MICROBANKING BULLETIN - Microfinance Information Exchange

MICROBANKING BULLETIN - Microfinance Information Exchange

MICROBANKING BULLETIN - Microfinance Information Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

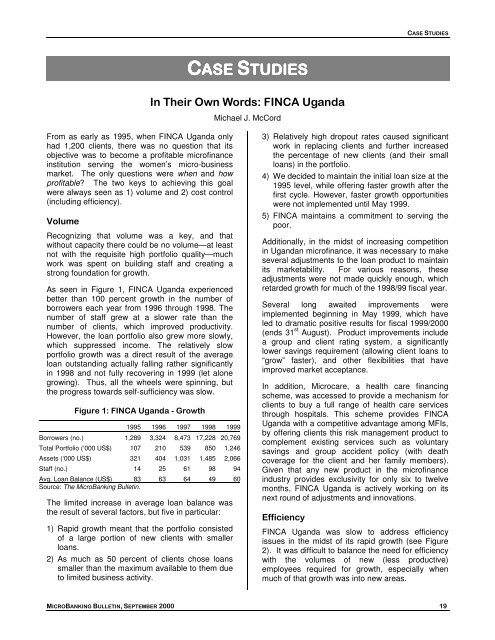

CASE STUDIESCASESTUDIESIn Their Own Words: FINCA UgandaMichael J. McCordFrom as early as 1995, when FINCA Uganda onlyhad 1,200 clients, there was no question that itsobjective was to become a profitable microfinanceinstitution serving the women’s micro-businessmarket. The only questions were when and howprofitable? The two keys to achieving this goalwere always seen as 1) volume and 2) cost control(including efficiency).VolumeRecognizing that volume was a key, and thatwithout capacity there could be no volume—at leastnot with the requisite high portfolio quality—muchwork was spent on building staff and creating astrong foundation for growth.As seen in Figure 1, FINCA Uganda experiencedbetter than 100 percent growth in the number ofborrowers each year from 1996 through 1998. Thenumber of staff grew at a slower rate than thenumber of clients, which improved productivity.However, the loan portfolio also grew more slowly,which suppressed income. The relatively slowportfolio growth was a direct result of the averageloan outstanding actually falling rather significantlyin 1998 and not fully recovering in 1999 (let alonegrowing). Thus, all the wheels were spinning, butthe progress towards self-sufficiency was slow.Figure 1: FINCA Uganda - Growth1995 1996 1997 1998 1999Borrowers (no.) 1,289 3,324 8,473 17,228 20,769Total Portfolio (‘000 US$) 107 210 539 850 1,246Assets (‘000 US$) 321 404 1,031 1,485 2,066Staff (no.) 14 25 61 98 94Avg. Loan Balance (US$) 83 63 64 49 60Source: The MicroBanking Bulletin.The limited increase in average loan balance wasthe result of several factors, but five in particular:1) Rapid growth meant that the portfolio consistedof a large portion of new clients with smallerloans.2) As much as 50 percent of clients chose loanssmaller than the maximum available to them dueto limited business activity.3) Relatively high dropout rates caused significantwork in replacing clients and further increasedthe percentage of new clients (and their smallloans) in the portfolio.4) We decided to maintain the initial loan size at the1995 level, while offering faster growth after thefirst cycle. However, faster growth opportunitieswere not implemented until May 1999.5) FINCA maintains a commitment to serving thepoor.Additionally, in the midst of increasing competitionin Ugandan microfinance, it was necessary to makeseveral adjustments to the loan product to maintainits marketability. For various reasons, theseadjustments were not made quickly enough, whichretarded growth for much of the 1998/99 fiscal year.Several long awaited improvements wereimplemented beginning in May 1999, which haveled to dramatic positive results for fiscal 1999/2000(ends 31 st August). Product improvements includea group and client rating system, a significantlylower savings requirement (allowing client loans to“grow” faster), and other flexibilities that haveimproved market acceptance.In addition, Microcare, a health care financingscheme, was accessed to provide a mechanism forclients to buy a full range of health care servicesthrough hospitals. This scheme provides FINCAUganda with a competitive advantage among MFIs,by offering clients this risk management product tocomplement existing services such as voluntarysavings and group accident policy (with deathcoverage for the client and her family members).Given that any new product in the microfinanceindustry provides exclusivity for only six to twelvemonths, FINCA Uganda is actively working on itsnext round of adjustments and innovations.EfficiencyFINCA Uganda was slow to address efficiencyissues in the midst of its rapid growth (see Figure2). It was difficult to balance the need for efficiencywith the volumes of new (less productive)employees required for growth, especially whenmuch of that growth was into new areas.<strong>MICROBANKING</strong> <strong>BULLETIN</strong>, SEPTEMBER 2000 19