MICROBANKING BULLETIN - Microfinance Information Exchange

MICROBANKING BULLETIN - Microfinance Information Exchange

MICROBANKING BULLETIN - Microfinance Information Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

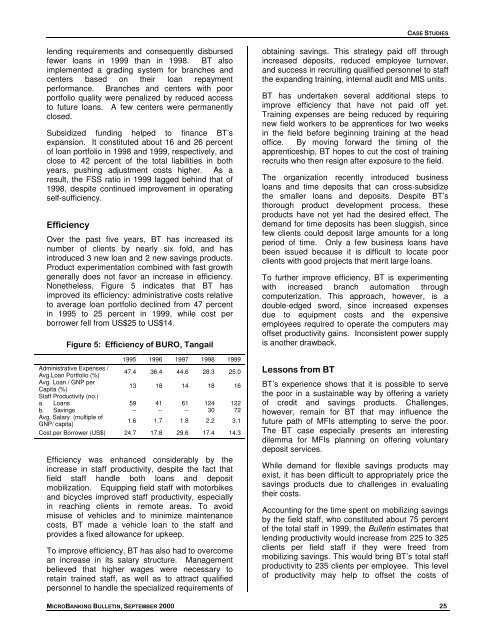

CASE STUDIESlending requirements and consequently disbursedfewer loans in 1999 than in 1998. BT alsoimplemented a grading system for branches andcenters based on their loan repaymentperformance. Branches and centers with poorportfolio quality were penalized by reduced accessto future loans. A few centers were permanentlyclosed.Subsidized funding helped to finance BT’sexpansion. It constituted about 16 and 26 percentof loan portfolio in 1998 and 1999, respectively, andclose to 42 percent of the total liabilities in bothyears, pushing adjustment costs higher. As aresult, the FSS ratio in 1999 lagged behind that of1998, despite continued improvement in operatingself-sufficiency.EfficiencyOver the past five years, BT has increased itsnumber of clients by nearly six fold, and hasintroduced 3 new loan and 2 new savings products.Product experimentation combined with fast growthgenerally does not favor an increase in efficiency.Nonetheless, Figure 5 indicates that BT hasimproved its efficiency: administrative costs relativeto average loan portfolio declined from 47 percentin 1995 to 25 percent in 1999, while cost perborrower fell from US$25 to US$14.Figure 5: Efficiency of BURO, Tangail1995 1996 1997 1998 1999Administrative Expenses /Avg.Loan Portfolio (%)47.4 36.4 44.6 28.3 25.0Avg. Loan / GNP perCapita (%)13 18 14 18 16Staff Productivity (no.)a. Loans59 41 61 124 122b. Savings-- -- -- 30 72Avg. Salary (multiple ofGNP/ capita)1.6 1.7 1.8 2.2 3.1Cost per Borrower (US$) 24.7 17.8 29.6 17.4 14.3Efficiency was enhanced considerably by theincrease in staff productivity, despite the fact thatfield staff handle both loans and depositmobilization. Equipping field staff with motorbikesand bicycles improved staff productivity, especiallyin reaching clients in remote areas. To avoidmisuse of vehicles and to minimize maintenancecosts, BT made a vehicle loan to the staff andprovides a fixed allowance for upkeep.To improve efficiency, BT has also had to overcomean increase in its salary structure. Managementbelieved that higher wages were necessary toretain trained staff, as well as to attract qualifiedpersonnel to handle the specialized requirements ofobtaining savings. This strategy paid off throughincreased deposits, reduced employee turnover,and success in recruiting qualified personnel to staffthe expanding training, internal audit and MIS units.BT has undertaken several additional steps toimprove efficiency that have not paid off yet.Training expenses are being reduced by requiringnew field workers to be apprentices for two weeksin the field before beginning training at the headoffice. By moving forward the timing of theapprenticeship, BT hopes to cut the cost of trainingrecruits who then resign after exposure to the field.The organization recently introduced businessloans and time deposits that can cross-subsidizethe smaller loans and deposits. Despite BT’sthorough product development process, theseproducts have not yet had the desired effect. Thedemand for time deposits has been sluggish, sincefew clients could deposit large amounts for a longperiod of time. Only a few business loans havebeen issued because it is difficult to locate poorclients with good projects that merit large loans.To further improve efficiency, BT is experimentingwith increased branch automation throughcomputerization. This approach, however, is adouble-edged sword, since increased expensesdue to equipment costs and the expensiveemployees required to operate the computers mayoffset productivity gains. Inconsistent power supplyis another drawback.Lessons from BTBT’s experience shows that it is possible to servethe poor in a sustainable way by offering a varietyof credit and savings products. Challenges,however, remain for BT that may influence thefuture path of MFIs attempting to serve the poor.The BT case especially presents an interestingdilemma for MFIs planning on offering voluntarydeposit services.While demand for flexible savings products mayexist, it has been difficult to appropriately price thesavings products due to challenges in evaluatingtheir costs.Accounting for the time spent on mobilizing savingsby the field staff, who constituted about 75 percentof the total staff in 1999, the Bulletin estimates thatlending productivity would increase from 225 to 325clients per field staff if they were freed frommobilizing savings. This would bring BT’s total staffproductivity to 235 clients per employee. This levelof productivity may help to offset the costs of<strong>MICROBANKING</strong> <strong>BULLETIN</strong>, SEPTEMBER 2000 25