Information Exchange

MICROBANKING BULLETIN - Microfinance Information Exchange

MICROBANKING BULLETIN - Microfinance Information Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

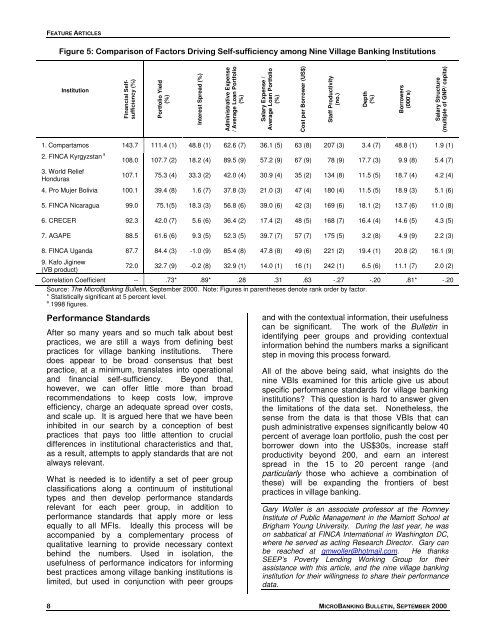

FEATURE ARTICLESFigure 5: Comparison of Factors Driving Self-sufficiency among Nine Village Banking InstitutionsInstitutionFinancial Selfsufficiency(%)Portfolio Yield(%)Interest Spread (%)Administrative Expense/ Average Loan Portfolio(%)Salary Expense /Average Loan Portfolio(%)Cost per Borrower (US$)Staff Productivity(no.)Depth(%)Borrowers(000’s)Salary Structure(multiple of GNP/ capita)1. Compartamos 143.7 111.4 (1) 48.8 (1) 62.6 (7) 36.1 (5) 63 (8) 207 (3) 3.4 (7) 48.8 (1) 1.9 (1)2. FINCA Kyrgyzstan a 108.0 107.7 (2) 18.2 (4) 89.5 (9) 57.2 (9) 67 (9) 78 (9) 17.7 (3) 9.9 (8) 5.4 (7)3. World ReliefHonduras107.1 75.3 (4) 33.3 (2) 42.0 (4) 30.9 (4) 35 (2) 134 (8) 11.5 (5) 18.7 (4) 4.2 (4)4. Pro Mujer Bolivia 100.1 39.4 (8) 1.6 (7) 37.8 (3) 21.0 (3) 47 (4) 180 (4) 11.5 (5) 18.9 (3) 5.1 (6)5. FINCA Nicaragua 99.0 75.1(5) 18.3 (3) 56.8 (6) 39.0 (6) 42 (3) 169 (6) 18.1 (2) 13.7 (6) 11.0 (8)6. CRECER 92.3 42.0 (7) 5.6 (6) 36.4 (2) 17.4 (2) 48 (5) 168 (7) 16.4 (4) 14.6 (5) 4.3 (5)7. AGAPE 88.5 61.6 (6) 9.3 (5) 52.3 (5) 39.7 (7) 57 (7) 175 (5) 3.2 (8) 4.9 (9) 2.2 (3)8. FINCA Uganda 87.7 84.4 (3) -1.0 (9) 85.4 (8) 47.8 (8) 49 (6) 221 (2) 19.4 (1) 20.8 (2) 16.1 (9)9. Kafo Jiginew(VB product)72.0 32.7 (9) -0.2 (8) 32.9 (1) 14.0 (1) 16 (1) 242 (1) 6.5 (6) 11.1 (7) 2.0 (2)Correlation Coefficient -- .73* .89* .28 .31 .63 -.27 -.20 .81* -.20Source: The MicroBanking Bulletin, September 2000. Note: Figures in parentheses denote rank order by factor.* Statistically significant at 5 percent level.a 1998 figures.Performance StandardsAfter so many years and so much talk about bestpractices, we are still a ways from defining bestpractices for village banking institutions. Theredoes appear to be broad consensus that bestpractice, at a minimum, translates into operationaland financial self-sufficiency. Beyond that,however, we can offer little more than broadrecommendations to keep costs low, improveefficiency, charge an adequate spread over costs,and scale up. It is argued here that we have beeninhibited in our search by a conception of bestpractices that pays too little attention to crucialdifferences in institutional characteristics and that,as a result, attempts to apply standards that are notalways relevant.What is needed is to identify a set of peer groupclassifications along a continuum of institutionaltypes and then develop performance standardsrelevant for each peer group, in addition toperformance standards that apply more or lessequally to all MFIs. Ideally this process will beaccompanied by a complementary process ofqualitative learning to provide necessary contextbehind the numbers. Used in isolation, theusefulness of performance indicators for informingbest practices among village banking institutions islimited, but used in conjunction with peer groupsand with the contextual information, their usefulnesscan be significant. The work of the Bulletin inidentifying peer groups and providing contextualinformation behind the numbers marks a significantstep in moving this process forward.All of the above being said, what insights do thenine VBIs examined for this article give us aboutspecific performance standards for village bankinginstitutions? This question is hard to answer giventhe limitations of the data set. Nonetheless, thesense from the data is that those VBIs that canpush administrative expenses significantly below 40percent of average loan portfolio, push the cost perborrower down into the US$30s, increase staffproductivity beyond 200, and earn an interestspread in the 15 to 20 percent range (andparticularly those who achieve a combination ofthese) will be expanding the frontiers of bestpractices in village banking.Gary Woller is an associate professor at the RomneyInstitute of Public Management in the Marriott School atBrigham Young University. During the last year, he wason sabbatical at FINCA International in Washington DC,where he served as acting Research Director. Gary canbe reached at gmwoller@hotmail.com. He thanksSEEP’s Poverty Lending Working Group for theirassistance with this article, and the nine village bankinginstitution for their willingness to share their performancedata.8 <strong>MICROBANKING</strong> <strong>BULLETIN</strong>, SEPTEMBER 2000