MICROBANKING BULLETIN - Microfinance Information Exchange

MICROBANKING BULLETIN - Microfinance Information Exchange

MICROBANKING BULLETIN - Microfinance Information Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

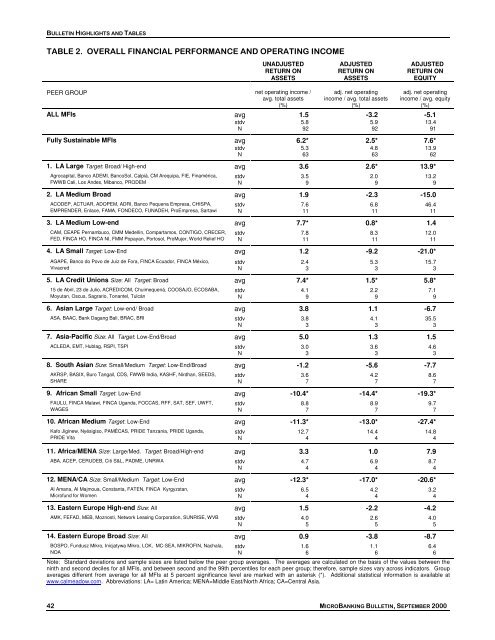

<strong>BULLETIN</strong> HIGHLIGHTS AND TABLESTABLE 2. OVERALL FINANCIAL PERFORMANCE AND OPERATING INCOMEUNADJUSTEDRETURN ONASSETSADJUSTEDRETURN ONASSETSADJUSTEDRETURN ONEQUITYPEER GROUP net operating income /avg. total assets(%)adj. net operatingincome / avg. total assets(%)adj. net operatingincome / avg. equity(%)ALL MFIs avg 1.5 -3.2 -5.1stdv 5.8 5.9 13.4N 92 92 91Fully Sustainable MFIs avg 6.2* 2.5* 7.6*stdv 5.3 4.8 13.9N 63 63 621. LA Large Target: Broad/ High-end avg 3.6 2.6* 13.9*Agrocapital, Banco ADEMI, BancoSol, Calpiá, CM Arequipa, FIE, Finamérica, stdv 3.5 2.0 13.2FWWB Cali, Los Andes, Mibanco, PRODEM N 9 9 92. LA Medium Broad avg 1.9 -2.3 -15.0ACODEP, ACTUAR, ADOPEM, ADRI, Banco Pequena Empresa, CHISPA, stdv 7.6 6.8 46.4EMPRENDER, Enlace, FAMA, FONDECO, FUNADEH, ProEmpresa, Sartawi N 11 11 113. LA Medium Low-end avg 7.7* 0.8* 1.4CAM, CEAPE Pernambuco, CMM Medellín, Compartamos, CONTIGO, CRECER, stdv 7.8 8.3 12.0FED, FINCA HO, FINCA NI, FMM Popayan, Portosol, ProMujer, World Relief HO N 11 11 114. LA Small Target: Low-End avg 1.2 -9.2 -21.0*AGAPE, Banco do Povo de Juiz de Fora, FINCA Ecuador, FINCA México, stdv 2.4 5.3 15.7Vivacred N 3 3 35. LA Credit Unions Size: All Target: Broad avg 7.4* 1.5* 5.8*15 de Abril, 23 de Julio, ACREDICOM, Chuimequená, COOSAJO, ECOSABA, stdv 4.1 2.2 7.1Moyutan, Oscus, Sagrario, Tonantel, Tulcán N 9 9 96. Asian Large Target: Low-end/ Broad avg 3.8 1.1 -6.7ASA, BAAC, Bank Dagang Bali, BRAC, BRI stdv 3.8 4.1 35.5N 3 3 37. Asia-Pacific Size: All Target: Low-End/Broad avg 5.0 1.3 1.5ACLEDA, EMT, Hublag, RSPI, TSPI stdv 3.0 3.6 4.6N 3 3 38. South Asian Size: Small/Medium Target: Low-End/Broad avg -1.2 -5.6 -7.7AKRSP, BASIX, Buro Tangail, CDS, FWWB India, KASHF, Nirdhan, SEEDS, stdv 3.6 4.2 8.6SHARE N 7 7 79. African Small Target: Low-End avg -10.4* -14.4* -19.3*FAULU, FINCA Malawi, FINCA Uganda, FOCCAS, RFF, SAT, SEF, UWFT, stdv 8.8 8.9 9.7WAGES N 7 7 710. African Medium Target: Low-End avg -11.3* -13.0* -27.4*Kafo Jiginew, Nyésigiso, PAMÉCAS, PRIDE Tanzania, PRIDE Uganda, stdv 12.7 14.4 14.8PRIDE Vita N 4 4 411. Africa/MENA Size: Large/Med. Target: Broad/High-end avg 3.3 1.0 7.9ABA, ACEP, CERUDEB, Citi S&L, PADME, UNRWA stdv 4.7 6.9 8.7N 4 4 412. MENA/CA Size: Small/Medium Target: Low-End avg -12.3* -17.0* -20.6*Al Amana, Al Majmoua, Constanta, FATEN, FINCA Kyrgyzstan, stdv 6.5 4.2 3.2Microfund for Women N 4 4 413. Eastern Europe High-end Size: All avg 1.5 -2.2 -4.2AMK, FEFAD, MEB, Moznosti, Network Leasing Corporation, SUNRISE, WVB stdv 4.0 2.6 4.0N 5 5 514. Eastern Europe Broad Size: All avg 0.9 -3.8 -8.7BOSPO, Fundusz Mikro, Inicjatywa Mikro, LOK, MC-SEA, MIKROFIN, Nachala, stdv 1.6 1.1 6.4NOA N 6 6 6Note: Standard deviations and sample sizes are listed below the peer group averages. The averages are calculated on the basis of the values between theninth and second deciles for all MFIs, and between second and the 99th percentiles for each peer group; therefore, sample sizes vary across indicators. Groupaverages different from average for all MFIs at 5 percent significance level are marked with an asterisk (*). Additional statistical information is available atwww.calmeadow.com. Abbreviations: LA= Latin America; MENA=Middle East/North Africa; CA=Central Asia.42 <strong>MICROBANKING</strong> <strong>BULLETIN</strong>, SEPTEMBER 2000